[ad_1]

Delicate well being info being shared with insurers is more likely to severely harm client belief in well being corporations and insurers, as resistance to sharing information with both of them was already excessive. An Observer investigation within the Guardian discovered that UK personal well being corporations had been sharing information donated for medical analysis to insurers with out permission on a number of events between 2020 and 2023.

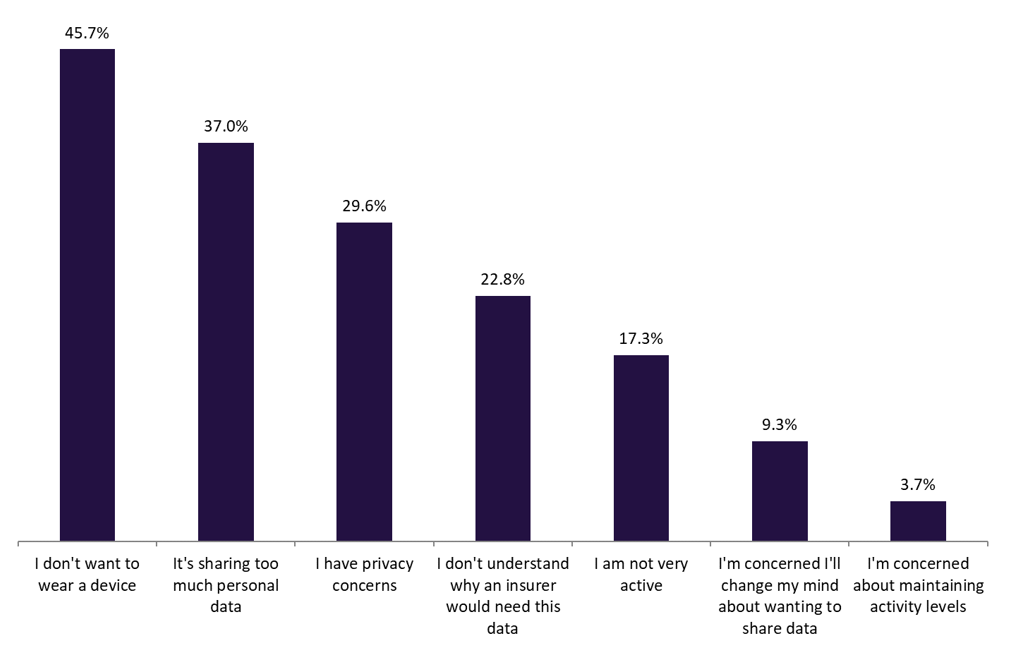

GlobalData’s 2022 UK Insurance coverage Client Survey (outcomes proven above) discovered that there was already a comparatively excessive stage of resistance to sharing information with insurers. It discovered {that a} complete of 88.7% of respondents have been involved in regards to the loss, theft, or misuse of non-public information (55.8% have been barely involved, 28.0% have been involved, and 4.9% so involved they might think about shopping for insurance coverage towards id theft and lack of private information). Solely 11.3% of respondents had no considerations on this matter. Moreover, when asking respondents who have been towards sharing well being information from a tool akin to a smartwatch with insurers why they held this opinion, considerations round using the info have been a well-liked reply. The most well-liked response was ‘not eager to put on a tool,’ however three choices closely linked to considerations round how information is used have been additionally regularly chosen. ‘It’s sharing an excessive amount of private information,’ ‘I’ve privateness considerations,’ and ‘I don’t perceive why an insurer would want this information’ have been three of the highest 4 solutions to this query.

Subsequently, the extent of resistance to sharing private information was already excessive earlier than this damaging story in a nationwide newspaper. Though the insurers concerned haven’t been named, it’s nonetheless more likely to impression the entire business. Accumulating and analysing private information is essential for insurers, because it permits them to enhance their danger profiling and underwriting and create extra correct pricing. It may possibly additionally permit them to trace behaviour over time and consequently incentivize customers to enhance features akin to their well being or driving, which reduces the probabilities of a declare. The insurance coverage business typically fares poorly in client belief indexes. It subsequently wants to make sure that it’s squeaky clear with client information. If not, it should face important fines attributable to GDPR laws, and it’ll not take a lot to dissuade customers from sharing private information that can be utilized to assist each events.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

choice for your corporation, so we provide a free pattern you could obtain by

submitting the under kind

By GlobalData

[ad_2]