[ad_1]

Miami particularly has develop into a magnet for the ultra-rich and their companies due to its low taxes and top quality of life. A number of finance moguls, corresponding to Ken Griffin and Josh Harris, have moved to the area lately, whereas Texas has additionally seen an inflow of the rich from higher-tax states corresponding to California and New York.

Washington’s capital features tax may “disincentivize individuals to return right here or incentivize them to go away,” mentioned Aaron Johnson, tax counsel with Lane Powell, a regulation agency that challenged the capital features tax in courtroom. “Anyone who has the wherewithal and the flexibility to create tax efficiencies will.”

Like Florida, Washington state has no revenue tax. The capital features tax was proposed as a option to seize a few of the wealth concentrated within the state — which is dwelling to company giants like Microsoft Corp. and Starbucks Corp. in addition to Amazon.

The 7% excise tax went into impact Jan. 1, 2022 on features over $250,000 per yr, excluding retirement-account gross sales, actual property and sure small companies. The Washington Supreme Courtroom upheld it as a permissible excise tax in April, rejecting arguments from enterprise teams that it’s an unlawful revenue tax.

Billionaire Ken Fisher mentioned in March he would transfer his agency from Washington to Texas, criticizing the capital features tax and the courtroom choice that upheld it.

The capital features tax now faces a poll measure more likely to be earlier than Washington voters in November searching for to repeal it.

The initiative is one among six conservative poll measures supported by Brian Heywood, a cash supervisor primarily based close to Seattle who moved to Washington from California greater than a decade in the past partly to flee excessive taxes and regulation.

Heywood has mentioned he’s involved that Democrats who’ve lengthy managed Washington politics will construct on the capital features tax to attempt to implement a state revenue tax.

He joined different anti-tax advocates in warning that these efforts will encourage the state’s wealthiest residents to go away or make Washington a much less engaging place to begin a enterprise like Amazon within the first place.

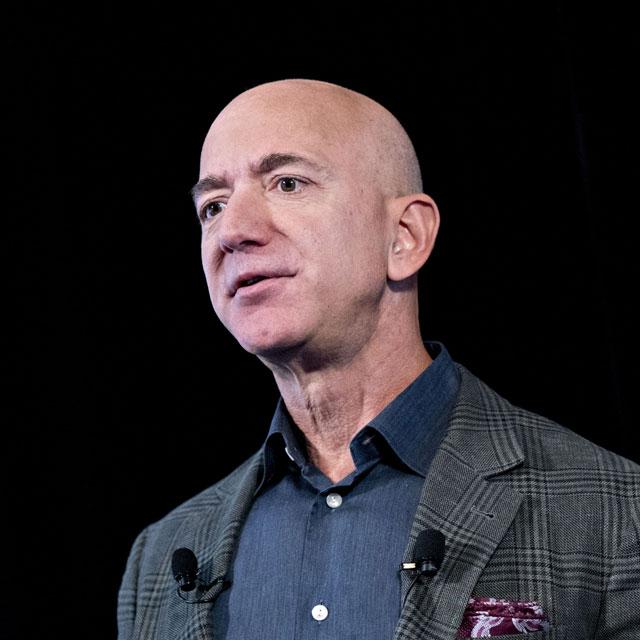

(Credit score: Andrew Harrer/Bloomberg)

[ad_2]