[ad_1]

Property house owners in Lee County, Fla., might lose their flood insurance coverage premium reductions beneath the Nationwide Flood Insurance coverage Program (NFIP) Neighborhood Ranking System (CRS), in accordance with a latest announcement by FEMA.

CRS is a voluntary program that acknowledges and encourages neighborhood floodplain administration practices that exceed NFIP minimal necessities. Over 1,500 communities take part nationwide.

FEMA knowledgeable leaders within the affected communities – which embrace Cape Coral, Bonita Springs, Estero, Fort Myers Seaside, and unincorporated Lee County – that they’d start shedding their reductions beginning October 1. Below CRS, these communities at present obtain reductions of as much as 25 p.c. Unincorporated Lee County and the Metropolis of Cape Coral get the most important profit resulting from their Class 5 rankings. Charges will improve by roughly $300 yearly for the 115,000 owners impacted by FEMA’s determination.

“This retrograde is as a result of great amount of unpermitted work, lack of documentation, and failure to correctly monitor exercise in particular flood hazard areas, together with substantial harm compliance,” FEMA mentioned in a press release.

FEMA officers informed the Miami Herald that the issues started shortly after Hurricane Ian in 2022, when federal groups visited the communities hit the toughest and appeared on the properties they thought have been more than likely to be considerably broken, together with older houses inbuilt flood zones, some with earlier flood harm.

“What the crew discovered, sadly, is there was plenty of unpermitted work, lack of documentation,” mentioned Robert Samaan, the regional administrator for FEMA’s Area 4, together with Florida. “It was only a failure to correctly monitor the exercise within the particular flood hazard space.”

FEMA shared with the Herald three letters it despatched Lee County in 2023 — one in February, one in June and one in December — asking for data on the variety of broken houses and warning that not offering the knowledge might consequence within the county shedding its flood insurance coverage reductions.

In latest months, a lot of Florida communities, together with Miami-Dade County, have benefited from decrease flood insurance coverage premiums because of improved CRS scores that replicate resilience-related funding. CRS has change into significantly useful as NFIP pricing reforms – generally known as Danger Ranking 2.0 –that extra intently align premium charges with property-specific dangers – have contributed to rising premiums for some property house owners. Earlier than these reforms, it was not unusual for lower-risk house owners to be subsidizing higher-risk ones by their premium charges.

Rising NFIP charges have been accompanied by one other development: elevated involvement by non-public insurers within the flood insurance coverage market.

“Florida has probably the most strong non-public flood insurance coverage market in the US, which offers shoppers with quite a few choices for protection,” mentioned Mark Friedlander, director of company communications for Triple-I. “Almost a 3rd of Florida flood insurance policies are written by non-public carriers, and lots of non-public flood insurers supply higher pricing and extra strong insurance policies than NFIP. It’s value taking the time to buy protection and acquire a number of quotes.”

As lately as 2018, non-public insurers supplied solely 3 p.c of flood protection in Florida.

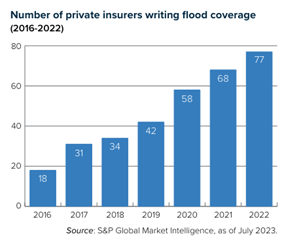

This progress mirrors a nationwide development. Between 2016 and 2022 the whole flood market grew 24 p.c – from $3.29 billion in direct premiums written to $4.09 billion – with 77 non-public corporations writing 32.1 p.c of the enterprise, up from 18 corporations writing 12.5 p.c. Non-public insurers are accounting for an even bigger piece of a rising pie.

Florida’s Workplace of Insurance coverage Regulation has closely promoted the availability of personal flood insurance coverage within the state over the previous a number of years, and lots of non-public flood insurers are domiciled within the state, Friedlander mentioned.

“We’re dedicated to serving to these communities take applicable remediation actions to take part within the Neighborhood Ranking System once more and work in direction of future coverage reductions,” FEMA mentioned in its assertion.

Earlier this 12 months, Sea Isle Metropolis, N.J., had its Class 3 ranking restored after a quick demotion in 2023. Sea Isle Metropolis and Avalon are the one cities within the state to have Class 3 rankings.

Be taught Extra:

Coastal New Jersey City Regains Class 3 NFIP Ranking

FEMA Reauthorization Session Highlights Significance of Danger Switch and Discount

Attacking the Danger Disaster: Roadmap to Funding in Flood Resilience

[ad_2]