[ad_1]

GlobalData surveying signifies that many customers seeking to swap insurance coverage suppliers are literally struggling to search out higher offers regardless of rampant premium hikes in lots of private strains. The information that MoneySuperMarket introduced file annual income from its insurance coverage division in 2023, up 28% in 2022, exhibits the problem insurers face in competing on value in such a value-driven market. With premiums at file ranges and such a big proportion of customers seeking to swap (even when many can’t), the aggregator has seen such spectacular outcomes via greater commissions and improved conversion charges.

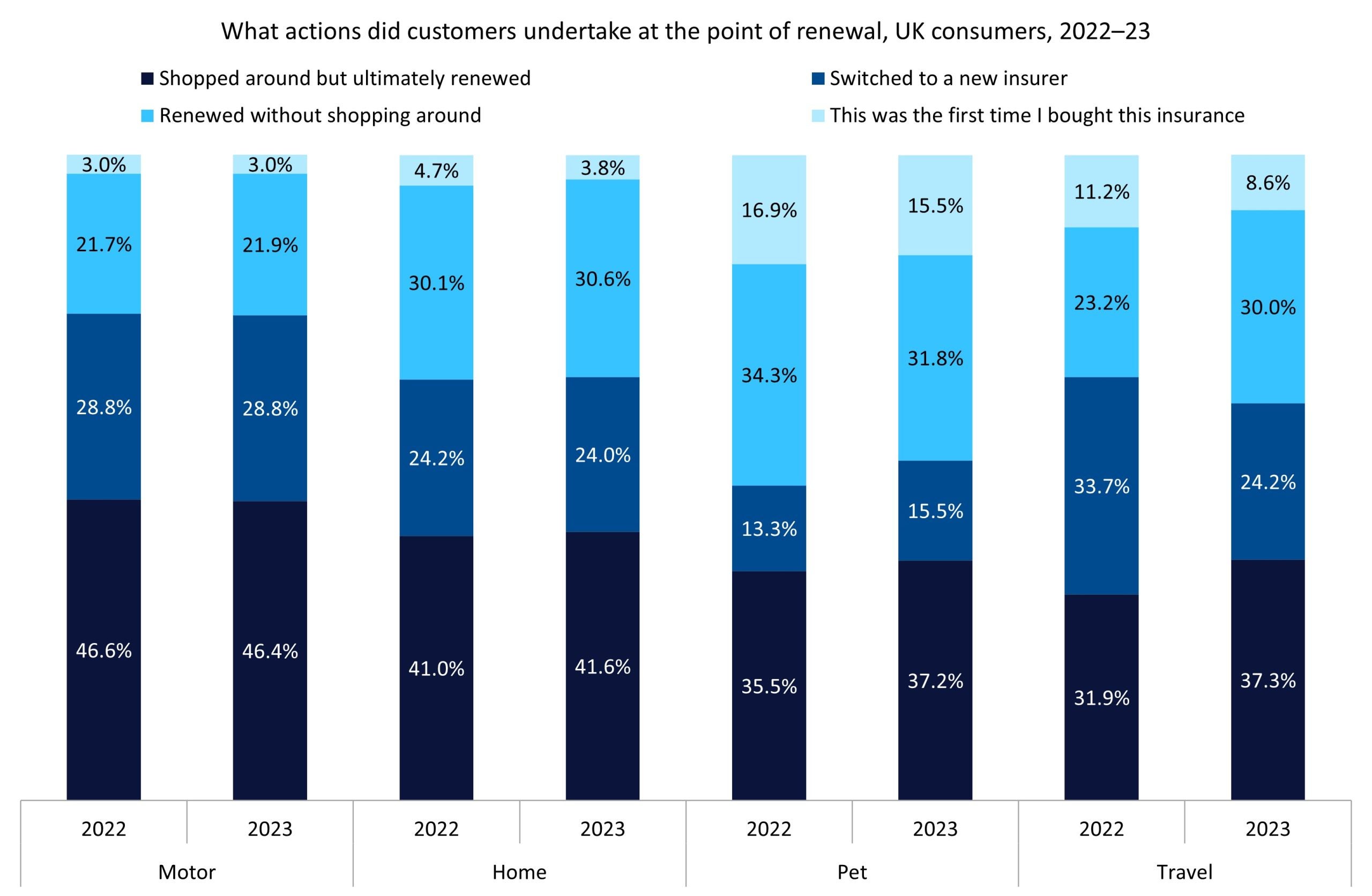

Value comparability web sites (PCWs) are uniquely positioned to make the most of spiralling insurance coverage premiums within the post-pandemic world. In response to GlobalData’s 2023 UK Insurance coverage Client Survey, greater than 50% of UK insurance coverage prospects shopped round earlier than both switching or renewing with their insurer. Premiums within the motor and residential strains have risen considerably previously two years. Knowledge from the Affiliation of British Insurers (ABI) signifies the common premium elevated by 33.5% between This fall 2022 and This fall 2023. For mixed, buildings-only, and contents-only insurance policies, these will increase have been 19.1%, 21.9%, and 12%, respectively.

Given these hefty value rises (together with the myriad of different further prices handed on to customers previously few years), it’s no shock that so many people are searching for higher offers on their insurance coverage. Within the motor line, 75.2% of shoppers shopped round earlier than renewing or switching their coverage. Simply over one-third of this group discovered a less expensive supplier and switched. These figures are largely just like 2022, suggesting a steady and aggressive market as many customers have been unable to search out higher offers even when actively looking out. Related findings have been seen within the residence line, with 65.6% of customers buying round in 2023; once more, simply over one-third of this cohort have been capable of finding an alternate and swap.

Robust competitors throughout private strains, accompanied by spiralling prices (in each claims and working bills), has put enormous stress on insurers. RSA’s exit from UK private strains exhibits that even the most important gamers are struggling to maintain up with these prices. In 2022, RSA was the second-largest residence insurance coverage supplier, with an 11.3% market share as per GlobalData’s UK Prime 25 Basic Insurance coverage Competitor Analytics. Insurance coverage has at all times been a value-driven market—greater than 60% of all switchers did so attributable to a decrease premium from their new insurer—and the cost-of-living disaster has pushed much more customers to squeeze the utmost worth from their merchandise. The development of financially constrained customers searching for higher offers on their insurance coverage (or cancelling altogether) will certainly proceed in 2024. Insurers will wrestle to repeatedly move rising prices on to customers and so should discover a manner of minimizing claims and working prices. In any other case, a repeat of 2023—by which the one winners appear to have been PCWs—seems a certainty.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we would like you to take advantage of

helpful

choice for your enterprise, so we provide a free pattern that you may obtain by

submitting the under type

By GlobalData

[ad_2]