[ad_1]

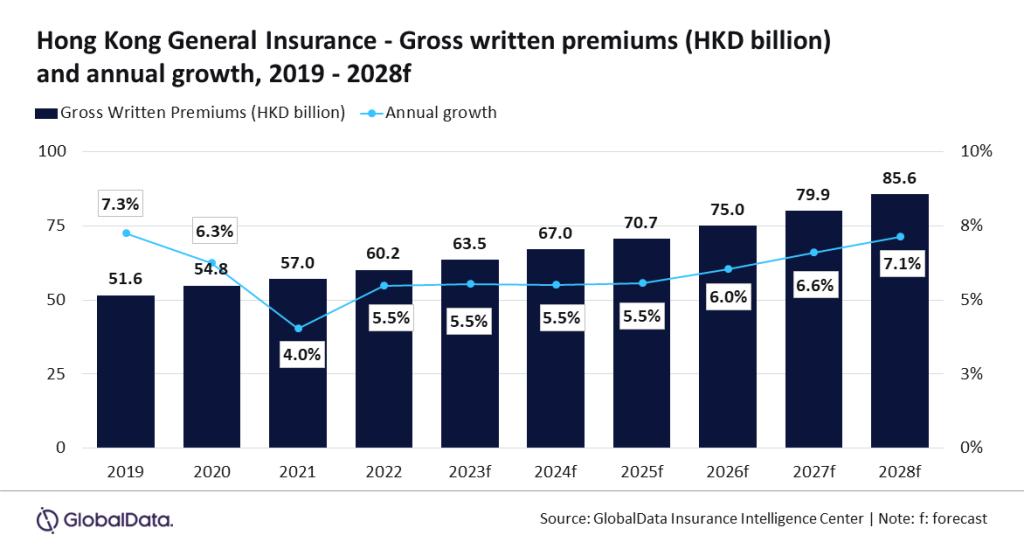

The final insurance coverage market in Hong Kong is about to develop at a CAGR of 6.3% from HKD67bn ($8.6bn) in 2024 to $10.9bn in 2028.

That is when it comes to gross written premiums, based on GlobalData.

As well as, the final insurance coverage business in Hong Kong is predicted to develop by 5.5% in 2024 and 2025, based on the GlobalData Insurance coverage Database.

This progress shall be supported by main insurance coverage traces, similar to private accident and well being (PA&H), legal responsibility, and property, which altogether account for 75% of the final insurance coverage GWP in 2023.

PA&H insurance coverage is the main line of enterprise in Hong Kong basic insurance coverage, accounting for 31.4% of the market in 2023. It’s projected to develop by 7.2% in 2024, primarily pushed by a rise in well being consciousness and a a restoration within the demand for medical insurance insurance policies from mainland China after the removing of prolonged journey restrictions.

Legal responsibility insurance coverage is the second largest line, accounting for a 24.1% share of the final insurance coverage GWP in 2023. Hong Kong was the fourth-largest legal responsibility insurance coverage market within the APAC area in 2023.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

determination for your enterprise, so we provide a free pattern you can obtain by

submitting the under kind

By GlobalData

Anurag Baliarsingh, insurance coverage analyst at GlobalData, commented: “Hong Kong basic insurance coverage business witnessed a constant progress of 5.5% in 2022 and 2023. The expansion was supported by a restoration within the demand for well being and journey insurance coverage insurance policies from mainland Chinese language prospects, obligatory insurance coverage courses, and rising medical inflation that resulted in a rise within the premiums for medical insurance insurance policies. The development is anticipated to proceed in 2024 and 2025.

“Chinese language prospects are principally attracted by the superior care, high-quality medical amenities, and shorter ready occasions provided in Hong Kong. The medical insurance insurance policies provided in Hong Kong embrace choices for added protection for relations, larger protection for particular kinds of sickness, and severity-based safety that aren’t out there within the insurance policies provided in Mainland China.”

[ad_2]