[ad_1]

Generative AI (GenAI) has the potential to rework the insurance coverage business by offering underwriters with precious insights within the areas of 1) danger controls, 2) constructing & location particulars and three) insured operations. This expertise might help underwriters determine extra worth within the submission course of and make higher high quality, extra worthwhile underwriting selections. Elevated ranking accuracy from CAT modeling means higher, extra correct pricing and decreased premium leakage. On this publish, we are going to discover the chance areas, GenAI functionality, and potential influence of utilizing GenAI within the insurance coverage business.

1) Danger management insights zone in on materials information

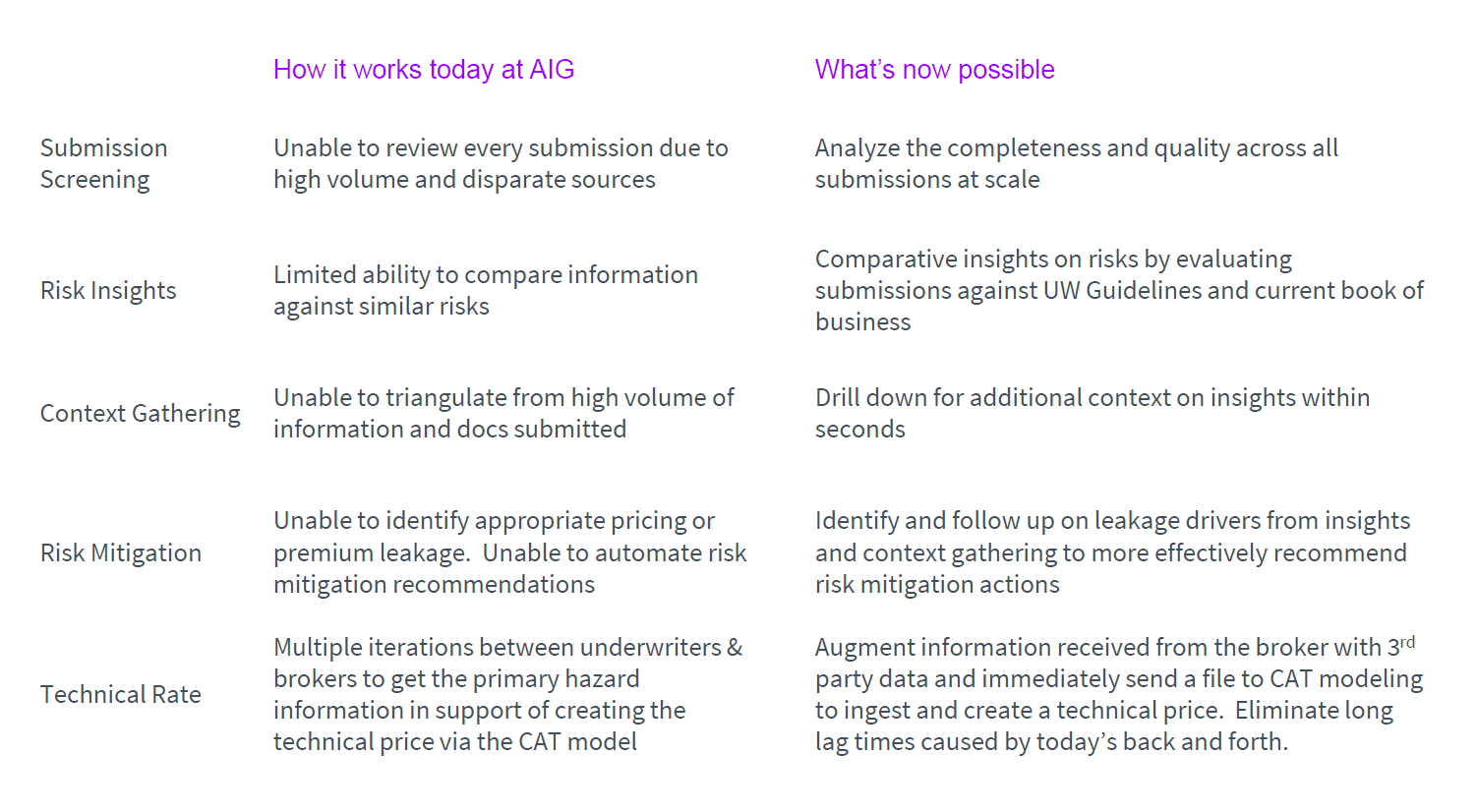

Generative AI permits risk management evaluation insights to be highlighted to indicate loss prevention measures in place in addition to the effectiveness of these controls for lowering loss potential. These are vital to knowledgeable underwriting selections and may handle areas which might be constantly missed or ache factors for underwriters in information gathering. Presently in relation to submission screening, underwriters are unable to assessment each submission as a result of excessive quantity and disparate sources. Generative AI permits them to analyze the completeness and high quality throughout all submissions at scale. Which means they transfer from a restricted means to check data in opposition to related dangers to a situation the place they’ve comparative insights on dangers by evaluating submissions in opposition to UW Tips and present e book of enterprise.

What generative AI can do:

- Generate a complete narrative of the general danger and its alignment to carriers’ urge for food and e book

- Flagging, sourcing and figuring out lacking materials information required

- Managing the lineage for the info that has been up to date

- Enriching from auxiliary sources TPAs/exterior information (e.g., publicly listed merchandise/companies for insured’s operations)

- Validating submission information in opposition to these extra sources (e.g., geospatial information for validation of vegetation administration/proximity to constructing & roof development supplies)

Synthesizing a submission package deal with third occasion information on this means permits it to be offered in a significant, easy-to-consume means that in the end aids decision-making. These can all enable quicker, improved pricing and danger mitigation suggestions. Augmenting the knowledge acquired from the dealer with third occasion information additionally eliminates the lengthy lag occasions brought on by in the present day’s backwards and forwards between underwriters and brokers. This may be occurring instantly to each submission concurrently, prioritizing inside seconds throughout your entire portfolio. What an underwriter may do over the course of per week may very well be executed instantaneously and constantly whereas making knowledgeable, structured suggestions. The underwriter will instantly know management gaps primarily based on submission particulars and the place important deficiencies / gaps might exist that would influence loss potential and technical pricing. In fact, these should then be thought of in live performance with every insured’s particular person risk-taking urge for food. These enhancements in the end create the flexibility to write down extra dangers with out extreme premiums; to say sure whenever you may in any other case have mentioned no.

2) Constructing & Location particulars insights help in danger publicity accuracy

Let’s take the instance of a restaurant chain with a number of properties that our insurance coverage service is underwriting for example constructing element insights. This restaurant chain is in a CAT-prone area reminiscent of Tampa, Florida. How might these insights be used to complement the submission to make sure the underwriter had the complete image to precisely predict the chance publicity related to this location? The high-risk hazards for Tampa, in accordance with the FEMA’s Nationwide Danger Index, are hurricanes, lightning, and tornadoes. On this occasion, the insurance coverage service had utilized a medium danger stage to the restaurant as a result of:

- a previous security inspection failure

- lack of hurricane safety models

- a possible hyperlink between a previous upkeep failure and a loss occasion

which all elevated the chance.

Then again, in preparation for these hazards, the restaurant had applied a number of mitigation measures:

- necessary hurricane coaching for each worker

- metallic storm shutters on each window

- secured out of doors objects reminiscent of furnishings, signage, and different unfastened objects that would grow to be projectiles in excessive winds

These had been all added to the submission indicating that that they had the required response measures in place to lower the chance.

Whereas constructing element insights expose what is actually being insured, location element insights present the context wherein the constructing operates. Risk management evaluation from constructing value determinations and security inspection reviews uncover insights displaying which places are the highest loss driving places, whether or not previous losses had been a results of lined peril or management deficiency, and adequacy of the management methods in place. Within the case of the restaurant chain for instance, it didn’t have its personal hurricane safety models however in accordance with the detailed geo-location information, the constructing is situated roughly 3 miles away from the closest fireplace station. What this actually means is that by way of context gathering, underwriters transfer from being unable to triangulate from excessive quantity of knowledge and paperwork submitted to having the ability to drill down for added context on insights inside seconds. This in flip permits underwriters to determine and comply with up on leakage drivers from insights and context gathering to advocate danger mitigation actions extra successfully.

3) Operations insights assist present suggestions for added danger controls

Insured operations particulars synthesize data from the dealer submission, monetary statements and data on which points will not be included in Acord types / functions by the dealer. The hazard grades of every location related to the insured’s operations and the predominant and secondary SIC codes would even be supplied. From this, quick visibility into loss historical past and high loss driving places in contrast with complete publicity shall be enabled.

If we take the instance of our restaurant chain once more, it may very well be attributed a ‘excessive’ danger worth relatively than the aforementioned ‘medium’ because of the reality that the location has potential dangers from e.g. catering supply operations. By analyzing the operation publicity, that is how we determine that prime danger in catering :

The utmost occupancy is excessive at 1000 individuals, and it’s situated in a purchasing advanced. The variety of claims over the past 10 years and the common declare quantity might additionally point out a better danger for accidents, property injury, and legal responsibility points. Though some danger controls might have been applied reminiscent of OSHA compliant coaching, safety guards, hurricane and fireplace drill response trainings each 6 months, there could also be further controls wanted reminiscent of particular danger controls for catering operations and fireplace security measures for the out of doors open fireplace pizza furnace.

This supplementary data is invaluable in calculating the true danger publicity and attributing the right danger stage to the shopper’s state of affairs.

Advantages to generative AI past extra worthwhile underwriting selections

In addition to aiding in additional worthwhile underwriting selections, these insights provide extra worth as they train new underwriters (in considerably decreased time) to grasp the info / pointers and danger insights. They enhance analytics / ranking accuracy by pulling all full, correct submission information into CAT Fashions for every danger and so they cut back important churn between actuary /pricing / underwriting on danger data.

Please see beneath a recap abstract of the potential influence of Gen AI in underwriting:

In our latest AI for everybody perspective, we discuss how generative AI will rework work and reinvent enterprise. These are simply 3 ways in which insurance coverage underwriters can achieve insights from generative AI. Watch this area to see how generative AI will rework the insurance coverage business as a complete within the coming decade.

If you happen to’d like to debate in additional element, please attain out to me right here.

Disclaimer: This content material is supplied for common data functions and isn’t meant for use instead of session with our skilled advisors. Copyright© 2024 Accenture. All rights reserved. Accenture and its brand are registered emblems of Accenture.

[ad_2]