[ad_1]

We assessment the pet insurance coverage business’s most respected firms, analysis extensively, and analyze buyer suggestions. Our licensed insurance coverage agent fact-checks all the things, and we replace our protection all year long as suppliers change their insurance policies, premiums, payout limits, reimbursements, customer support expertise, and extra. Who’re one of the best pet insurance coverage firms this yr? Let’s discover out.

Finest Pet Insurance coverage Opinions

The variety of pet insurance coverage firms to select from is overwhelming. Folks typically resolve to go along with the biggest, most well-known firm, failing to spend the important time wanted to contemplate their choices totally.

Beneath, we spotlight a short snapshot of every main U.S. firm, together with what stands out relating to protection and exclusions, what might sway you to decide on an organization, and any reductions the supplier provides. We encourage you to get quotes and evaluate charges from at the very least three firms and skim our in-depth critiques of these you have an interest in earlier than signing up.

Corporations are listed in keeping with our rankings adopted by alphabetically.

Pets Finest Evaluate

Pets Finest is our greatest general decide for pet insurance coverage as a result of it provides in depth protection at an inexpensive worth on common in comparison with the competitors. Its plans are utterly customizable, so that you pay for the protection you need and what you’ll be able to afford. There are no higher age limits, so even in the event you undertake a senior canine or resolve you need protection on your pet after they’re older, you gained’t be restricted in your protection choices.

Pets Finest additionally has some distinctive plans and options. The truth is, it’s one of many few pet insurance coverage suppliers to supply an accident-only plan, which will be useful for these wanting a real emergency-only choice at a lower cost. Moreover, it offers protection for curable pre-existing situations as soon as healed or cured.

Wellness plans are additionally accessible by Pets Finest as an add-on to your pet insurance coverage coverage. This can be a handy choice on your family and enable you to finances for routine bills like vaccinations, flea/tick prevention, heartworm testing, and extra. Pets Finest has a lot to supply to suit every pet dad or mum’s wants, so it’s value your consideration.

Pets Finest additionally administers insurance policies by Farmers Insurance coverage, PEMCO, and Progressive.

| Execs | Cons |

|---|---|

| Customise your plan to suit your finances and wishes with completely different deductible, reimbursement, and payout choices | Longer than common declare processing averages (7-14 days) |

| Might have choice for Pets Finest to pay your vet on to keep away from ready for reimbursement | Excludes various/holistic therapies and C-sections |

| Accident-only plan accessible | |

| Optionally available wellness plans accessible as an add-on | |

| Shorter than common ready durations (3 days for accidents and 14 days for hip dysplasia) | |

| Constantly among the many lowest costs |

Pets Finest provides the next reductions:

- 5% off for a number of pets

- 5% off for army members and their households

Use this hyperlink to make the most of the very best worth. No promo code is required. You may as well go to our devoted Pets Finest reductions web page to be taught extra.

In-Depth Evaluate Of Pets Finest

Fetch Evaluate

Fetch is great in order for you protection for a really younger pet as a result of it provides protection as younger as six weeks outdated. As compared, you must wait till eight weeks with most opponents.

One other distinctive characteristic of Fetch insurance policies is its VirtualVet go to protection. You possibly can cowl as much as $1,000 in digital vet visits, whether or not over video chat, name, or textual content.

Fetch provides protection for a number of situations generally excluded by different suppliers with out requiring an additional payment. If you would like a pet insurance coverage coverage with out worrying about add-ons and further charges, Fetch is value your consideration.

| Execs | Cons |

|---|---|

| Customise your plan to suit your finances and wishes with completely different deductible, reimbursement, and payout choices | Cannot have Fetch pay your vet on to keep away from ready for reimbursement |

| Behavioral therapies, various/holistic therapies, C-sections, sick go to examination charges, and gum illness are included in protection | No accident-only plan accessible |

| Optionally available wellness plans accessible as an add-on | Longer than common accident ready interval (15 days) |

Fetch provides the next reductions:

- As much as 10% off for animal shelter adoptees and workers, company profit plans, medical providers pets, strategic companions, army, veterinary workers, and college students

- 10% off premiums for Walmart customers

- Save $25 or extra if you pay quarterly or yearly

- 10% off for AARP members for all times

Use this hyperlink to make the most of the very best worth. No promo code is required. Alternatively, name 800-237-1123. You may as well go to our devoted Fetch promotion web page to be taught extra.

In-Depth Evaluate Of Fetch

Wholesome Paws Evaluate

All of Wholesome Paws’ plans embody limitless payouts. An insurance coverage plan with no cap on payouts means you by no means have to fret about hitting the utmost in your protection payouts, and you may at all times anticipate to be reimbursed for lined prices after you have got met your deductible.

We frequently discover Wholesome Paws to have the bottom costs in comparison with different suppliers’ limitless payout plans. Wholesome Paws helps scale back financial euthanasia as a result of pet dad and mom aren’t pressured about the price of a life-saving process that may very well be restricted by insurance policies with decrease payout limits.

Wholesome Paws additionally has one of many quickest declare processing timelines, averaging solely two days. In comparison with opponents, this can be a speedy turnaround and prevents additional monetary stress one may expertise whereas ready for a declare to be thought-about and paid again.

The corporate is understood for being constant in its choices and never rocking the boat. It hasn’t undergone vital turbulence with underwriter adjustments or worth fluctuations as lots of its opponents have.

Customer support is a high precedence for Wholesome Paws, and it has a number of the greatest critiques within the enterprise. Wholesome Paws minimizes prospects’ threat of sudden monetary penalties when utilizing pet insurance coverage.

| Execs | Cons |

|---|---|

| Might have choice for Wholesome Paws to pay your vet instantly and keep away from ready for reimbursement | Restricted customization choices based mostly in your pet’s age |

| Shorter than common CCL surgical procedure ready interval (15 days) | No accident-only plan accessible |

| Shorter than common declare processing (2 days) | Not enrolling pets older than 14 years outdated |

| Limitless payouts for all plans | Excludes behavioral therapies, various/holistic therapies, C-sections, examination charges, and gum illness |

| Longer hip dysplasia ready durations than common (12 months) and pets enrolled after age 6 are ineligible for hip dysplasia protection (MD does not have this age limitation) | |

| Longer than common accident ready interval (15 days) |

Use this hyperlink to make the most of the very best worth and get a quote on your pet from Wholesome Paws. You may as well go to our devoted Wholesome Paws promotion web page to be taught extra.

In-Depth Evaluate Of Wholesome Paws

Embrace Evaluate

Embrace has probably the most complete protection for accidents and diseases, together with $1,000 yearly for dental sickness protection. For situations that some insurers exclude from their insurance policies, Embrace maintains protection.

There are a number of methods to customise your Embrace plan to suit your finances and protection wants. It’s one of many few insurers providing each a wellness and accident-only plan along with its accident and sickness plans.

Embrace can be an excellent choice, because it covers behavioral remedy and coaching identified by a licensed veterinarian for a lined situation. So, suppose your canine is anxious, aggressive, or harmful if you depart them. In that case, it might be on account of a behavioral situation that could be lined underneath an Embrace coverage underneath the appropriate situations. Behavioral remedy and coaching aren’t generally lined by most pet insurance coverage suppliers.

Embrace additionally administers insurance policies by Allstate, American Household, Geico, and USAA.

| Execs | Cons |

|---|---|

| Customise your plan to suit your finances and wishes with completely different deductible, reimbursement, and payout choices | Restricted to accident-only protection in the event you enroll your canine after their fifteenth birthday |

| Might have choice for Embrace to pay your vet on to keep away from ready for reimbursement | C-sections are excluded |

| Optionally available wellness plans accessible as add-on | |

| Shorter than common accident ready interval (2 days) and declare processing (5 days) | |

| Behavioral therapies, various/holistic therapies, examination charges, gum illness, and tooth extractions are included |

Embrace provides the next reductions:

- 10% off (5% off in NY) for a number of pets

- 5% off for army and veterans (NY and TN excluded)

- 10% off in case your firm or clinic provides Embrace as an worker profit (FL, ND, NY, and TN excluded)

- 5% off in NY in the event you pay yearly

- As much as 25% off for eligible USAA prospects

- Your deductible robotically goes down $50 annually you don’t obtain a declare fee

Use this hyperlink to make the most of the very best worth. No promo code is required. You may as well go to our devoted Embrace low cost web page to be taught extra.

In-Depth Evaluate Of Embrace

Figo Evaluate

We’ve chosen Figo for one of the best worth in pet insurance coverage as a result of it provides in depth protection, low pricing, glorious customer support, and quick declare processing (averages three days). Figo’s plans are customizable, with a number of choices to suit your finances and protection wants, plus two non-compulsory wellness plans. There are not any higher age limits, and the minimal age to enroll your canine is eight weeks.

Figo provides protection for situations generally excluded by different suppliers, akin to behavioral therapies, various/holistic therapies, and C-sections. It’s additionally one of many solely firms to supply a 100% reimbursement choice. Moreover, Figo provides protection for curable pre-existing situations freed from remedy and signs after one yr.

Figo has a one-day ready interval for accidents, the shortest size of any firm included on this article. Total, Figo has thorough protection and aggressive pricing, which makes it a superb choice for pet dad and mom.

Figo additionally administers insurance policies by Costco.

| Execs | Cons |

|---|---|

| Customise your plan to suit your finances and wishes with completely different deductible, reimbursement, and payout choices | Cannot have Figo pay your vet on to keep away from ready for reimbursement |

| Optionally available wellness plans accessible as an add-on | No accident-only plan accessible |

| Shorter than common accident ready interval (1 day) | |

| Constantly among the many lowest costs | |

| Shorter than common declare processing (3 days) | |

| Behavioral therapies, various/holistic therapies, and C-sections are included in protection | |

| Diminishing deductible for annually a policyholder is declare free, reducing by $50 till it’s $0 |

Figo provides the next reductions:

- 5% off any new Figo pet insurance coverage coverage (unique for Canine Journal readers – use this hyperlink)

- 5% off for a number of pets

- Your deductible robotically goes down $50 annually you don’t obtain a declare fee

Use this hyperlink to make the most of the very best worth. No promo code is required. You may as well go to our devoted Figo low cost web page to be taught extra.

In-Depth Evaluate Of Figo

Lemonade Pet Insurance coverage Evaluate

Lemonade started promoting insurance coverage in 2015 and branched into pet insurance coverage in 2020, providing low costs, which made it interesting to many purchasers. After a few years in enterprise, their costs fall in the direction of the mid-range, however the firm remains to be creating plenty of buzz with its AI-driven declare course of.

Lemonade’s Synthetic Intelligence (AI) hurries up the reimbursement course of. Most Lemonade claims are processed inside two days, however many are processed inside minutes of submission. Past velocity, one other distinctive factor about Lemonade is that you may bundle your pet insurance coverage coverage along with your Lemonade owners, renters, co-op, or condominium insurance coverage, which could prevent 10%.

| Execs | Cons |

|---|---|

| Customise your plan to suit your finances and wishes with completely different deductible, reimbursement, and payout choices | Cannot have Lemonade pay your vet on to keep away from ready for reimbursement |

| Optionally available wellness plans accessible as an add-on | No accident-only plan accessible |

| Shorter than common ready durations (2 days for accidents and 14 days for hip dysplasia) | Solely accessible in 37 states and Washington DC |

| Shorter than common declare processing (2 days) | Breed restrictions based mostly on age |

| Behavioral therapies, various/holistic therapies, examination charges, and gum illness protection can be found for an additional payment |

Lemonade provides the next reductions:

- 10% off in the event you bundle along with your renters, owners, auto, condominium, or co-op insurance coverage

- 5% off for a number of pets

- 5% off in the event you pay yearly

Use this hyperlink to make the most of the very best worth. No promo code is required.

In-Depth Evaluate Of Lemonade

Pet Insurance coverage Corporations (All Of Your Choices)

In addition to the insurers listed above, many different opponents exist within the market. The remaining U.S. pet insurance coverage suppliers are listed under and on our devoted pet insurance coverage firms web page alphabetically. Included are hyperlinks to our in-depth particular person critiques in the event you’d prefer to be taught extra about an organization.

If you happen to dwell exterior of the U.S. and wish to study your choices, under are pet insurers you’ll be able to think about.

| AUSTRALIA | Petsy Pet Insurance coverage | RSPCA | Tesco | |

| CANADA | OVMA Pet Well being Insurance coverage | Peppermint | Pets Plus Us | PHI Direct |

| HONG KONG | Blue Cross | OneDegree | PetbleCare | Prudential |

| IRELAND | Allianz | |||

| UNITED KINGDOM | Agria | Itch | Petplan | Waggel |

AKC Pet Insurance coverage Evaluate

AKC Pet Insurance coverage is the one supplier to supply protection for pre-existing situations after one yr of steady protection. This may be life-changing for purchasers with canines affected by power diseases or different pre-existing situations. In case your canine has a pre-existing situation, AKC Pet Insurance coverage may very well be a superb choice on your family.

| Execs | Cons |

|---|---|

| No vet data or examination required to enroll | No sickness protection choice for canines enrolled after age 9 |

| Optionally available wellness plans accessible as add-on | Should buy protection or congenital and hereditary situations individually |

| Claims are sometimes paid inside 7 days | Examination payment protection is accessible for a further payment |

| Your pet is roofed after they journey with you within the U.S. or Canada | $3 – $4 month-to-month transaction payment (relying on the state) – highest within the pet insurance coverage area, waived if paid yearly |

| Affords protection for pre-existing situations after twelve months of steady pet insurance coverage protection (not in FL and WA) |

AKC provides the next reductions:

- 5% off for a number of pets

- 5% off for canines who go the AKC Canine Good Citizen check

- 10% off for puppies coming from breeders who take part within the AKC Bred with H.E.A.R.T or AKC Breeder of Benefit packages

In-Depth Evaluate Of AKC Pet Insurance coverage

Animalia Pet Insurance coverage Evaluate

Animalia is likely one of the latest pet insurance coverage suppliers accessible. It’s at the moment solely accessible in 39 states. Nevertheless, it’s one of many solely insurers to supply protection for prescription meals and dietary dietary supplements. Animalia is an effective choice for many who have pets with bilateral situations (akin to hip dysplasia, CCL damage, cataracts, and many others.) as a result of it has no bilateral exclusions in its coverage.

| Execs | Cons |

|---|---|

| No lifetime limits on any plan | Pets aren’t eligible for enrollment after fifteenth birthday |

| Reductions accessible for multi-pets | No non-compulsory wellness plan |

| Digital declare submitting | Extra price for dental protection |

| Covers the examination charges for accidents and diseases | 30 day ready interval for most cancers protection |

| Covers digital vet visits, prescription meals, and dietary dietary supplements | Solely accessible in 39 states |

| Shorter than common ready durations (5 days for diseases, accidents, cruciate ligament accidents, and hip dysplasia) | Not lined when touring along with your pet exterior of the U.S. |

| No on-line portal for policyholders |

Animalia provides the next low cost:

Use this hyperlink to make the most of the very best worth. No promo code is required.

In-Depth Evaluate Of Animalia Pet Insurance coverage

ASPCA Pet Well being Insurance coverage Evaluate

ASPCA Pet Well being Insurance coverage has a large title behind its pet insurance coverage product, which can provide the assurance you have to select them. Their insurance policies are thorough, and so they supply protection for a lot of situations typically excluded by different suppliers.

As for pricing, ASPCA Pet Well being Insurance coverage sometimes falls extra within the center, however that may differ based mostly in your pet’s particulars and the plan customizations you select. For instance, an accident-only coverage shall be cheaper than an accident and sickness coverage with a $100 deductible, 90% reimbursement, and a $10,000 annual payout restrict.

Optionally available wellness plans are additionally accessible that can assist you finances for routine bills, akin to dental cleanings, annual vet checkups, flea/heartworm prevention, and extra. You possibly can alter your protection to suit the price of pet insurance coverage into your finances in some ways.

ASPCA Pet Insurance coverage additionally administers insurance policies by Vacationers and Waffle.

| Execs | Cons |

|---|---|

| Customise your plan to suit your finances and wishes with completely different deductible, reimbursement, and payout choices | Longer than common accident ready interval (14 days) |

| Might have choice for ASPCA Pet Well being Insurance coverage to pay your vet on to keep away from ready for reimbursement | Longer than common declare processing (15-30 days) |

| Accident-only plan accessible | C-sections, gum illness, and tooth extractions are excluded |

| Optionally available wellness plans accessible as add-on | |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (14 days) | |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included |

ASPCA Pet Insurance coverage provides the next low cost:

- 10% off for a number of pets

Use this hyperlink to make the most of the very best worth. No promo code is required.

In-Depth Evaluate Of ASPCA Pet Insurance coverage

Bivvy Evaluate

Bivvy is now not offering pet insurance coverage. Present Bivvy insurance policies will finish on their coverage anniversary date (acknowledged on the declaration web page). Bivvy will notify you of that non-renewal date and can proceed processing claims that happen and are handled earlier than that date.

CarePlus Evaluate

CarePlus is Chewy’s wellness and insurance coverage model providing Trupanion and Lemonade insurance policies. The model remains to be new and present process common adjustments. Nevertheless, the massive promoting level of a CarePlus coverage is that 100% of the prescriptions bought by Chewy.com are lined by your CarePlus pet insurance coverage plan.

| Execs | Cons |

|---|---|

| Limitless payouts for all plans | Quotes are typically among the many most costly in comparison with opponents |

| Might have choice for Trupanion to pay your vet on to keep away from ready for reimbursement | Should improve plans to have protection for examination charges, behavioral remedies, and bodily and rehab therapies |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (14 or 30 days) | Solely accessible in 42 states at the moment |

| Optionally available wellness plan accessible as a stand-alone plan | |

| Accident-only plan accessible | |

| Declare processing averages 3-7 days however typically paid in 24 hours | |

| 100% of prescriptions lined when bought by Chewy.com | |

| Covers your pet in the event that they journey exterior the U.S. with you |

In-Depth Evaluate Of CarePlus By Chewy Pet Insurance coverage

Companion Shield Evaluate

Companion Shield provides a really distinctive coverage. Pricing isn’t based mostly on breed, it has no ready durations, and its base plan consists of an annual wellness examination. Nevertheless, you should use an in-network vet to get claims reimbursed and solely not too long ago adopted pets from one in every of their collaborating shelter companions can enroll.

| Execs | Cons |

|---|---|

| Premiums don’t enhance on account of your pet getting old | Lifetime payout limits |

| No ready durations | No details about annual payout limits |

| No higher age limits | Utilizing an out-of-network vet will be expensive |

| Good in-network advantages | Rigid coverage choices |

| Multi-pet low cost as much as 15% | Strict prior approval necessities |

| Free annual wellness examination (with in-network vet) | No wellness plans accessible |

| Protection for various and holistic care | Doesn’t cowl your pet in the event that they journey exterior the U.S. with you |

In-Depth Evaluate Of Companion Shield

Hartville Evaluate

Hartville provides comparable merchandise to ASPCA Pet Well being Insurance coverage with the identical protection, exclusions, and many others. Insurance policies are complete, and you may select from non-compulsory wellness plans. The most important grievance from prospects is that reimbursements are decrease than they anticipated.

| Execs | Cons |

|---|---|

| Customise your plan to suit your finances and wishes with completely different deductible, reimbursement, and payout choices | Low reimbursements reported by prospects |

| Might have choice for Hartville to pay your vet on to keep away from ready for reimbursement | Longer than common accident ready interval (14 days) |

| Pet is roofed after they journey with you within the U.S., Guam, Puerto Rico, U.S. Virgin Islands, and Canada | Longer than common declare processing (15-30 days) |

| Accident-only plan accessible | C-sections, gum illness, and tooth extractions are excluded |

| Optionally available wellness plans accessible as add-on | |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (14 days) | |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included |

Hartville provides the next low cost:

- 10% off for a number of pets

In-Depth Evaluate Of Hartville

ManyPets Evaluate

ManyPets is a number one pet insurance coverage supplier within the U.Ok. and Sweden and has branched into the U.S. market. One distinctive characteristic offered is grief counseling upon the dying of a pet. No different firm provides this. Moreover, a household plan covers as much as three pets underneath one annual restrict.

| Execs | Cons |

|---|---|

| No transaction or one-time charges | Not enrolling pets older than 14 years outdated |

| Pets enrolled after 6 aren’t eligible for hip dysplasia protection | |

| Not accessible in all 50 states |

In-Depth Evaluate Of ManyPets

MetLife Evaluate

MetLife has a wholesome pet incentive, which lowers the deductible by $50 every coverage yr you don’t obtain a declare reimbursement. In case your coverage restrict is $5,000 or extra and you’ve got an unused quantity of $1,000 or extra on the finish of the coverage interval, MetLife will enhance your coverage restrict by $500 at no further price if you renew.

| Execs | Cons |

|---|---|

| Optionally available wellness plans accessible as add-on | Doesn’t cowl remedy, providers, or provides offered exterior the U.S. |

| 80% of claims are processed inside 10 days | |

| Diminishing deductible |

MetLife provides the next reductions:

- 10% off for vets, shelter personnel, and many others.

- For army, veterans, first responders, and healthcare employees

In-Depth Evaluate Of MetLife

Nationwide Evaluate

Nationwide is the solely pet insurance coverage supplier we assessment that gives unique pet insurance coverage and canine and cat insurance coverage. You probably have a rabbit, fowl, reptile, ferret, or one other small mammal, think about insurance coverage by Nationwide.

Like canine or cat insurance coverage, unique pet insurance coverage covers sudden visits to the vet which might be topic to the insurance coverage plan you select. Relying in your alternatives, this will likely embody accidents, diseases, the dying of your pet, and extra.

Nationwide can be the one firm we assessment to supply a conventional pet insurance coverage product and a profit schedule-style plan just like a wellness plan with financial protection limits per situation/remedy. Suppose you’re already aware of Nationwide’s insurance coverage merchandise in different areas of your life. In that case, it might be value contemplating sticking with them, nevertheless it’s additionally value getting a number of quotes from others.

| Execs | Cons |

|---|---|

| Optionally available wellness plan accessible as add-on | Cannot have Nationwide pay your vet on to keep away from ready for reimbursement |

| Shorter than common hip dysplasia ready interval (14 days) | Restricted to accident-only protection for pets 10 and older |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included in protection | Longer than common ready durations (14 days for accidents and 12 months for CCL surgical procedure) |

| Shorter than common declare processing (4 days) | C-sections, gum illness, and tooth extractions are excluded |

| One of many solely pet medical insurance firms to supply unique pet insurance coverage |

Nationwide Pet Insurance coverage provides the next reductions:

- 5% off for 2-3 pets lined

- 10% off for 4 or extra pets lined

Use this hyperlink to make the most of the very best worth. No promo code is required.

In-Depth Evaluate Of Nationwide

Odie Evaluate

Odie requires add-ons for fundamental protection that opponents embody of their insurance policies robotically. Plan customization choices are restricted. Accident-only plans can be found, and you may add a wellness plan onto your insurance coverage coverage. Wishbone Pet Insurance coverage can be managed by Odie.

| Execs | Cons |

|---|---|

| Common premium pricing is usually decrease than different suppliers | Should pay further for workplace visits, prescription treatment, rehab, acupuncture, and chiropractic care protection |

| No age restrictions and protection begins as early as 7 weeks | Behavioral situations are excluded |

| Declare processing averages 4-5 enterprise days | No limitless payout limits |

| Optionally available wellness plans accessible as add-on | Bilateral situations are excluded |

| Your pet is roofed after they journey with you within the U.S., Canada, or Puerto Rico |

In search of an Odie Pet Insurance coverage promo code? Click on right here for one of the best deal we may discover.

In-Depth Evaluate Of Odie

Paw Shield Evaluate

Paw Shield administers Embrace pet insurance coverage insurance policies. The one distinction is that Paw Shield provides a credit score line referred to as Paytient that you should use with 0% curiosity to pay the vet payments upfront as a substitute of paying out of pocket. Clients have entry to $2,000 to assist pay their vet payments till they’ve the money to repay the debt.

| Execs | Cons |

|---|---|

| No per-incident limits on their claims as they use an annual deductible | $25 enrollment payment |

| No lifetime restrict | Solely covers enrolled pets age 14 and youthful for accidents and diseases (accident solely could also be accessible for ages 15+) |

| Optionally available wellness plans accessible as add-on (not accessible in RI) | If one leg has a CCL (ACL) damage previous to enrollment, the opposite leg won’t be lined even when there are not any prior points; it’s thought-about a pre-existing situation |

| Pays claims inside 10-15 days on common | Pricing for blended breeds generally varies between Embrace and Paw Shield |

| Covers your pet in the event that they journey exterior the U.S. with you | |

| Eligible to use for a digital Paytient Visa card to pay for vet payments |

Paw Shield has the next reductions:

- 10% off (5% off in NY) for a number of pets

- 5% off for army and veterans (NY and TN excluded)

No promo code is required. Use this hyperlink to make the most of the very best worth.

In-Depth Evaluate Of Paw Shield

Petco Evaluate

Petco administers Nationwide pet insurance coverage insurance policies. The one distinction is that Petco provides reductions and financial savings on veterinary providers accessible by Petco’s community of hospitals and clinics. If you happen to dwell close to one in every of Petco’s amenities and assume you might make the most of their vet providers, then Petco’s pet insurance coverage by Nationwide may enable you to get reductions on vet care.

| Execs | Cons |

|---|---|

| Optionally available wellness plan accessible as add-on | Longer than common ready durations (14 days for accidents and 12 months for CCL surgical procedure) |

| Shorter than common hip dysplasia ready interval (14 days) | C-sections, gum illness, and tooth extractions are excluded |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included in protection | Pets older than 10 are ineligible for sickness enrollment |

| Shorter than common declare processing (4 days) | |

| Unique pet insurance coverage accessible | |

| Reductions accessible by Petco vet providers |

In-Depth Evaluate Of Petco

PetPartners Evaluate

PetPartners provides comparable merchandise to AKC Pet Insurance coverage with the identical protection, exclusions, and many others. Insurance policies are complete, and you may select from non-compulsory wellness plans. Like AKC Pet Insurance coverage, you obtain protection for pre-existing situations after one yr of steady protection.

| Execs | Cons |

|---|---|

| No vet data or examination required to enroll | No sickness protection choice for canines enrolled after age 9 |

| Optionally available wellness plans accessible as add-on | Should buy protection or congenital and hereditary situations individually |

| Claims are sometimes paid inside 7 days | Examination payment protection is accessible for a further payment |

| Your pet is roofed after they journey with you within the U.S. or Canada | $3 – $4 month-to-month transaction payment (relying on the state) – highest within the pet insurance coverage area, waived if paid yearly |

| Affords protection for pre-existing situations after twelve months of steady pet insurance coverage protection (not in FL and WA) |

PetPartners provides the next low cost:

- 5% off for a number of pets

In-Depth Evaluate Of PetPartners

Prudent Pet Evaluate

Prudent Pet has spectacular protection however is costlier than its opponents. Declare processing buyer suggestions is sporadic, with some saying it’s quick and others saying it’s sluggish. Nevertheless, it’s displaying some promise for being newer to the pet insurance coverage business.

| Execs | Cons |

|---|---|

| No lifetime payout limits on any plans | Premiums had been considerably greater than common after we ran quotes |

| No higher age limits | Longer than common accident ready interval (5 days) |

| 60% of claims are processed inside 1 day | If there’s a knee damage previous to enrollment or through the ready interval, they gained’t cowl the second leg if an damage happens (thought-about bilateral situation) |

| Your pet is roofed after they journey with you within the U.S., Canada, Puerto Rico, and different U.S. territories | No cellular app |

| Competitively priced wellness plans | $2 transaction payment |

Prudent Pet provides reductions to army and veterinarians and their workers.

In-Depth Evaluate Of Prudent Pet

Pumpkin Evaluate

Pumpkin is the primary pet insurance coverage producer to incorporate underneath a world pharmaceutical large. It has many plan customizations and protection for situations typically excluded by opponents. Pumpkin has complete protection, however expertise must catch up and get a cellular app for shoppers to file claims.

| Execs | Cons |

|---|---|

| 90% reimbursement for all plans | Worth quotes are typically costlier than most opponents however this can be on account of solely providing 90% |

| Optionally available wellness plan accessible as add-on | $2/month transaction payment |

| Your pet is roofed after they journey with you within the U.S., Canada, Puerto Rico, Guam, and U.S. Virgin Islands | Longer than common accident and sickness ready durations (14 days) |

| No higher age limits | No app |

| Excludes routine dental procedures |

In-Depth Evaluate Of Pumpkin

Spot Evaluate

Spot Pet Insurance coverage was based in 2019 and provides some ways to customise your plan. You possibly can select an accident-only coverage or accident and sickness coverage, add on a wellness plan, and alter your deductible, reimbursement, and payout choices. These choices present a variety of the way to assist match Spot into your finances.

Spot additionally has comparatively quick 14-day ready durations for CCL surgical procedure and hip dysplasia in comparison with many different pet insurance coverage suppliers. So if both of those situations considerations your canine, Spot could also be value contemplating.

| Execs | Cons |

|---|---|

| Customise your plan to suit your finances and wishes with completely different deductible, reimbursement, and payout choices | Cannot have Spot pay your vet on to keep away from ready for reimbursement |

| Accident-only plan accessible | Longer than common accident ready interval (14 days) |

| Optionally available wellness plans accessible as add-on | Longer than common declare processing (10-14 days) |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (14 days) | C-sections, gum illness, and tooth extractions are excluded |

| Behavioral therapies, alternative-holistic therapies, and examination charges are included |

Spot provides the next low cost:

- 10% multi-pet low cost if you use this hyperlink.

- 10% off for eligible Purina prospects

- As much as 20% off for eligible AAA prospects

Use this hyperlink to make the most of the very best worth. No promo code is required.

In-Depth Evaluate Of Spot

Toto Evaluate

Toto has extra limitations for its pet insurance coverage insurance policies than different insurers. Nevertheless, it is likely one of the solely suppliers to supply Last Respects protection, which reimburses a portion of cash for the price of an post-mortem, cremation, and urns. Lastly, Toto might change your premium, reimbursement charge, annual deductible, and coverage phrases and situations at renewal.

| Execs | Cons |

|---|---|

| No lifetime or per-incident payout limits for accident or sickness plans | Longer than common sickness ready interval (14 days) |

| Optionally available wellness plan accessible as add-on | 180-day ready interval for IVDD and CCL accidents |

| Your pet is roofed after they journey with you within the U.S., Canada, and different U.S. territories | Protection is restricted to accidents just for pets over 9 years outdated at enrollment |

| Last Respect protection is accessible for pets enrolled earlier than their fifth birthday | Bilateral situations excluded |

| No cellular app | |

| No limitless payout restrict choice |

In-Depth Evaluate Of Toto

Trupanion Evaluate

Certainly one of Trupanion’s most talked about options is Trupanion’s Vet Direct Pay, which eliminates the declare processing wait time. Many different pet insurance coverage firms supply a vet direct pay choice. Nonetheless, Trupanion’s Vet Direct Pay is the one choice that permits fee throughout checkout. If Trupanion’s Vet Direct Pay isn’t accessible at your vet’s workplace, you’ll be able to name to ask about it or communicate along with your vet about them setting it up.

Trupanion can be a superb alternative for breeds with a previous damage or ailment to at least one aspect of their physique however not the opposite. This pet can be thought-about predisposed to a bilateral situation, however many Trupanion insurance policies have no bilateral exclusions. A bilateral situation is any situation or illness that might have an effect on each side of the physique. Examples embody hip dysplasia, CCL accidents, cataracts, and extra. Most pet insurance coverage suppliers exclude bilateral protection as a result of if one thing occurs on one aspect of the physique, there’s a strong likelihood it may additionally occur to the opposite over time. Nevertheless, Trupanion is keen to take this threat.

Lastly, Trupanion is usually chosen by breeders due to its Breeder Assist Program. This system’s main focus is the Go Dwelling Day Supply, which lets breeders present patrons with a proposal for Trupanion enrollment with out ready durations. This implies a pet dad or mum can decide up their pet from the breeder and get pet insurance coverage instantly with none ready durations. Moreover, Trupanion insurance policies cowl breeding-related well being situations, one other perk for breeders.

Trupanion additionally administers insurance policies by Geico and State Farm.

| Execs | Cons |

|---|---|

| 90% reimbursement with limitless payouts for all plans | No accident-only plan accessible |

| Might have choice for Trupanion to pay your vet on to keep away from ready for reimbursement | Pets older than 14 are ineligible for enrollment |

| Shorter than common CCL surgical procedure and hip dysplasia ready durations (30 days) | Longer than common sickness ready interval (30 days) |

| Shorter than common declare processing averages (2 days) | Constantly among the many most costly |

| Behavioral therapies, C-sections, and tooth extractions are included in protection | Examination charges are excluded |

Use this hyperlink to make the most of the very best worth and get a quote on your pet from Trupanion. You may as well go to our devoted Trupanion promotions web page to be taught extra.

In-Depth Evaluate Of Trupanion

Wagmo Evaluate

Wagmo has per-incident deductibles and lifelong payout limits, so this may very well be a superb choice on your pet in the event you’re frightened about power situations. Nevertheless, in the event you anticipate requiring a lifetime payout past $100,000, then assess different choices.

| Execs | Cons |

|---|---|

| Declare reimbursement averages 1 day for wellness and 3-5 enterprise days for accidents and diseases, after the declare is accepted | No limitless payout choice |

| Optionally available wellness plan accessible as add-on | Per-incident deductible and lifelong payout limits |

| Longer than common accident ready interval (15 days) | |

| Pets older than 15 are ineligible for enrollment | |

| 30-day ready interval for most cancers remedy | |

| Hip dysplasia isn’t lined for pets older than 6 |

In-Depth Evaluate Of Wagmo

24Petprotect Evaluate

24Petprotect offers accident and sickness plans in addition to accident-only insurance coverage insurance policies to assist provide your protection and finances wants. There are additionally a number of deductible, payout, and reimbursement choices that can assist you get the plan you want.

| Execs | Cons |

|---|---|

| Optionally available wellness plan accessible as add-on | $2 transaction payment (waived if paying yearly) |

| Covers curable pre-existing situations which might be freed from signs and remedy for 180 days | No limitless payout choice |

| Your pet is roofed after they journey with you within the U.S., Canada, Guam, Puerto Rico, and U.S. Virgin Islands | Longer than common accident ready interval (14 days) |

| Larger premiums in comparison with others | |

In-Depth Evaluate Of 24Petprotect

Price And Protection Comparisons

We’ve compiled a few comparability tables that handle price and protection points:

If you happen to’re uncertain the place to begin, it’s best to if it’s worthwhile having pet insurance coverage. It addresses frequent questions akin to how pet insurance coverage works, what it covers, statistics, whether or not it’s value it for everybody, and extra.

Free Pet Insurance coverage Quotes

Our protection comparability is comparatively easy, however pricing comparisons can get sophisticated. Why? Pricing quotes are distinctive as a result of they’re based mostly on a pet’s age, breed, geographic location, the supplier and plan you choose, and a number of other different components.

For that reason, we encourage you to get quotes from a number of firms earlier than deciding on a pet insurance coverage supplier. We’ve made this simple for you by making a free quote kind that pulls quotes from high pet insurance coverage firms if you fill out your pet’s particulars. You possibly can higher perceive the protection wanted by getting into your pet’s particular traits.

What Are The Totally different Varieties Of Pet Insurance coverage Plans?

There are two pet insurance coverage: accident-only and accident and sickness. Some firms additionally supply an non-compulsory wellness plan for an additional cost, nevertheless it isn’t an insurance coverage product. Since a number of pet insurance coverage suppliers supply wellness plans throughout enrollment, we included them to make sure you know the complete vary of choices throughout new enrollment.

What Do Accident-Solely Pet Insurance coverage Plans Cowl?

An accident-only plan solely covers vet payments related to an accident, akin to torn ligaments, damaged bones, overseas physique ingestion, poisoning, accidents, chunk wounds, and extra. Diseases are excluded from this protection. An accident-only pet insurance coverage plan is usually cheaper than an accident and sickness one because it covers fewer bills. Nevertheless, just some firms supply this coverage kind.

What Do Accident & Sickness Pet Insurance coverage Plans Cowl?

That is the most typical and common kind of pet insurance coverage plan. It covers accidents (like damaged bones, overseas physique ingestion, and different objects lined in accident-only plans) and sickness-related situations (like most cancers, allergy symptoms, urinary tract infections, arthritis, pores and skin infections, ear infections, and extra). One of these coverage is extra complete than an accident-only one.

What Do Wellness Plans Cowl?

Wellness protection is bought as an add-on or a standalone product and comes with an incremental payment. Usually, this program covers issues that happen throughout an annual examination, akin to vaccination, flea/tick/heartworm remedy, tooth cleansing, and spay/neuter procedures. A wellness plan is a monetary instrument to assist cowl the prices related to preventative measures that help your canine’s general well being and forestall diseases the place doable. Common vet visits, particularly ones lined with a wellness plan, additionally encourage homeowners to be extra proactive with their pet’s well being. Wellness plans should not pet insurance coverage as they don’t cowl prices related to accidents or diseases.

| Plan Sort/Want | Accident-Solely | Accident & Sickness (hottest) |

Wellness |

|---|---|---|---|

| Harm-related situations (damaged bones, overseas physique ingestion, poisoning, chunk wounds, and many others.) | | ||

| Illness-related situations (allergy symptoms, urinary tract infections, arthritis, most cancers, ear infections, and many others.) | | | |

| Preventative measures (annual exams, vaccination, flea/tick/heartworm prevention, tooth cleansing, spay/neuter procedures, and many others.) | | | |

| Price | $ | $$ | $$$* |

What Does Pet Insurance coverage Cowl?

Pet insurance coverage protection varies based mostly on the coverage kind and the corporate you select. Nearly all of accident and sickness pet insurance coverage cowl the next objects when deemed medically vital. Nevertheless, this protection might have limitations, so please test your coverage.

Our consultants have put collectively a complete information to what pet insurance coverage covers. You’ll additionally discover price and reimbursement examples, standards to contemplate, alternate options to pet insurance coverage, wellness plans, and extra.

| Coated | Excluded |

|---|---|

| Blood assessments | Boarding |

| Most cancers (chemo & radiation) | Cremation & burial prices |

| CAT scans | Elective procedures (e.g., declawing, ear cropping, spaying/neutering, tail docking, and many others.) |

| Continual situations | Meals & dietary supplements |

| Congenital situations | Grooming |

| Emergency care | Pre-existing situations* |

| Euthanasia | Being pregnant & breeding |

| Hereditary situations | Vaccines |

| MRIs | |

| Non-routine dental remedy | |

| Prescription drugs | |

| Rehabilitation | |

| Specialised exams & care | |

| Surgical procedure & hospitalization | |

| Ultrasounds | |

| X-rays |

Did You Know?

U.S. pet insurers used to drop sick pets or exclude power and hereditary situations in insurance policies. Fortuitously, this isn’t the case in the present day.

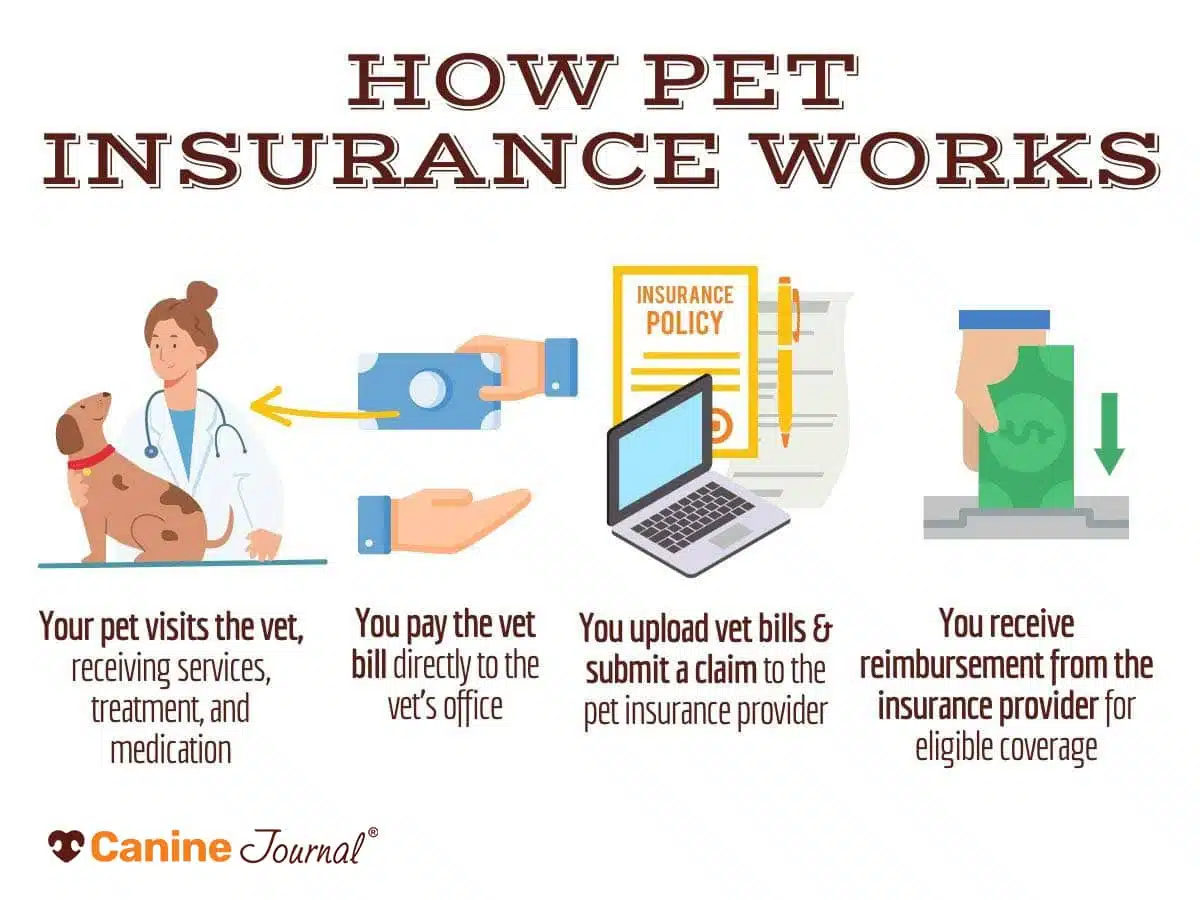

How Does Pet Insurance coverage Work?

- Go to the vet and pay your invoice on the time of service.

- Ship a accomplished declare kind and an itemized receipt to your insurance coverage firm. Some firms require a signature out of your vet, so it’s sensible to take a printed copy of your declare kind to your go to.

- As soon as the declare is accepted, the insurance coverage firm will ship your reimbursement* through your chosen fee technique (test, direct deposit, and many others.).

*The reimbursement timeline can differ from a couple of minutes to some weeks, relying on the complexity of your declare and the promised processing time. The reimbursement quantity is determined by your coverage particulars, together with deductible, annual payout, reimbursement proportion, protection, and exclusions.

Pet Insurance coverage Declare Instance

Let’s stroll by an instance to raised perceive the way it works.

Suppose your coverage has the next protection:

- $250 annual deductible

- 80% reimbursement

- $5,000 payout restrict

In that case, you’re liable for the next:

- Any unplanned vet payments associated to lined objects as much as $250,

- 20% of the entire vet invoice as much as $5,000, after which

- 100% above the $5,000 payout restrict.

How To Select The Finest Pet Insurance coverage For You

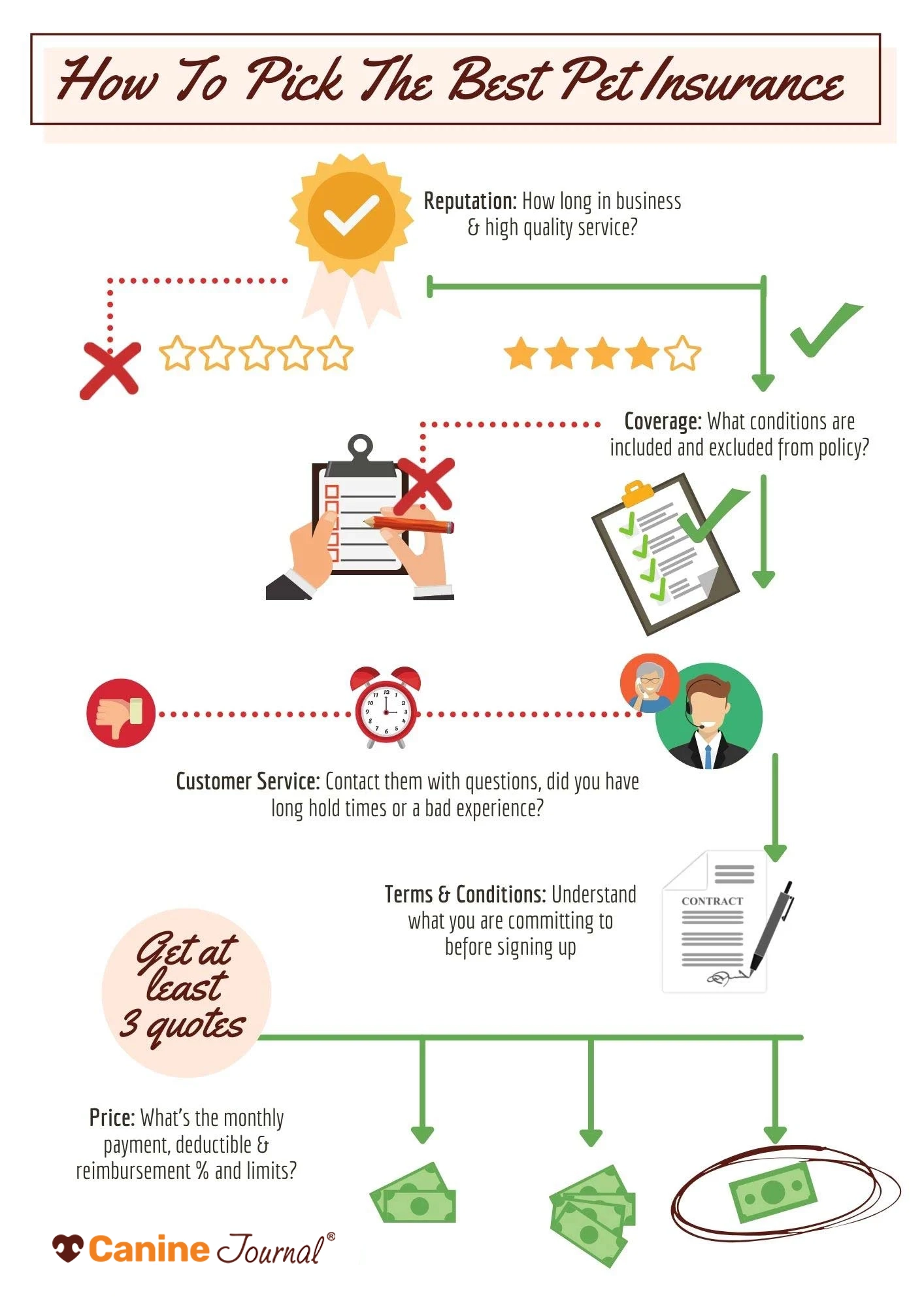

How can one resolve with so many pet insurance coverage firms to select from? This is the reason it’s essential to take the time to contemplate your choices fastidiously. By understanding the important thing issues and committing to the analysis, you might discover a supplier that matches your breed and well being considerations.

It’s sensible to think about any diseases your canine’s breed could also be predisposed to. For instance, suppose your pet is predisposed to hip dysplasia. In that case, you’ll wish to make sure you’re happy with the phrases related to hip dysplasia protection. Some firms add extra ready durations to hip dysplasia or think about it a bilateral situation, thus excluding it from protection as a pre-existing situation. Moreover, think about a dialog along with your vet about any potential situations they’d advocate masking based mostly on the breed or combine.

After you have got a listing of your must-haves, you’re able to slender down your listing of choices.

- Your greatest concern as a pet dad or mum needs to be the repute of the pet insurance coverage supplier. Have you ever heard of them? Do household and associates use them? What has their expertise been after they’ve needed to file a declare? Getting a pet insurance coverage coverage is barely helpful if it covers what you anticipate it to cowl and in the event you can afford the month-to-month premium. Bear in mind, though the month-to-month price is essential, it’s not probably the most essential issue when selecting insurance coverage. The entire level of any insurance coverage coverage is guaranteeing you have got the protection to pay for in any other case unaffordable payments in emergencies.

- Resolve what kind of protection you need on your canine and which extra perks could also be negotiable to decrease your prices. If you happen to’d prefer to be taught extra about what a number of the generally referenced phrases in pet insurance coverage imply, try our terminology 101 part that breaks the lingo down into layperson’s phrases for you.

- Acquire quotes from at the very least three firms to get an thought of how a lot your month-to-month premium shall be. Pricing varies drastically, and simply because an organization costs you extra doesn’t imply the protection is extra thorough.

- Don’t hesitate to contact potential suppliers with any questions earlier than signing up. And pay shut consideration to that have — it might mirror customer support high quality down the street.

- Take into account the declare reimbursement course of, together with the way it works, the typical processing timeline, and whether or not there’s an choice for the corporate to pay the vet instantly. If an organization takes longer than you’ll be able to anticipate reimbursement, you might wish to search different choices.

Choosing a pet insurance coverage plan is a private alternative, and nobody is aware of what your canine wants higher than you. Take the time to make an knowledgeable determination, and understand it’ll be definitely worth the added safety in the long term.

Continuously Requested Questions

Listed below are some questions we’ve obtained from our readers relating to pet insurance coverage. Don’t see yours? Ask us within the feedback.

Can I Go To Any Vet With Pet Insurance coverage?

Most pet insurance coverage firms permit you to select any licensed vet on your pet’s well being care wants. We all know one firm, Companion Shield, that’s the exception to this rule. Companion Shield claims to cowl extra of the fee inside its accepted community of vets. Whereas they permit you to use an out-of-network vet, it might price you extra money.

What Are The Disadvantages Of Pet Insurance coverage?

Though we really feel that pet insurance coverage is efficacious and price it for many, listed here are 4 cons to concentrate on:

- Routine preventative exams and related bills aren’t included in your pet insurance coverage coverage. You will need to buy a wellness plan at an incremental price to cowl these.

- You’ll nonetheless have out-of-pocket bills, together with your deductible and any quantity that surpasses your payout restrict. Additionally, you will be liable for masking the stability of the reimbursement quantity (i.e., in the event you selected an 80% plan and your supplier agrees to cowl your declare, you’ll nonetheless owe 20%).

- Most pet insurance coverage suppliers exclude pre-existing situations from protection, and you might be liable for related prices.

- Not like human well being care, most pet insurance coverage firms require you to pay vet bills upfront and anticipate reimbursement. Some firms supply a vet direct pay choice as an alternative choice to this normal reimbursement mannequin. Nonetheless, you should work along with your vet to make sure that is in place earlier than you start remedy.

What Ought to I Ask Earlier than Shopping for Pet Insurance coverage?

These are questions we advocate asking your supplier earlier than you enroll.

- Can I select my vet?

- What are the ready durations?

- What’s excluded from protection?

- Are there further charges for protection associated to examination charges, prescription treatment, or different objects?

- Are you able to present me an instance of how a declare is dealt with?

- What’s going to I be liable for paying?

- What occurs if I purchase a coverage after my pet will get sick or harm?

- Are there any limits on advantages (per-incident, annual, or lifetime)?

- How briskly will my declare be processed and repaid?

Is It Value Making A Pet Insurance coverage Declare?

You probably have a pet insurance coverage coverage, it’s virtually at all times value it to make a pet insurance coverage declare. Suppliers have made submitting claims moderately easy. Even when you realize you gained’t get reimbursed as a result of you have got but to hit your deductible, the declare will go towards your deductible. It will not be value submitting a declare in case your coverage has any limits (per coverage interval or per situation) and you’ve got already hit the utmost.

Are New Corporations Eligible To Win Classes?

No. Traditionally, new firms have entered the pet insurance coverage area by providing low costs to achieve market share. Nevertheless, after a while within the enterprise with extra paid claims, these firms have a tendency to extend charges to enhance their profitability. This hurts you, the shopper, as a result of this causes their premiums to extend considerably — and in the event you visited your vet or submitted a declare, your pet now has a pre-existing situation. So, in the event you want to change suppliers to discover a extra aggressive charge, that situation is unlikely to be lined. Finally, you will have been higher off beginning with a special, extra well-established firm.

Due to these points, we’ve determined solely to incorporate pet insurance coverage firms in our high spots with at the very least 5 full years of nationwide expertise. This method provides firms time to ascertain a constant pricing system and repute, supplying you with and our workforce a greater thought of what to anticipate.

Our consultants will nonetheless cowl new entrants (topic to reader demand) and produce you all the things we will discover on these firms in our critiques as a result of we wish you to know all of the accessible choices. Additional, we added a “Finest Newcomer” class to our rankings to supply a suggestion amongst new entrants within the pet insurance coverage area. We additionally think about whether or not an organization is new to the insurance coverage business or simply the pet insurance coverage sector.

Finest Pet Insurance coverage Suppliers By Worth And Wants

We additionally assessment suppliers based mostly on worth and particular wants. Head to our greatest pet insurance coverage by worth and wishes article to see suppliers ranked based mostly on younger pets, protection, worth, vet direct pay, pre-existing situation protection, and extra.

Why Belief Canine Journal?

Selecting the best pet insurance coverage coverage on your pet is a private determination. That’s why we worth your belief in us to supply all the target info you have to make an knowledgeable alternative.

Canine Journal has been masking the subject of pet insurance coverage since 2012, effectively earlier than different conglomerates found the rising recognition of well being look after our pets. Lots of our authors have private expertise with pet insurance coverage, together with Kimberly Alt, who has been Canine Journal’s go-to writer for pet insurance coverage for over a decade, having written about almost each doable side associated to pet insurance coverage. Kimberly is aware of the topic so effectively that she will reply a breadth and depth of pet insurance coverage questions instantly. And on the uncommon event she doesn’t know the reply off the highest of her head, she will discover it inside minutes on account of her in depth listing of sources.

Kimberly additionally consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance coverage agent, for extra experience, to make sure accuracy, and provides Canine Journal the authority to write down about and help readers in buying insurance policies legally.

Here’s a fast comparability desk displaying what we provide in comparison with the competitors.

Tagged With: Comparability, Reviewed By Insurance coverage Agent

[ad_2]