[ad_1]

Traders who’re promoting shares as a result of the Federal Reserve could reduce plans for rate of interest cuts are lacking the purpose. The transfer can be a superb signal for the economic system — and subsequently fairness markets, in accordance Morgan Stanley Funding Administration’s Andrew Slimmon.

“I feel a affected person Fed validates that the economic system is robust,” Slimmon informed Bloomberg Tv on Tuesday in an interview. “That’s higher for equities.”

Slimmon is price listening to, as he was appropriately optimistic final yr whereas the S&P 500 Index soared 24%. Against this, his extremely publicized Morgan Stanley colleague Mike Wilson, the agency’s main sell-side strategist, repeatedly referred to as for a rout that by no means materialized.

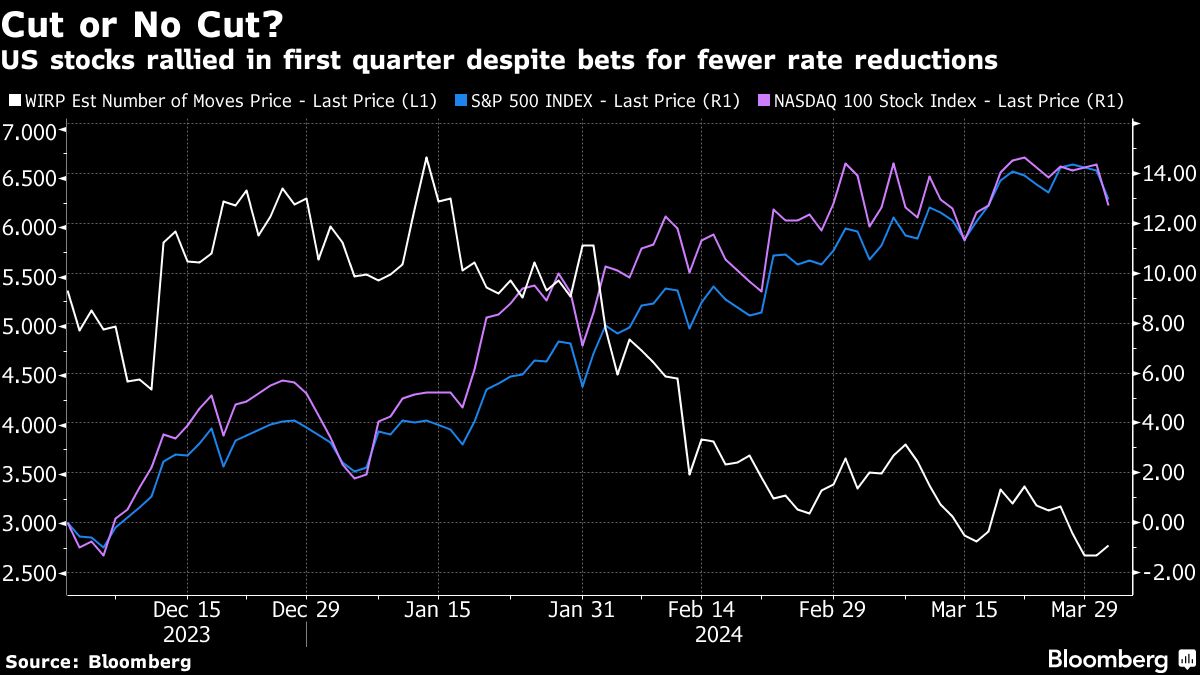

After the strongest first quarter since 2019, U.S. equities are beginning April on a downbeat observe as a wave of robust financial information renews considerations that the Fed will likely be in no rush to loosen coverage.

In actual fact, traders at the moment are extra hawkish than central bankers, projecting about 65 foundation factors of fee cuts this yr, in contrast with the 75 foundation factors signaled by the median estimate of projections launched following the Fed’s March assembly.

Merchants have recalibrated their expectations for fee reductions all through this yr, dialing again bets to round three reductions from six initially of 2024. However the S&P 500 nonetheless rose over 10% within the first quarter.

[ad_2]