[ad_1]

Samsung Bioepis has a Biosimilar Market Report for Q2 2024. Some key highlights:

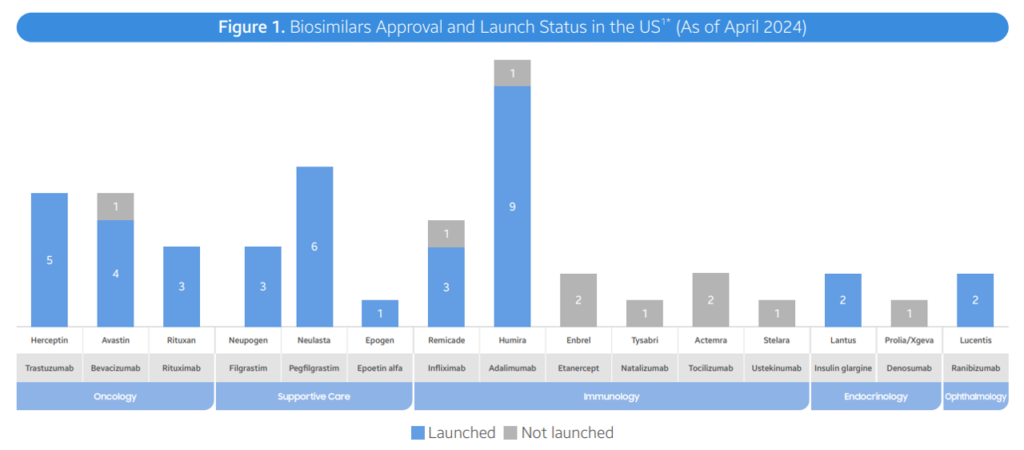

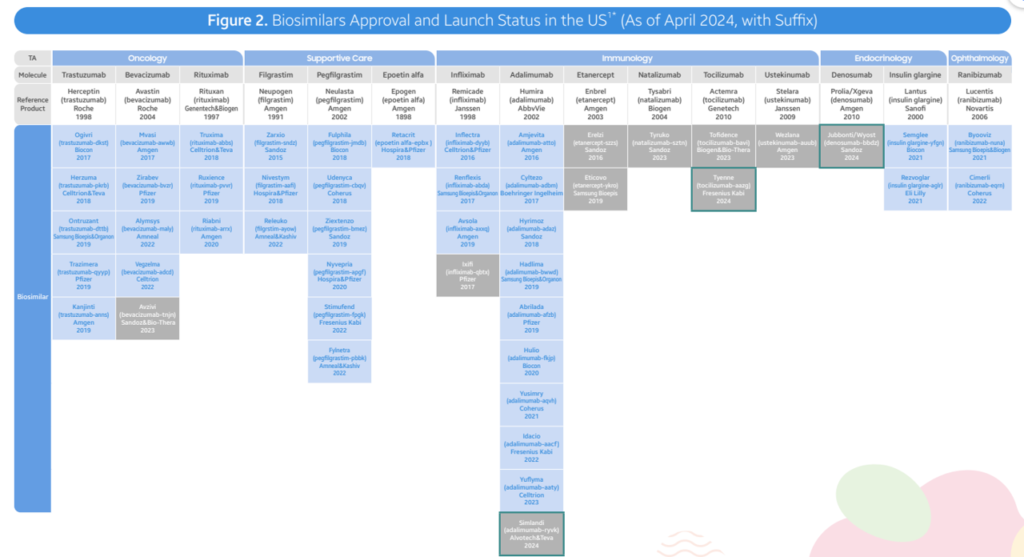

- As of April 2024, the FDA has accepted a complete of 48 biosimilars throughout 15 distinctive organic molecules. Of the 48 approvals, 38 biosimilars have launched within the US market. In Q2 2024, 3 new biosimilars had been accepted within the US (Simlandi for Humira (adalimumab); Jubbonti/Wyost for Prolia/Xgeva (denosumab); Tyenne for Actemra (tocilizumab))

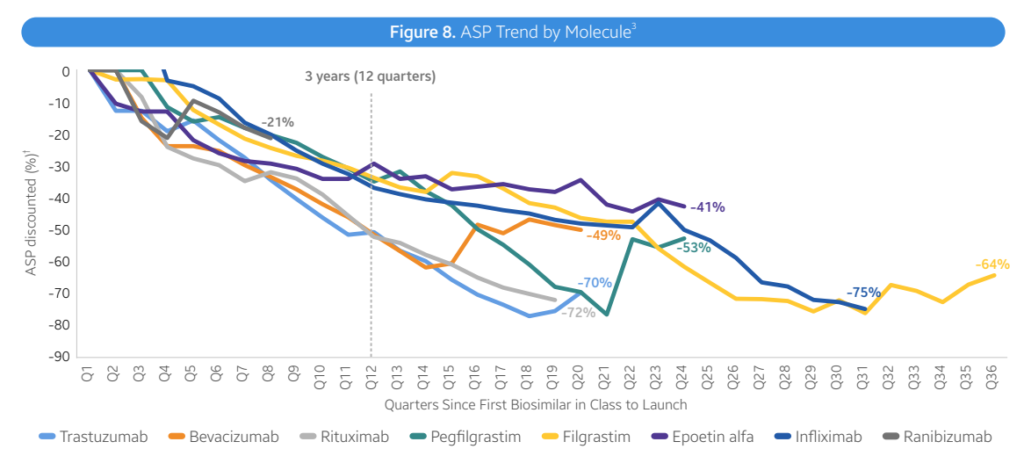

- Average reductions. Total, biosimilars are resulting in decrease costs, largely by way of rebates relatively than record worth. Nevertheless, costs fell by 41% inside 3 years with lots of variability throughout therapeutic areas.

- In oncology, biosimilars wholesale acquisition price (WAC) costs had been 10%-25% decrease than reference merchandise. In supportive care,

- For supportive care, WAC costs of biosimilars for pegfilgrastim and epoetin alfa are 20-60% decrease reference, however common gross sales costs (ASP) for the reference merchandise has fallen to match ASP for biosimilars in an effort to retain market share.

- Immunology (Infliximab). Infliximab biosimilars launched with progressively decrease WACs, starting from -19% to -59% in reductions. Biosimilar competitors has led to ASP costs 75-90% decrease than the reference product WAC

- Immunology (Humira). Adalimumab (Humira) biosimilars have taken completely different approaches. Two biosimilars have used decrease WAC costs (85% reductions). Most Infliximab biosimilars launched with progressively decrease WACs, starting from -19% to -59% in reductions. Biosimilar competitors has led to ASP costs 75-90% decrease than the reference product WAC

- Opthalmology. Current ranibizumab (Lucentis) biosimilar launches have already led to 30-40% decrease reference product ASP prices. Six different biosimilars have used an strategy with comparable WAC costs to branded Humira however with massive rebates the cut back costs by 55%-90% of the reference product.

- Diabetes. Biosimilars for Lantus (insulin glargin) have additionally used a blended strategy the place some merchandise have decrease WAC and others have comparable WAC however decrease costs on account of rebates.

- Biosimilar uptake varies by molecule. Three years post-launch, biosimilar uptake for bevacizumab, trastuzumab, pegfilgrastm and rituximab had been all >50%. For different medication comparable to insulin glargine, epoetin alfa and infliximab, market shares had been all <50% at yr 3. On the whole, market share rises considerably over time, nonetheless, in immunology Humira branded merchandise nonetheless comprise 96% market share.

- Inflation Discount Act. There are some provisions which can be constructive for biosimilars and others much less so.

- Professional: Lack of producer income from Medicare Drug Value Negotiation and Inflation Rebate might lead producers to launch with increased record costs and/or cut back rebate charges in different therapeutic areas or strains of enterprise (e.g. non-public insurance coverage). Biosimilars might supply larger price aid in these future markets. Moreover, the elevated Medicare cost restrict for biosimilars to ASP + 8% helps offset a number of the losses that suppliers might incur when utilizing cheaper ASP biosimilars on the medical profit

- Con: Medicare Drug Value Negotiation will impose pricing strain on the chosen medication and their related opponents. In these markets (i.e. Enbrel, Stelara), the financial savings that biosimilars can supply to plans could also be decreased, making step remedy by way of biosimilars a much less engaging technique for plan sponsors to implement. Furthermore, reductions and caps within the Half D member price sharing necessities, whereas a constructive enchancment for the general affordability of Medicare beneficiaries, unintentionally reduces the monetary incentive for members to change to a biosimilar from an originator product

You may learn the complete deck right here.

[ad_2]