[ad_1]

The monster run in equities and different danger property that formed the ultimate stretch of 2023 has room to run effectively into the brand new 12 months if inflation continues to ebb, in line with strategists at BlackRock Inc.’s Funding Institute.

Momentum from the Federal Reserve’s dovish shift final month might energy the inventory market “effectively into 2024” if value pressures proceed to ease, in line with a staff led by Jean Boivin, BII’s head of analysis, and international chief funding strategist Wei Li.

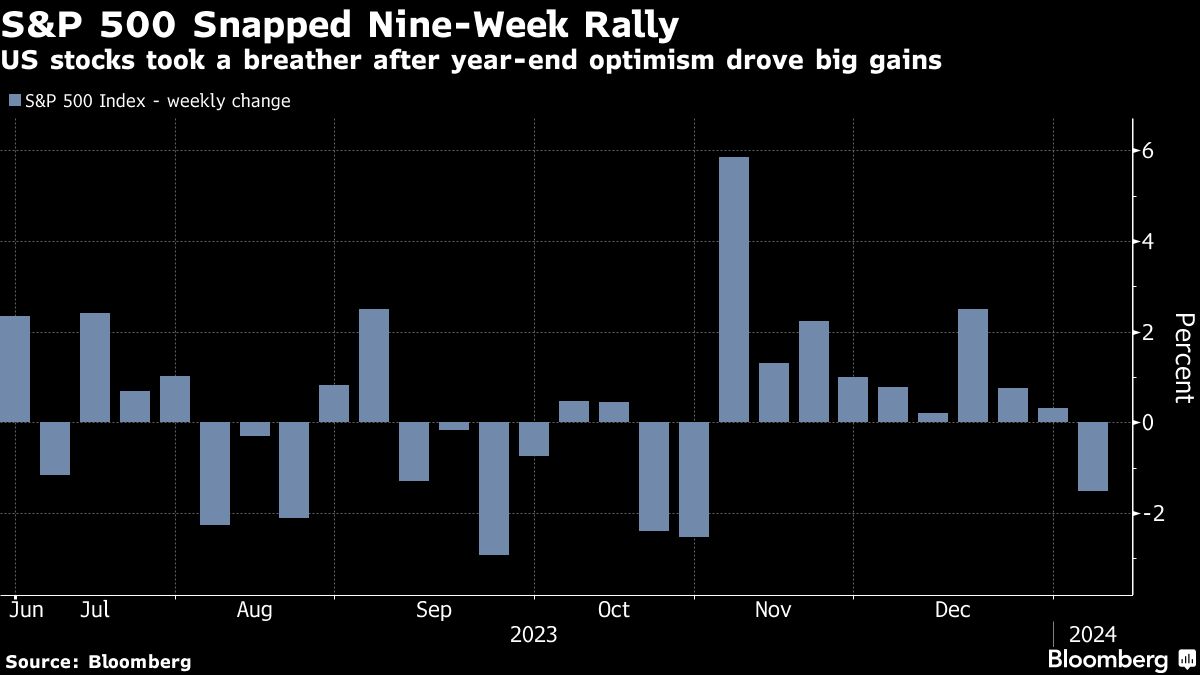

The S&P 500 Index capped 2023 inside spitting distance of its all-time excessive, climbing 24% for the 12 months because the US financial system remained resilient within the face of the best rates of interest in additional than twenty years.

That optimism bolstered by expectations for cuts in 2024 and enthusiasm round synthetic intelligence propelled expertise shares towards their finest 12 months because the dot-com increase.

Positive aspects in U.S. shares accelerated within the remaining weeks of buying and selling after Fed officers affirmed their readiness to ease financial coverage this 12 months.

“That when once more highlighted how hopes and disappointments in regards to the Fed drove market flip-flops all through 2023,” the strategists wrote in weekly commentary Monday. “The ultimate rally was no totally different, in our view. It has left fairness markets priced for a near-perfect end result: a gentle touchdown, the place inflation falls and central banks sharply reduce charges.”

U.S. shares, nonetheless, have had a rocky begin to 2024 buying and selling, snapping a nine-week successful streak on Friday. The 12 months’s jittery kick off for shares and bonds indicated that traders could also be nervous in regards to the macroeconomic outlook, in line with the staff led by Boivin and Li.

BlackRock Funding Institute expects the patron value index readout this Thursday to point out falling items costs main inflation decrease in 2024, however they anticipate provide constraints placing inflation on a “curler coaster.”

[ad_2]