[ad_1]

The place will tomorrow’s earnings come from?

Whenever you take a look at the historical past of practically any long-term, profitable firm, you see occasional shifts in product and repair choices. IBM is a superb instance. IBM is 112 years outdated. For many of that point, IBM was thought of a producer. Their merchandise had been machines that might tabulate, kind, and maintain knowledge. Many of those machines had been cutting-edge. IBM’s electrical typewriters used a rotating ball to strike the ribbon and paper, as an alternative of a lever. The outcome was a quicker typing tempo and a extra versatile appear and feel from kind — you may swap out the ball for a distinct font.

Whenever you take a look at IBM right now, you don’t consider manufacturing. Their worthwhile merchandise have modified over time. These shifts and “enterprise dangers” give corporations larger resilience and longevity by permitting the corporate to overlap core enterprise capabilities with the brand new enterprise alternatives that exist exterior the core enterprise. Many instances these fringe companies grow to be core companies, then, if the corporate is round lengthy sufficient, these core companies are sometimes changed by different up-and-coming alternatives. Look how far cloud computing, automation, and AI are from desktop calculators and punch card tabulators.

Some insurers may argue that their core worth proposition of threat merchandise won’t ever change. However in right now’s world, “by no means” may be overturned in a second. Main insurers ought to at all times hold a watch out for worthwhile alternatives on the periphery. Is there a brand new revenue heart ready within the wings in your group to select it up?

Indicators from the perimeter

At Majesco, we intently study buyer traits that may have an effect on insurance coverage’s product choices and its fringe alternatives. Via our market surveys, we establish areas the place there are gaps between what particular person and enterprise clients need and what insurers are presently offering. A few of these gaps are massive. They symbolize alternatives which can be too huge to overlook. For an in-depth take a look at these traits, make sure to learn Bridging the Buyer Expectation Hole: Property Insurance coverage.

For right now’s dialogue, we’ll give attention to three areas of value-added service alternative as recognized by means of Majesco analysis:

- Preventive companies (Business and Particular person P&C)

- Utilization-based supplemental protection (Business and Particular person P&C)

- Providers directed to particular life-style wants (Particular person P&C)

Preventive Providers (Business/SMB)

Danger is rising. In keeping with McKinsey’s 2023 insurance coverage report, a mixture of things goes to push insurers into new market territories.[i]

- Elevated CAT occasions within the US (Up 50% within the 2017-2023 timeframe from the 2007-2017 timeframe),

- Elevated cyber dangers, and

- The necessity for larger relevance with their choices

Both insurers and reinsurers must gear as much as tackle extra threat, or they need to innovate round serving to clients cut back or get rid of threat. Or perhaps it’s all the above. As we speak’s elevated catastrophes, inflation, risky market atmosphere, and stress on profitability demand a larger give attention to preventable losses and higher outcomes by means of underwriting profitability, proactive threat mitigation to attenuate or get rid of claims, and enhanced buyer experiences.

Enterprise clients need confidence and safety that goes past the loss-recovery contract. Whereas insurers are targeted on how they will higher assess threat, many at the moment are increasing to additionally give attention to the prevention of losses and creating threat resilience for patrons.

Prevention is the way forward for insurance coverage. Whereas prevention companies by means of surveys and schooling are usually not new within the insurance coverage business, the methods to establish and stop threat are altering. Each know-how or value-added service that aids in prevention and threat mitigation is a know-how that may give insurers a secure basis upon which to develop, even in unstable instances. A prevented declare additionally occurs to be the final word buyer expertise.

Majesco helps insurers to establish preventable dangers and reduceable impacts by each industrial mindsets and new applied sciences that may help. We started by trying on the disparities between SMB and Insurer curiosity specifically applied sciences and companies.

Business Property SMB – Insurer Gaps

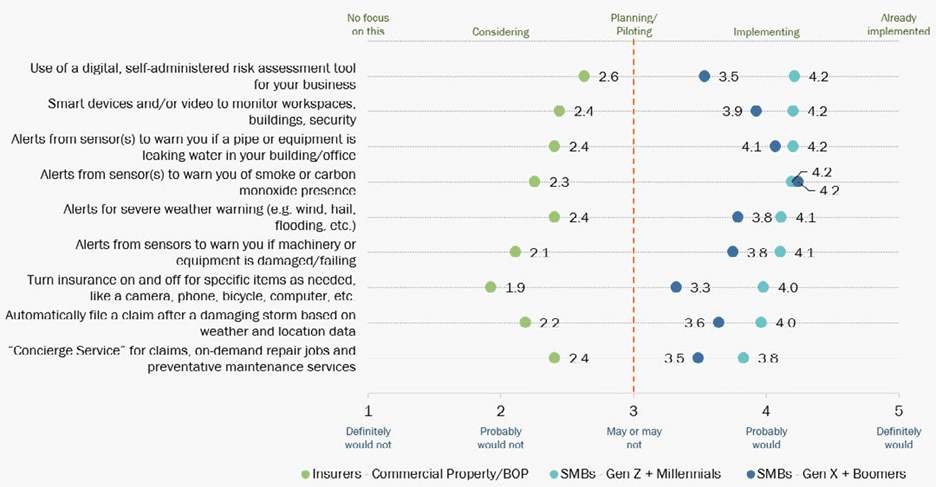

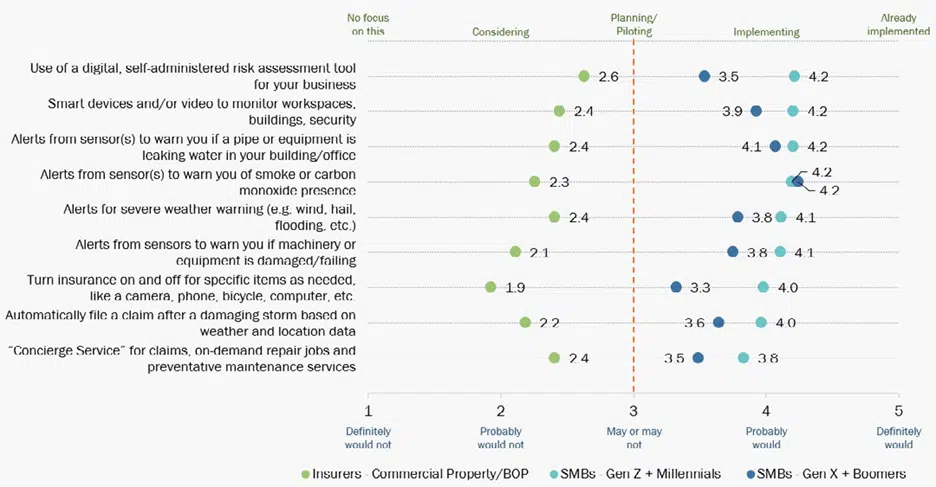

In keeping with Majesco surveys, there are massive gaps between what SMB clients need and what insurers are or are usually not delivering, with as much as a two-times differential, as seen in Determine 1. Most significantly, that is constant for each generational teams (Gen Z-Millennial SMBs and Gen X-Boomer SMBs), with little differentiation.

Wanting on the proper aspect of Determine 1, we see the SMB propensity to make use of explicit preventive applied sciences and companies. These embrace Safety monitoring with good units or video, plus sensors and alerts for smoke/CO, water leaks, gear failure, and extreme climate. Objects akin to these promote security and supply peace of thoughts by serving to to keep away from or reduce threat.

These companies have among the many highest ranges of curiosity for each segments. Each teams’ demand for companies is to assist make their lives simpler with excessive curiosity in digital property self-assessment instruments, computerized claims FNOLs based mostly on extreme climate and placement knowledge, and concierge service for repairs and preventative upkeep. For SMBs, this turns into an actual worth with all of the pressures they face day after day.

Take into account automated and concierge companies, for instance. Insurers have a possibility to repair one problem — the SMB time crunch — whereas addressing major threat points, akin to preventive upkeep that may save claims. Worth-added companies like these can add worth to each the policyholder and the insurer.

The applied sciences and knowledge that energy value-added companies exist right now and lots of of them are operational. For instance, Majesco’s LossControl360 makes use of AI and machine studying to raised assess threat and supply a report of areas to cut back it. Insurers can use the huge loss management survey knowledge Majesco has together with third-party knowledge to make use of our Property Intelligence AI mannequin to boost underwriting, and loss management assessments after which leverage the outcomes to speak and educate clients on understanding and managing their threat.

Determine 1

Buyer-Insurer gaps in value-added companies for industrial property insurance coverage

Utilization-Based mostly Insurer Gaps for All P&C Carriers

Each private and industrial P&C are affected by gaps that may be remedied by means of usage-based merchandise for every type of property. One widespread problem regards insuring objects which can be seldom used, akin to leisure autos, small (however costly) private objects, akin to images gear, or different leisure gear, akin to bikes and scooters. For SMBs, these may embrace items of not often used, however necessary gear, rented autos specialty, event-driven initiatives which will sometimes fall below the realm of E&S insurance policies. Wherever there’s a short-term, short-term threat, there may be the chance for a brand new product and income.

Taking a look at each Determine 1 and Determine 2, we get a way that the best gaps happen on some of these objects, the place people and SMBs need protection, however can’t abide by the price of a full-time coverage. Insurers would love the extra premiums, however their techniques aren’t at all times constructed to deal with insurance coverage that may be turned on and off. This looks as if a priceless alternative for insurers to shut safety gaps and start serving a rising market. It makes essentially the most sense to start providing these merchandise to present policyholders, however with expertise, these merchandise are additionally ripe for placement by means of channel companions.

Private Property Shopper – Insurer Gaps

Individuals need security they usually need their lives to run easily, amid an unpredictable world. They’ve life-style wants. They may pay for companies to assist them keep the established order regardless of new challenges. That is the candy spot of value-added companies. To verify that present insurance-related applied sciences are desired by clients, Majesco surveyed client sentiment. Are these applied sciences viable for adoption? Will they be accepted?

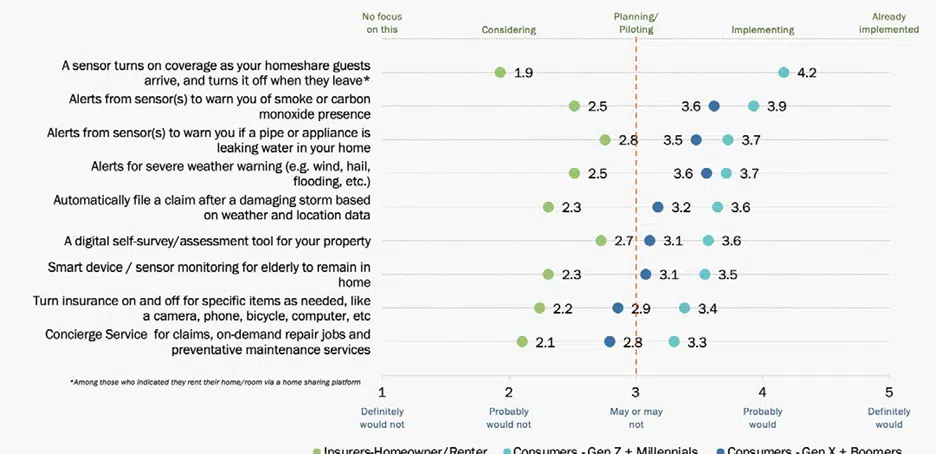

In our client analysis, we see a generational alignment in value-added companies within the home-owner/renter insurance coverage house, possible pushed by their top-of-mind points (Determine 2). Clients worth security and peace of thoughts from alerts and monitoring units/companies like smoke/CO and water leak sensors, residence monitoring for aged members of the family, and extreme climate alerts. These choices have among the many highest ranges of curiosity for each generational segments.

Specifically, the monitoring of aged members of the family leverages sensor know-how to assist hold them of their properties moderately than a nursing residence or assisted dwelling, serving to to handle their monetary top-of-mind points. The US inhabitants is growing older, which goes to create recent buyer wants and insurance coverage alternatives. In October 2023, the U.S. Census Bureau launched a report that roughly 4 million households with an grownup age 65 or older, “had problem dwelling in or utilizing some options of their residence.” Nationally, only a few properties are ready to accommodate an growing older inhabitants. For instance, solely 19.6% of properties in New England could be thought of “aging-ready.”[ii]

Because the inhabitants ages and as middle-aged caregivers are referred to as upon to make selections that may profit the extent of take care of an older father or mother, these clients might be searching for protecting and preventive companies that may very well be thought of fringe companies — however might grow to be core revenue facilities because the inhabitants continues to age. Dwelling retrofitting for security, including residence sensors and cameras to enhance ranges of care within the residence, and growing strategies for watching over water and electrical injury (widespread points for the aged of their properties). And that is only for elder care. If insurers take into account further life-style components, a complete array of doable services and products begins to take form.

Ease of computerized claims FNOLs based mostly on climate and placement knowledge, automated cyber safety monitoring, and digital property self-assessment instruments all present self-service capabilities more and more demanded by clients. A world of threat accommodates fear. Insurers can ease worries with value-adds.

For instance, concierge companies for repairs and preventative upkeep are additionally of excessive curiosity amongst customers. They know the worth of their spare time and lots of of them don’t need to spend their spare time fixing issues. Danger prevention and mitigation of their most beneficial belongings – their residence and private property — is a excessive precedence.

The breadth and powerful curiosity in these value-added companies supply insurers a possibility to deepen buyer relationships whereas creating potential new income streams to offset the curiosity in personalised pricing. However insurers want to maneuver properly past consideration into motion…by delivering value-added companies.

Determine 2

Buyer-Insurer gaps in value-added companies for private property insurance coverage

Your Entrepreneurial Enterprise

Your online business has a core services or products. It’s the factor you do properly, and it offers earnings over the lengthy haul. These with an entrepreneurial spirit additionally go after the services and products that encompass the periphery of what they do. They see alternatives on the perimeter. They break down partitions of conference to achieve entry to new markets with recent concepts.

The place is your subsequent revenue heart? Majesco has not too long ago rolled out a brand new and expanded line of insurance-focused merchandise, akin to our P&C Clever Core Suite, Majesco Loss Management, Majesco Property Intelligence[DG1] , and Majesco Copilot, developed utilizing Microsoft’s cutting-edge AI fashions. They’re prepared to assist insurers transfer into innovation’s quick lane.

Construct resilience into your framework by including value-added companies to your combine. Contact Majesco right now and make sure to attend our upcoming traits webinar, Majesco on the Forefront: Methods and Improvements Shaping the Insurance coverage Trade.

[i] Javanmardian, Kia, James Polybank, Sirus Ramezani, Shannon Varney, Leda Zaharieva, International Insurance coverage Report 2023: Increasing industrial P&Cs market relevance, McKinsey & Co. March 2023

[ii] Census Bureau Releases New Report on Getting older-Prepared Houses, October 10, 2023, US Census Bureau

[DG1]Yperlink these

[ad_2]