[ad_1]

The biggest property and casualty insurance coverage firms on the earth wrote a mixed $1.45 trillion in premiums prior to now yr. Discover out which insurers rank within the high 10

The worldwide property and casualty (P&C) sector continues to face unprecedented challenges, pushing up claims prices and making funding returns much less predictable. Many P&C insurers weathered the storm by making massive modifications in how they conduct enterprise.

These embrace the corporations on this record. On this article, Insurance coverage Enterprise ranks the world’s largest property and casualty insurance coverage firms based mostly on written premiums prior to now yr. We may also present a region-by-region breakdown of the highest P&C insurers. The figures on this information are based mostly on the information market intelligence agency S&P International gathered.

Learn on and study extra in regards to the trade’s largest gamers on this article.

The 50 largest P&C insurers on the earth have written greater than $1.45 trillion in premiums prior to now yr, in response to S&P International’s knowledge.

US-based insurance coverage firms dominated the record, accounting for 40% of all written premiums. China is the second-most represented nation, with insurers there contributing over 12% to the worldwide determine.

When it comes to area, North America is dwelling to the biggest variety of insurers at 23, liable for 46% of the general premiums written. Europe comes subsequent contributing 33.5% to the entire. Asia follows accounting for 20.7%.

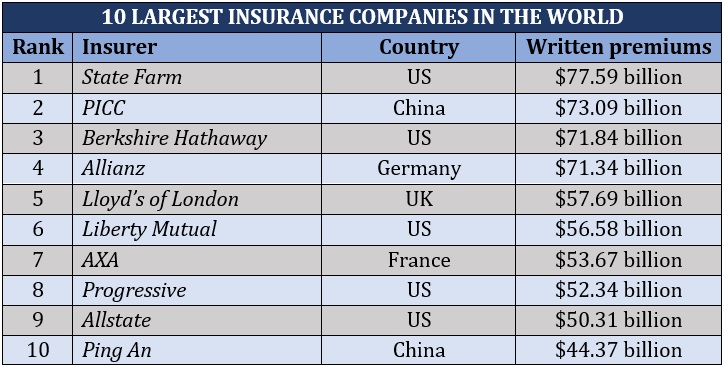

Listed below are the highest 10 largest property and casualty insurance coverage firms on the earth based mostly on the report.

1. State Farm

Nation of domicile: US

Direct written premiums: $77.59 billion

Market share: 5.34%

State Farm is the trade’s largest participant, each within the US and abroad. The Bloomington, Illinois-based P&C insurance coverage big wrote nearly $78 billion value of premiums prior to now yr. The corporate affords a spread of automobile, dwelling, and small enterprise insurance policies. It additionally has a strong portfolio of life, well being, and incapacity protection.

The insurer is well-known within the trade for offering aggressive auto insurance coverage charges. Nevertheless, besides for private auto protection, State Farm has ceased writing new insurance policies in California. The corporate factors to inflation, troublesome reinsurance market, and growing disaster publicity as the principle causes for the pullback.

State Farm insurance policies can be found solely to US shoppers. The insurer boasts a community of 19,000 brokers nationwide.

2. PICC

Nation of domicile: China

Gross written premiums: $73.09 billion

Market share: 5.03%

Beijing-headquartered Folks’s Insurance coverage Firm (Group) of China, extra popularly generally known as PICC, operates as an insurance coverage and funding holding agency. The trade big runs its P&C insurance coverage enterprise via its subsidiary, the PICC Property and Casualty Firm.

PICC’s P&C arm affords a spread of normal insurance policies, together with motorized vehicle, householders, business, legal responsibility, hull and cargo, aviation, and credit score and surety insurance coverage. Other than being the biggest, the unit can be the oldest non-life insurance coverage supplier in mainland China.

PICC holds license from the Chinese language Ministry of Finance to underwrite short-term export credit score insurance coverage. Thus far, it’s the solely business insurer within the nation’s export credit score market. PICC Property and Casualty Firm has about 4,500 branches throughout China.

3. Berkshire Hathaway

Nation of domicile: US

Gross written premiums: $71.84 billion

Market share: 4.95%

Berkshire Hathaway owns a number of insurance coverage and reinsurance subsidiaries specializing in property and casualty insurance coverage. Certainly one of its hottest P&C manufacturers is automobile insurance coverage specialist GEICO. The Omaha, Nevada-headquartered conglomerate can be the agency behind outstanding trade gamers:

- Alleghany Company

- Berkshire Hathaway Direct

- Berkshire Hathaway GUARD

- Berkshire Hathaway Homestate Corporations (BHHC)

- Berkshire Hathaway Specialty Insurance coverage

- Central States Indemnity Co. of Omaha

- biBERK

- Nationwide Indemnity Firm

- United States Legal responsibility Insurance coverage

Insurance coverage is taken into account amongst Berkshire Hathaway’s “4 giants.” The enterprise accounts for a few quarter of the conglomerate’s whole income.

Berkshire Hathaway is owned by Warren Buffet, one among the insurance coverage trade’s richest tycoons. The person who is called the “Oracle of Omaha” is a continuing fixture on Forbes’ billionaires record with a web value of round $120 billion.

4. Allianz

Nation of domicile: Germany

Gross written premiums: $71.34 billion

Market share: 4.91%

Munich-headquartered Allianz SE affords a spread of property and casualty insurance coverage insurance policies via its subsidiaries in additional than 70 nations and territories. Its international workforce of 155,000 personnel serves over 126 million shoppers worldwide.

A few of the P&C insurance coverage big’s most notable manufacturers are:

- Allianz International Company & Specialty (AGCS): A multinational insurer offering enterprise insurance coverage and protection for big company and specialty dangers.

- Euler Hermes: The group’s credit score insurance coverage arm providing bonding, ensures, and assortment companies for managing business-to-business (B2B) commerce receivables.

Other than property and casualty insurance coverage, Allianz’s portfolio contains life and medical health insurance, and asset administration companies.

5. Lloyd’s of London

Nation of domicile: UK

Gross written premiums: $57.69 billion

Market share: 3.97%

Lloyd’s of London is the world’s main insurance coverage and reinsurance market, with a presence in additional than 200 nations and territories. Its member syndicates present protection to virtually each kind of danger. {The marketplace} caters to every kind of shoppers from nationwide governments and multinational conglomerates to start-ups and small enterprises.

The premiums above are mixed totals from 80 member syndicates. A few of the premiums could also be included within the general figures of insurance coverage firms within the record that personal Lloyd’s syndicates.

6. Liberty Mutual

Nation of domicile: US

Gross written premiums: $56.58 billion

Market share: 3.89%

One of many largest property and casualty insurance coverage firms on the earth, Liberty Mutual ranks third amongst all US insurers within the record. The mutual insurer boasts a forty five,000-strong workforce in about 900 places globally.

Liberty Mutual focuses on offering cowl for various P&C dangers. Its portfolio contains:

The mutual insurer conducts enterprise via two items:

- International Retail Markets (GRM): The unit combines the insurer’s experience in development markets exterior the US with robust and scalable US capabilities. This allows the corporate to benefit from alternatives to develop its enterprise internationally.

- International Threat Options (GRS): This consists of the agency’s property, casualty, specialty, and reinsurance services. The insurance policies are distributed via Liberty Mutual’s international community of insurance coverage brokers and brokers.

Liberty Mutual can be recognized for offering shoppers with versatile charges.

7. AXA

Nation of domicile: France

Gross written premiums: $53.67 billion

Market share: 3.69%

Paris-based AXA S.A. operates as a multinational insurance coverage and asset administration companies supplier. It boasts a worldwide community of 145,000 staff and distributors, making it among the many largest property and casualty insurance coverage firms worldwide.

AXA serves round 93 million shoppers in additional than 50 nations and territories. Other than P&C insurance coverage, the corporate operates medical health insurance, life and financial savings, and asset administration divisions. North America, Western Europe, the Asia-Pacific area, and the Center East are its key markets.

8. Progressive

Nation of domicile: US

Gross written premiums: $52.34 billion

Progressive is the second largest automobile insurer within the US, trailing solely State Farm. However the Ohio-based P&C insurance coverage firm ranks on high of the nation’s motorbike and specialty RV phase. The agency’s property and casualty portfolio contains:

- auto insurance coverage

- motorized vehicle insurance coverage

- householders’ insurance coverage

- rental insurance coverage

- renters’ insurance coverage

- business insurance coverage

- boat insurance coverage

- pet insurance coverage

Progressive’s insurance policies might be accessed instantly or via its community of 38,000 unbiased brokers. The insurer’s services are principally accessible within the US and Canada. The corporate writes greater than 13 million auto insurance coverage insurance policies yearly.

9. Allstate

Nation of domicile: US

Gross written premiums: $50.31 billion

Market share: 3.46%

Allstate is without doubt one of the largest publicly traded P&C insurers within the US, with round 16 million policyholders and 175 million insurance policies in-force. The corporate affords a spread of protection beneath the property, car, life, and business insurance coverage segments. It’s also the title behind well-liked insurance coverage manufacturers Reply Monetary, Embody, and Esurance.

Allstate services might be accessed primarily via its captive businesses. The agency has about 12,300 brokers and monetary representatives throughout the US and Canada.

10. Ping An

Nation of domicile: China

Gross written premiums: $44.37 billion

Market share: 3.05%

Shenzhen, Guangdong-headquartered Ping An is among the many largest property and casualty insurance coverage firms on the earth. It caters to greater than 220 million prospects and nearly 611 million on-line customers.

The group affords P&C insurance policies primarily via its subsidiary, Ping An Property & Casualty Insurance coverage Co. of China Ltd. Its merchandise embrace:

- accident and medical health insurance

- auto insurance coverage

- company property and casualty insurance coverage

- cargo insurance coverage

- engineering insurance coverage

- assure insurance coverage

- dwelling contents insurance coverage

- worldwide reinsurance

- legal responsibility insurance coverage

- commerce credit score insurance coverage

The corporate additionally has a strong well being and life insurance coverage portfolio delivered via its manufacturers Ping An Life, Ping An Annuity, and Ping An Well being. The agency employs greater than 362,000 employees worldwide.

Right here’s a abstract of the highest 10 largest property and casualty insurance coverage firms on the earth.

Largest property and casualty insurance coverage firms – region-by-region breakdown

S&P International’s knowledge might be damaged down into three main areas:

- North America

- Europe

- Asia-Pacific

Listed below are the ten high P&C insurers in every area based mostly on the figures the market intelligence agency gathered.

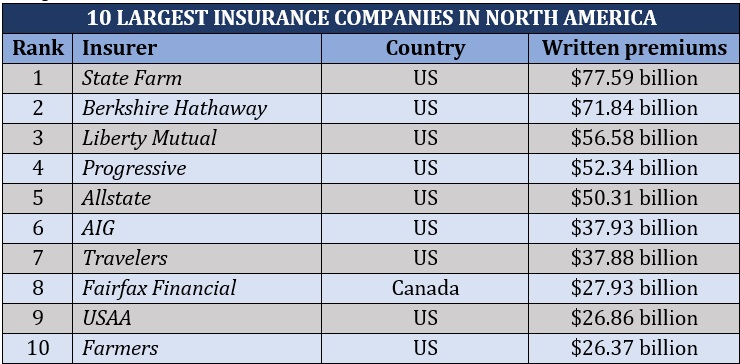

The biggest P&C insurers from the US and Canada accounted for $636.95 billion, or nearly 44% of the premiums written globally. Of those, $474.59 billion, or a few third, had been from the highest 10 North American property and casualty insurance coverage firms.

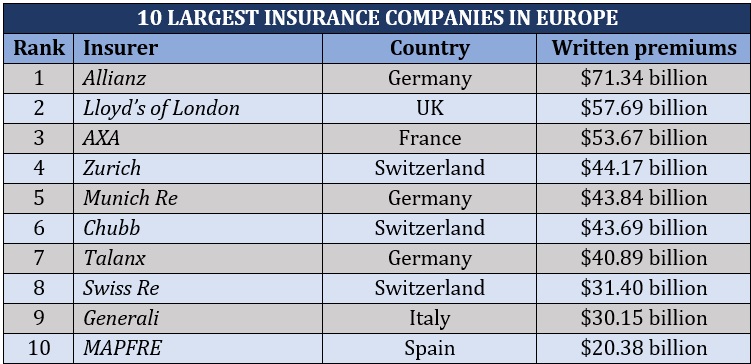

The most important trade gamers from Europe have written a mixed $495 billion in premiums. That is round 34% of the worldwide determine. The highest 10 firms within the area contributed nearly $446 billion to the entire.

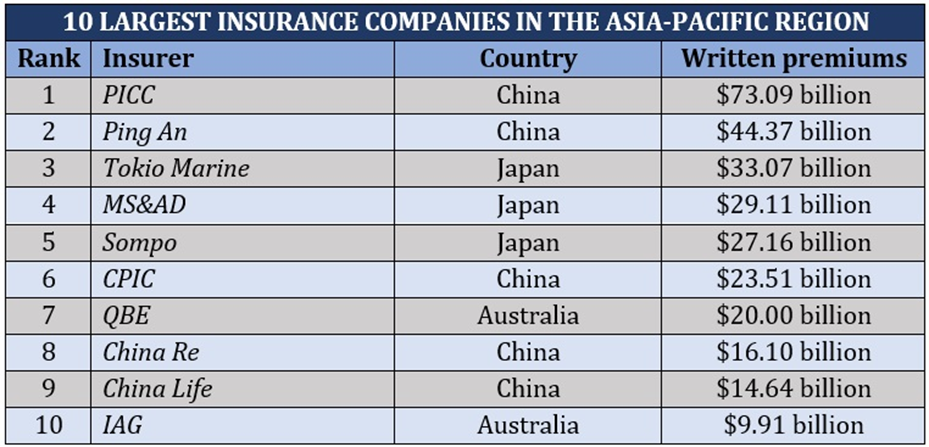

There are 11 property and casualty insurers within the high 50 which might be based mostly within the Asia-Pacific area. These firms accounted for almost $300 billion in written premiums or a few fifth of the general determine.

The P&C insurance coverage phase consists of two strains:

1. Private strains insurance coverage

This sort of insurance coverage protects people and their property when surprising disasters strike. The phase contains:

- enterprise interruption insurance coverage

- business auto insurance coverage

- business property insurance coverage

- cyber insurance coverage

- administrators’ and officers’ legal responsibility insurance coverage

- normal legal responsibility insurance coverage

- product legal responsibility insurance coverage

- skilled legal responsibility insurance coverage

- employees’ compensation insurance coverage

If you wish to discover out which property and casualty insurance coverage firms on the earth provide one of the best safety, Our Greatest in Insurance coverage Particular Stories web page is the place to go. Just lately, we unveiled our five-star awardees for the International Greatest in Insurance coverage.

Right here, we acknowledged insurance coverage professionals and corporations throughout North America, the UK, and the Asia-Pacific area who’ve excelled and raised the bar to supply top-notch companies.

What do you consider the biggest property and casualty insurance coverage firms on our record? Do you’ve expertise working with them? We’d like to see your story under.

Sustain with the newest information and occasions

Be a part of our mailing record, it’s free!

[ad_2]