[ad_1]

However the valuations stay comparatively tame considered in opposition to the bubble period of the late Nineties.

Supply: BofA

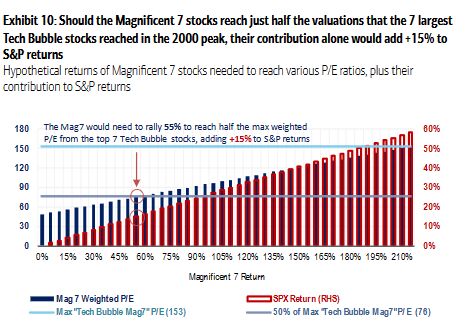

Supply: BofAIn the event that they had been to succeed in solely half of the height multiples of the seven largest tech shares of that point, right this moment’s so-called Magnificent Seven must rise by 55% every, in accordance with a latest evaluation by Financial institution of America Corp. strategists together with Benjamin Bowler. That’d translate to a 15% acquire for the S&P 500, all else equal.

Fueling the market’s newest leg up has been optimism over potential Federal Reserve interest-rate cuts and a rebound in company earnings. The Nasdaq 100 climbed 1% Wednesday as Netflix Inc. shares soared on better-than-expected subscriber numbers.

Bolstered by frenzy over synthetic intelligence, shares of the seven largest tech shares have doubled prior to now yr. Corporations like Apple and Microsoft, that are slated to report quarterly earnings in coming weeks, are projected to announce blockbuster outcomes.

Due to their dominant place in every little thing from e-commerce to clouding and electronics, huge seven’s earnings most likely expanded at a median tempo of 39%, analyst estimates compiled by Bloomberg present. That in contrast with marginal development predicted for all corporations within the S&P 500.

“I wouldn’t say it’s getting bubbly, nevertheless it’s getting stretched,” mentioned Yung-Yu Ma, chief funding officer for BMO Wealth Administration. “The query because the yr goes on is, are corporations capable of meet the excessive expectations which can be being priced in?”

With a prevailing lack of enthusiasm amongst Wall Avenue prognosticators, it didn’t take a lot for shares to exceed their goal. Their projection made in December requires the S&P 500 to rise 1.3% in 2024. That’s the least bullish year-ahead view since Bloomberg started monitoring the information in 1999.

The reservation displays flaring geopolitical tensions globally and the potential threat of an financial downturn after the Fed’s most aggressive fee hikes in a long time. But the market has as soon as once more proved its potential to beat headwinds.

The resilience is a reminder of the hazard of being left behind. Final yr, when the S&P 500 additionally managed to surpass Wall Avenue’s forecast by January, strategists initially held agency to their outlook solely to seek out themselves scrambling to play catch-up because the market saved operating greater.

Hedge funds, which trimmed their lengthy positions in tech megacaps between mid-August and December, are returning to the group because the business has restored management within the new yr, in accordance with knowledge compiled by Morgan Stanley’s prime dealer. Separate shopper knowledge from JPMorgan Chase & Co. confirmed the same sample.

“What we noticed in AI over the previous few weeks lends credence to the adage that should you aren’t lengthy, you’re brief,” Ron Adler, JPMorgan’s head of U.S. money fairness buying and selling, wrote in a be aware to purchasers earlier this week. “The transfer available in the market stays bolstered by a mix of euphoria and FOMO.”

(Credit score: Adobe Inventory)

[ad_2]