[ad_1]

Cellphones are part of us now. Most of our lives are spent inside inches of a cell machine. We want them nearly like we’d like meals and water. They permit us to run a lot of the logistics of our life wherever we could also be. They permit us to continually talk — merging life and work right into a seamless cloth. For good or unhealthy, our lives are actually much less compartmentalized and extra built-in right into a unified circulation of data, work, wellness, communication, buying, leisure, and maintenance.

Nonetheless, telephones and cell companies are costlier than ever. This has positioned cell phone service suppliers underneath elevated buyer worth scrutiny, particularly as a result of there are so few suppliers and so many subscribers. The sheer quantity — the ratio of subscribers to suppliers — is staggering. It has stretched cell supplier billing programs and it has pissed off thousands and thousands of consumers. It has additionally made competitors fierce.

Take into consideration your individual cell supplier expertise, particularly about billing and repair. For the reason that massive three (AT&T, Verizon, and T-Cell) largely carry the identical telephones, they’re now in a scenario the place worth, service and billing are presumably the best determiners of buyer loyalty and retention. What drives you to remain or change? Are you all about price or do you prioritize utilizing a customer-friendly model that makes cell use a rewarding expertise and provides different worth?

Buyer loyalty is fragile in any trade; insurance coverage is not any exception.

Nice buyer experiences, interfaces, straightforward transactions, and intuitive service can construct your model and improve buyer loyalty. Customer support points: whether or not by means of billing and fee of insurance policies or claims funds, can drive clients away. Clients nonetheless, figuratively, vote with their ft.

Roundtable views on insurance coverage billing and funds

Deloitte and Majesco hosted a roundtable with skilled billing and funds trade leaders to debate the market developments and subsequent methods and ways to raise billing and funds as a key a part of the client journey and expertise. We documented among the findings and most of the roundtable discussions in a current thought management report, Rethinking Billing and Funds within the Digital Age.

In a day and age the place competitors is as stiff because it has ever been, most of our contributors agree that billing and funds deserve nearer scrutiny, better consideration, and better precedence in order that it reaches its full potential as an environment friendly, efficient model builder.

Stepping As much as the brand new period of buyer billing and fee expectations

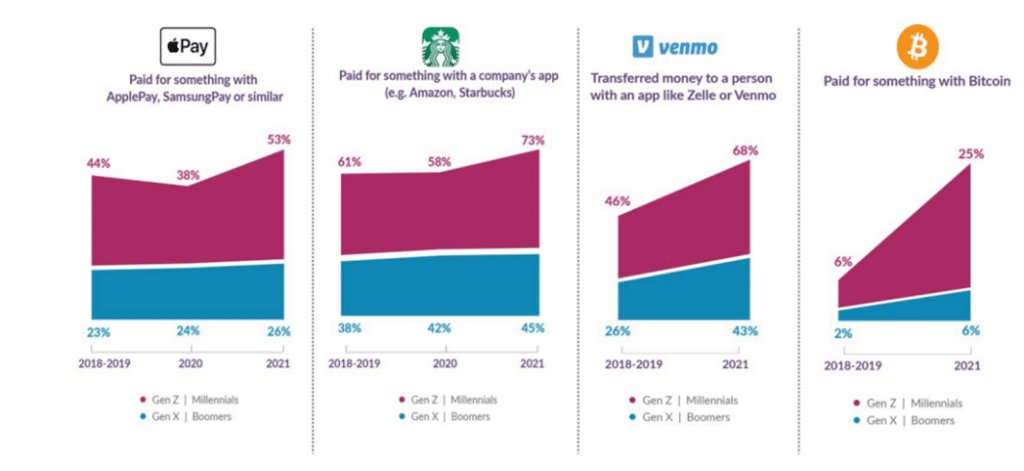

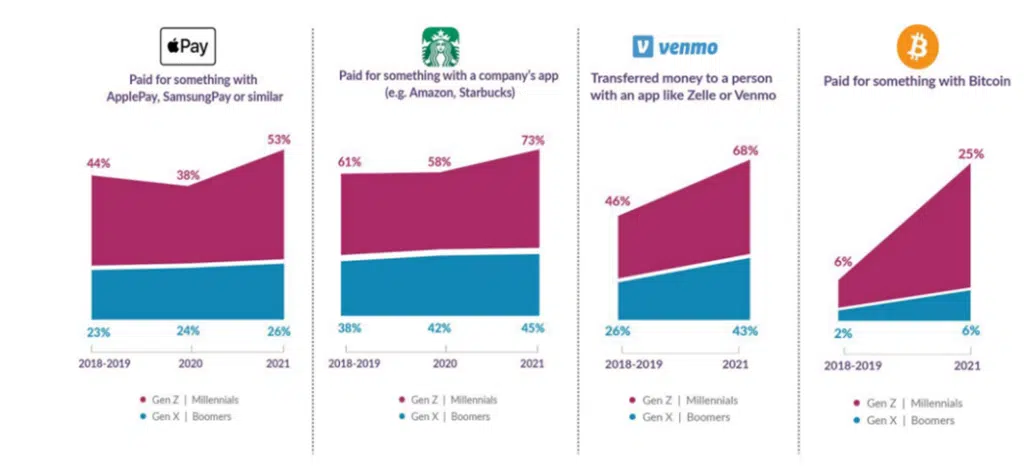

We see it throughout all industries and companies – clients are being attentive to how they’re billed and paid. Their expectations, whether or not met or unmet, are one figuring out think about whether or not they select to modify to or stick with an insurer. These expectations are being pushed by an ever-growing set of choices that embody all the things from customizable billing schedules to digital fee strategies like ApplePay, Venmo, firm apps, and others to make or settle for funds. On the identical time, clients expect a seamless digital expertise.

Majesco’s buyer analysis, mirrored in Determine 1, highlights the rising demand for these different fee strategies, notably for Gen Z and Millennials.

Determine 1: New Buyer Digital Commerce Expectations

Whereas insurers should adapt their methods to be digital-centric, some clients nonetheless want writing a examine. As one roundtable participant mentioned, 70% of P&C funds of their line of enterprise are made through examine – an astounding quantity contemplating how many individuals have tailored to digital choices. To retain belief and loyalty, and hold income unobstructed, insurers should meet all billing and fee choices.

These rising expectations speed up the shift of billing and funds from its conventional position as one of the crucial “again workplace” processes to the “entrance workplace” as a vital functionality in delivering an awesome buyer expertise. Insurers more and more understand the numerous position that billing performs. They’re waking as much as the truth that distinctive service is vital past the monetary operation. First-rate service is essential to constructing and enhancing relationships with clients, companions, and distributors. In at present’s more and more digital world, legacy billing programs don’t meet these rising wants and expectations.

Cultivating buyer experiences that assist the model.

Superior billing and fee capabilities can now not be considered merely from a transactional perspective, however now should fill a vital position in creating an inviting and holistic digital expertise. Each contact level is a chance to humanize and personalize the model relationship and strengthen model belief and loyalty.

In rethinking billing and funds, insurers are centered on key enterprise priorities together with:

- Buyer expertise – The prevalence of digital shopping for and fee choices throughout different industries, heightens the expectation for insurance coverage to ship related capabilities to be “on par.” Insurers compete with outdoors experiences.

- Transparency and suppleness – Buyer belief is influenced by transparency.

- Clients are searching for a single invoice for a number of insurance policies, no matter product or section.

- New merchandise similar to usage-based or gig insurance coverage (which mirror actuality, not estimates) require extra frequent and customized pricing and billing.

- Clients wish to run eventualities. Can they preview the affect on payments if they modify plans or choices?

- Superior analytics for model administration – Insurers need perception into:

- Propensity to resume or lapse.

- Doubtless response charges for cross-sell or upsell provides.

- Buyer expertise satisfaction.

- And, profitability for proactive/responsive enterprise administration.

- Worth-Added Companies – More and more insurers wish to improve the client relationship and develop income by providing value-added companies. The billing and fee choices for these companies typically require completely different approaches than conventional threat merchandise.

Communication is vital.

Well timed, frequent, and customized digital communication is equally as vital.

Digital channels like voice, good audio system, e-mail, or textual content/SMS are more and more used to boost the connection and expertise. Communications are now not restricted to billing statements or fee statuses. Frequent communication relating to different merchandise or value-added companies is suitable. How are insurers changing into useful, not simply transactional? Options relating to different billing choices that may higher align with a buyer’s life could present better buyer personalization and engagement. It’s more and more vital to keep away from coverage lapses or late renewals.

“Funds, from a billing perspective, is essentially the most frequent touchpoint that you’ve at any given level together with your insurers. That is the chance to have that nice buyer expertise, the place they are saying this was straightforward, this was frictionless.”

Roundtable Participant

Insurers should strategically and tactically start to convey billing and funds into buyer expertise and digital engagement plans. A various set of digital fee choices, superior applied sciences, and a coordinated mixture of digital communication strategies will lay a strong basis and meet the rising expectations of consumers, brokers, and companions.

“We’ve created an organizational change administration staff beneath our chief expertise officer. They’re constructing out a complete portfolio of messaging. We wish to perceive the obstacles that individuals see. If we are able to get that data and converse again in phrases they’re utilizing, we are able to affect them to the surroundings we would like.”

Roundtable Participant

Digital billing and funds: the place do insurers start?

Digital billing and funds can re-energize an insurer’s capability to fulfill retail developments head-on.

To get to the subsequent stage and rethink billing, they wanted to beat hurdles like crippling legacy debt that hinders their effectiveness and buyer expertise because it pertains to billing and funds and rethink their future state. What alternatives would come up if insurers might grow to be extremely digital, with a brand new working mannequin and a strong, but versatile know-how basis?

Take care of the hurdle of legacy debt.

One of many vital hurdles for digital transformation is legacy debt – each the working mannequin and know-how – stifling an insurer’s capability to fulfill buyer digital expectations, increase billing and fee choices and drive down operational prices. An insurer’s legacy debt removes the flexibility to launch new, progressive merchandise similar to embedded, on-demand, UBI, and value-added companies as a result of limitations of the know-how. Billing know-how like Majesco Billing for P&C, Majesco Billing for L&AH, Majesco Digital Digital Bill360 for P&C and our ecosystem of companions allows, not inhibits.

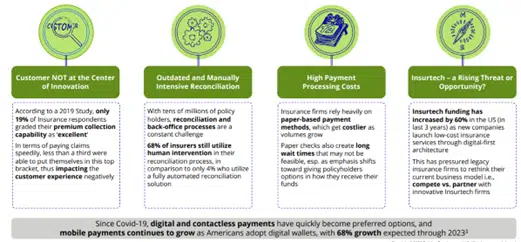

Every of the areas mirrored in Determine 2, highlights the market development challenges and operational realities of legacy debt.

Determine 2: Present state of funds within the insurance coverage sector

Addressing the present state requires a technique and plan that tackles the operational mannequin, together with all processes, know-how, and tradition. Immediately’s clients count on their most well-liked manufacturers to instinctively replace their processes and transaction capabilities to maintain up with what their units and existence have made doable.

They need a threat product, value-added companies, and an expertise that gives them with what they should handle their lives. Insurers should humanize the method and expertise. However conventional product-oriented methods handicap insurers. Insurers must “suppose outdoors their very own bins” and hold buyer lifecycles and desires in focus.

Insurers that take note of these shifts ought to take the subsequent step and make fast strikes to take away their crippling legacy debt.

Unify the know-how technique and customer-focused ways.

The longer term state calls for an operational mannequin and know-how that gives a basis to adapt, innovate and ship at velocity to execute technique and market shifts. The rising significance and adoption of platform applied sciences, APIs, microservices, digital capabilities, new/non-traditional knowledge sources, and superior analytics capabilities are actually essential to market management.

From the entrance workplace to the again workplace, SaaS next-generation platforms are reshaping the enterprise focus from coverage to buyer, from course of to expertise, from static to dynamic pricing, from point-in-time underwriting to steady underwriting, from the historic view of information to predictive and prescriptive knowledge, from conventional merchandise to new, progressive merchandise, and a lot extra. Insurers’ capability to ship elevated worth to the client relationship will deepen and differentiate buyer loyalty.

Central to the elevated worth is bettering buyer selections, but with selection comes complexity. This complexity could be simplified, managed, and optimized with a next-gen billing and fee unified technique.

A unified billing and fee technique supplies a holistic, enterprise strategy to enterprise capabilities, processes, and buyer engagement. It strikes billing and funds from the again workplace and a defensive place to the entrance workplace and an offensive place for buyer engagement, resulting in greater satisfaction, loyalty, and retention.

Conventional instance: Direct and Company Invoice

Direct and Company invoice are two of essentially the most used billing sorts. Direct invoice is when an insurer sends the invoice to the policyholder for fee on to the insurer. In distinction, company invoice the company payments the insured and collects the premium then pays the insurer. Particular processing is required to assist each of those. There are different sorts of billing together with record or group invoice, third get together invoice (similar to mortgagees), and cut up or multipayer billing.

Whereas these proceed to be dominantly used, as merchandise change and the way premium is calculated – extra steadily or in real-time – progressive billing choices are rising. Insurers should be capable of assist these new choices to fulfill product calls for of consumers.

Progressive instance: Computable contracts

One tactic of an offensive technique that’s being thought-about by some firms is together with the flexibility to have computable contracts (placing the coverage settlement into code) for every coverage. For instance, a rock hits your windshield. You’re taking an image and submit a declare. As a result of the info about your automobile and coverage are recognized by means of this computable contract, the fee can circulation instantly and digitally. The method is quick, and it naturally reduces operational prices.

Innovation centered on the client can drive further offensive performs whereas accelerating transformation. Making a holistic buyer expertise not solely supplies digital billing and fee choices, but in addition allows broader communication and engagement together with cross-sell or up-sell of insurance policies with further merchandise, amendments, or value-added companies primarily based on their distinctive demographics.

Progressive instance: Purchase now, pay later.

Inflation is inflicting clients to judge all their bills. In consequence, some are contemplating different financing choices similar to Purchase Now, Pay Later (BNPL). BNPL is a comparatively low-cost, versatile credit score possibility that gives quicker entry to credit score in comparison with different unsecured mortgage merchandise, thereby decreasing uncertainty and easing buy choices for purchasers.

This feature is primarily pushed by Fintechs who’re providing entry to credit score for purchasers with low credit score scores. It offers them the merchandise they want with a decrease up-front duty. They obtain:

- On the spot gratification (not like layaways).

- Higher money circulation administration by means of versatile compensation plans & rates of interest (0-30%).

- A considerably extra personal and protected transaction that is more cost effective and extra accessible than bank cards.

It’s estimated that 40% of consumers count on installment loans as a fee possibility, however in main downturns, Deloitte estimates that installment loans can act as an vital bridge for over 90% of consumers.

This fee possibility could possibly be a consideration in serving to individuals pay massive premiums. For some insurers, this sort of tactic could not appear essential. Nonetheless, when you contemplate that a part of model constructing is making transactions straightforward and painless, it suits squarely inside the insurance coverage model technique.

In our subsequent weblog, we’ll have a look at how insurers can arrive on the future state. How can insurers select and use the best mixture of billing and fee applied sciences that may match customer-focused methods and construct the model by means of the very best experiences? Deloitte and Majesco collectively are working ahead pondering, main insurers within the trade, to rethink their billing and funds operation and know-how to raise their model and buyer loyalty in a world of quickly altering expectations.

For a deeper look, you should definitely obtain the Majesco/Deloitte report, Rethinking Billing and Funds within the Digital Age.

Immediately’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Ajay Radhakrishnan, Principal, Deloitte Consulting

[ad_2]