[ad_1]

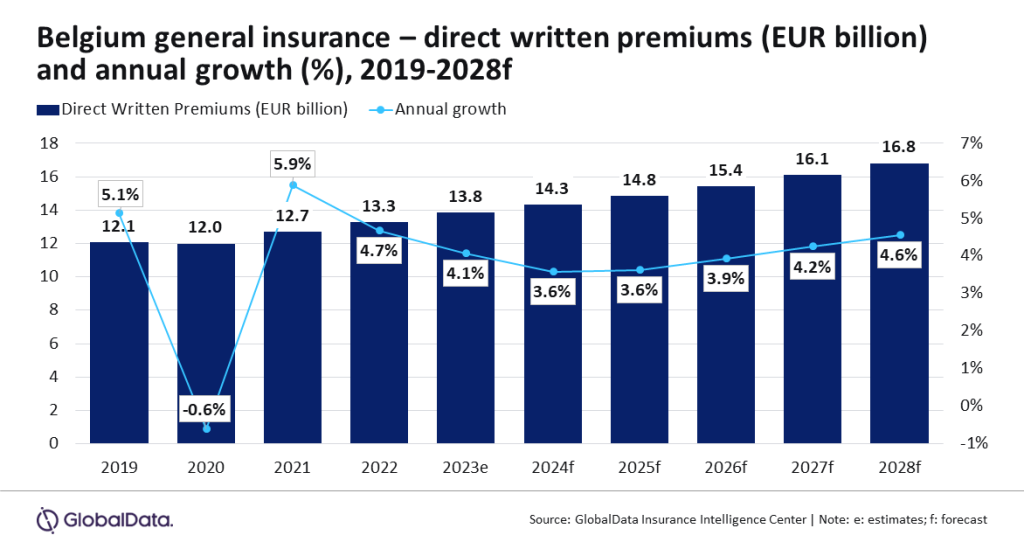

Common insurance coverage in Belgium is ready to develop at a CAGR of 4.1% from EUR14.3bn ($14.7bn) in 2024 to $17.7bn in 2028 by way of direct written premiums.

That is in response to GlobalData and its Insurance coverage Database, the overall insurance coverage business sector in Belgium is anticipated to develop by 3.6% in 2024. Motor, property and PA&H will all contribute to this development as they account for 76.9% of the business.

Motor insurance coverage has the most important share of normal insurance coverage in Belgium, taking on 31.3% of it in 2023.

As well as, motor insurance coverage DWP grew by 1.8% in 2023, supported by a rise in automobile gross sales.

Property insurance coverage is the second largest line, accounting for a 25.7% share of the overall insurance coverage DWP in 2023.

Moreover, property insurance coverage grew by 5.1% in 2023, pushed by the rising demand for dwelling multi-risk insurance coverage insurance policies, which accounted for a majority share of property insurance coverage premiums in 2023.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

helpful

choice for your corporation, so we provide a free pattern that you would be able to obtain by

submitting the under kind

By GlobalData

Prasanth Katam, insurance coverage analyst at GlobalData, mentioned: “Belgium has witnessed slower financial development in 2023, as the actual GDP grew by simply 1% as in comparison with 3.2% and 6.3% development in 2022 and 2021, respectively. In consequence, the expansion in Belgium’s normal insurance coverage business slowed down in 2023 and grew by 4.1% after rising by 4.7% in 2022. The development is anticipated to proceed in 2024.

“The excessive costs of electrical automobiles and better restore prices as in comparison with Inside combustion engine (ICE) automobiles clubbed with rising inflation ranges will immediate insurers to extend the premium costs for motor insurance coverage insurance policies in 2024, which can help the expansion of motor insurance coverage. Motor insurance coverage is anticipated to develop at a CAGR of two.8% throughout 2024-2028.

“Sensible dwelling sensors that present real-time alerts for water leaks and different potential damages are promoted by property insurers for early detection of damages and minimising claims. Policyholders, in flip, can get hold of premium reductions for adopting sensible dwelling applied sciences.”

[ad_2]