[ad_1]

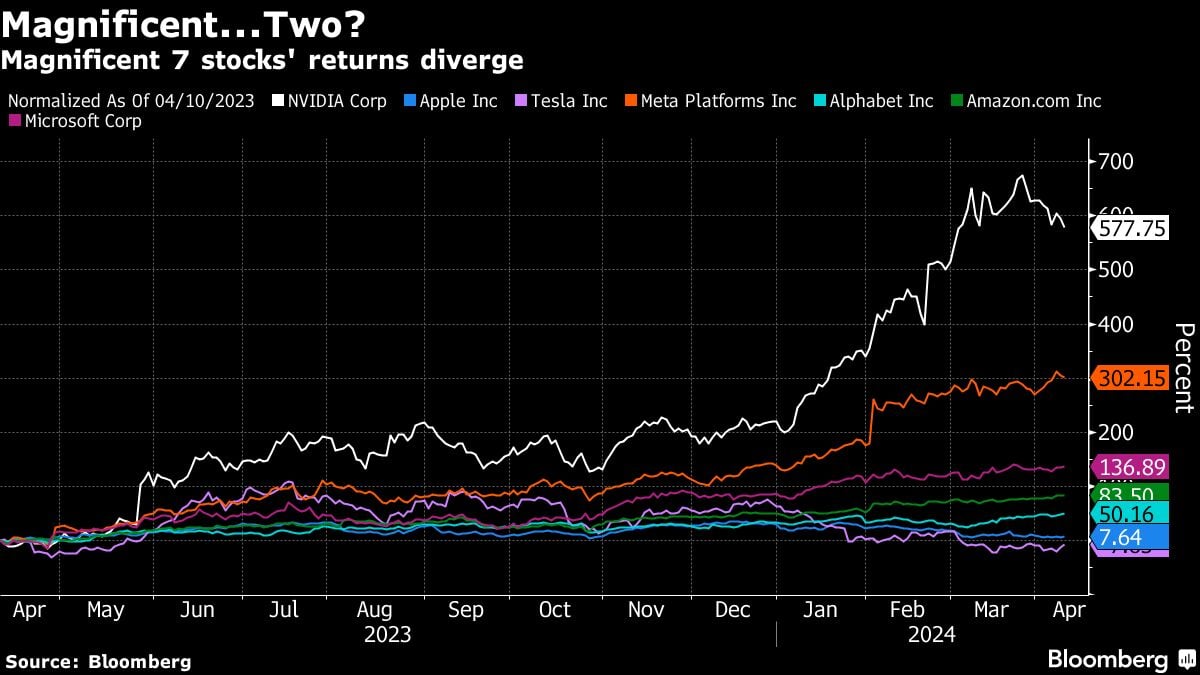

Apple Inc. shares have struggled on account of weak demand for iPhones in China, and Tesla Inc. is down 30% year-to-date on issues over electrical car demand.

Goldman Sachs Asset Administration, or GSAM, is holding an chubby place on power shares as a hedge towards inflation and geopolitical dangers, mentioned Wilson-Elizondo.

To this point this yr, it’s been an excellent commerce. S&P 500 oil and fuel corporations are up 16%, in contrast with an 11% achieve for tech shares.

She mentioned they’re nonetheless cautious on utilities and REITs, in addition to small-caps due to their sensitivity to high-interest charges. Even so, some small-caps are enticing due to their low cost valuations and some could also be takeover targets for fast-growing AI corporations.

“An lively supervisor can add plenty of worth on this section of the market,” she added.

Japan is one other space that Goldman is chubby on account of company reforms, enhancing enterprise sentiment and comparatively low valuations. “Japan affords a pleasant alternative to each a cyclical and structural story,” Wilson-Elizondo mentioned.

[ad_2]