[ad_1]

Based on a current paper by Doshi et al. (2023), the reply is ‘sure‘! Why do folks suppose in any other case?

Many individuals are involved that there will not be a sustainable approach for the personal group insurance coverage market, significantly in small self-insured companies, to cowl gene therapies? If a agency—significantly a smaller, self-insured agency—will get one or two sufferers who wants gene therapies, this might wreck their profitability for causes that don’t have anything to do with the underlying expense.

Nonetheless, gene remedy is the right case for why insurance coverage is required:

In spite of everything, the first objective of insurance coverage, in idea, is changing a big, sudden, unaffordable, however uncommon expense right into a average insurance coverage premium, by spreading a person massive expense over many premium payers.”

Furthermore, in a aggressive market, companies resolution to cowl cost-effective gene therapies could also be a aggressive benefit to draw labor.

…employers competing for risk-averse staff will supply such safety in opposition to monetary danger if they’re to match what different employers (massive or small) supply.

Nonetheless, the

situation nonetheless could also be related for small companies who self-insure and don’t maintain any

cease loss provisions for sufferers with outlier price. Corporations self-insure for 3 major causes

(i) state taxes don’t apply to self-insured plans, (ii) companies have extra

management over self-insured plans, and (iii) prices could also be decrease if the agency has a

more healthy than common inhabitants. What are cease loss provisions?

Cease-loss insurance coverage is a type of insurance coverage the place an out of doors insurer agrees to cowl self-insured employer claims in extra of some prespecified limits. It gives financing for unusually massive claims or declare totals.”

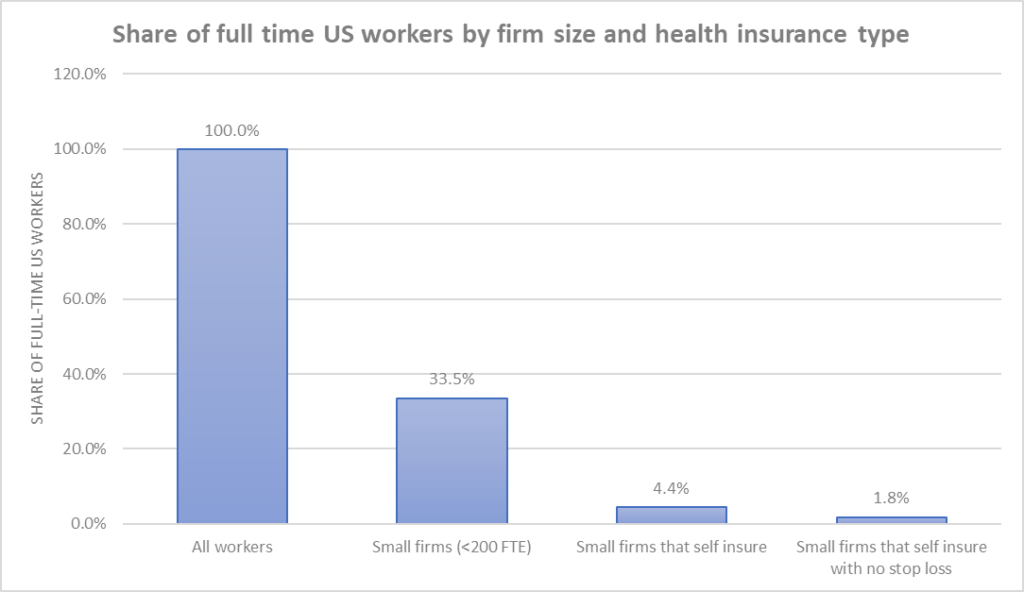

What number of staff are included in these kind of companies? Doshi et al. use information from the Medical Expenditures Panel Survey Insurance coverage Part (MEPS-IC) and the Kaiser Household Basis (KFF) Well being Advantages Survey of Employer Well being Profit Choices to seek out out. Total, solely 1.8% of staff are employed at small, self-insured companies with no stop-loss provision.

Furthermore, they

discover that information from MEPS finds that even amongst small, self-insured companies with

<200 FTE, 59.2% (MEPS) or 72% (KFF) have a stop-loss provision.

It’s true,

nevertheless, that the price of stop-loss protection has been rising over time. Between

2012-2022, cease loss insurance coverage protection elevated by 138% in comparison with household

premium will increase of solely 43% over that very same time interval.

[ad_2]