[ad_1]

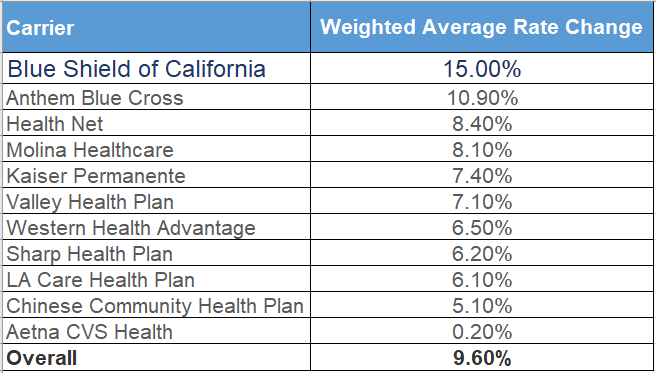

The 15 % improve within the particular person medical insurance premium by Blue Protect causes many Californian households to fret about how they will discover reasonably priced medical insurance in 2024 for his or her households.

The healthcare panorama in the USA is complicated, with quite a few elements influencing insurance coverage premiums. Much like different insurers, Blue Protect of California encounters challenges. These embrace escalating medical bills, developments in medical know-how, and better wages within the medical sector. and the rising prevalence of continual situations. These elements collectively contribute to the rising prices of offering well being protection.

Supply: Coated CA, learn full article right here

A number of interconnected elements contribute to the escalation of insurance coverage premiums throughout the healthcare trade. Before everything, medical inflation emerges as a major contributor as healthcare bills constantly develop. These bills embody hospital stays, pharmaceuticals, and medical procedures, immediately impacting insurers’ prices. Concurrently, developments in medical know-how are occurring alongside enhancements in therapy. Nevertheless, this progress comes at a excessive price, compelling insurers to regulate costs. Moreover, there are increased labor prices within the medical sector. Consequently, insurers are pressured to adapt to the altering medical panorama, leading to elevated healthcare prices and subsequently increased premiums.

The shifting demographics of the inhabitants play a pivotal position within the dynamics of the healthcare panorama. An growing older demographic, coupled with an uptick in continual illnesses, has led to an elevated demand for healthcare companies. Consequently, demographic adjustments place further pressure on insurers as they endeavor to adapt to the evolving wants of policyholders. This, in flip, considerably influences changes in premiums as insurers navigate the complexities of healthcare calls for in an ever-changing demographic panorama.

Why select Blue Protect?

In California, Blue Protect within the particular person insurance coverage market gives a HMO and a PPO. The HMO Trio Plan is notable for its sturdy major care physician community, prominently that includes the Windfall System. Inside this complete community, important medical establishments, together with St. John Hospital, St. Joseph, Windfall Cedars Tarzana, Entry Medical Group, and Allied Pacific-UCLA, are included.

The Blue Protect PPO plan options an intensive community, permitting policyholders self-access to quite a few distinguished docs affiliated with establishments reminiscent of UCLA, Cedars Sinai, and Windfall. This twin providing accommodates various preferences and healthcare wants, offering people with the flexibleness to decide on a plan that aligns with their particular necessities. Moreover, it ensures entry to a broad spectrum of healthcare professionals.

At Strong Well being Insurance coverage, we ease the complexity of the person insurance coverage market. We discover a well being plan that matches your finances and your medical wants. You could name us at 310-909-6135 or guide an appointment. We’d be pleased to reply your questions on your medical insurance for people, households, and small companies.

[ad_2]