[ad_1]

Retail traders are exhibiting their longest stretch of bullish choices market positioning since 2021’s meme inventory craze, in response to knowledge from Citadel Securities institutional choices desk.

That confidence has traders shedding defenses towards a minor correction.

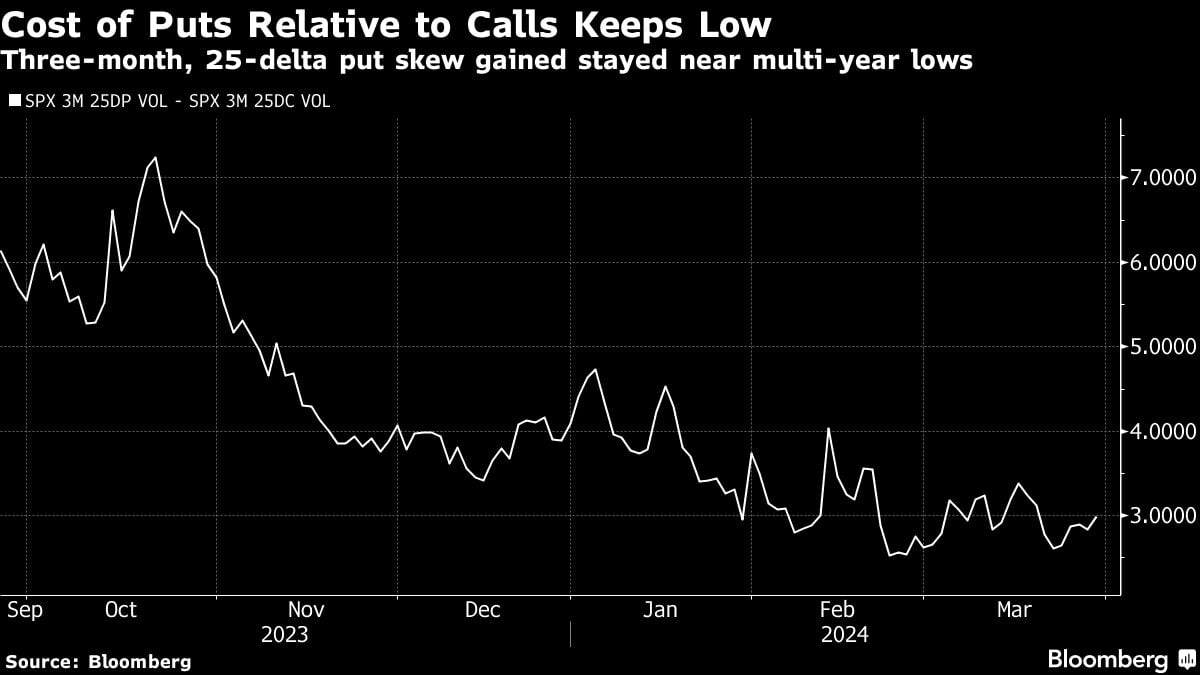

The price of S&P 500 bullish name choices expiring in a single yr with a 25% likelihood of coming within the cash — generally known as having a 25-delta — is up, whereas the price of equal bearish places is down. Which means traders are prepared for continued broad market advances and aren’t notably frightened a few slight pullback.

They’re, nonetheless, involved a few catastrophe, as positioning for a volatility spike will increase.

Common every day name quantity on the Cboe Volatility Index, or the VIX, was increased within the first quarter than the 2 prior quarters. And its two-month skew — measuring the price of 25-delta calls towards equal places — is round its highest stage in 5 years, in response to knowledge compiled by Bloomberg.

Traders are “not so involved with valuations, earnings, or any of the opposite run of the mill catalysts that would drive a correction,” mentioned Cboe World Markets Inc.’s Mandy Xu. “Nonetheless, there’s a number of concern of potential black swan occasions that would ship volatility spiking considerably increased.”

A chief danger is the timing and magnitude of rate of interest cuts from the Fed this yr. Chair Jerome Powell reiterated on Friday that the central financial institution isn’t dashing to ease coverage after the newest inflation knowledge got here in step with expectations. Discuss of higher-for-longer charges might dent sentiment within the quarter to come back.

There’s additionally the problem of how broad markets honest ought to the factitious intelligence darlings which have been driving the indexes stall out. “Stretched positioning and technicals” might immediate tech shares to steer the primary leg of a possible selloff, Barclays strategists warned in a current be aware.

For now, nonetheless, these fears are considerably contained, and hopes for one more stable earnings season might drive valuations additional into nose-bleed territory. It’s one motive why protecting places are out, and rally-chasing is in.

“Choices merchants appear way more inclined to purchase ‘FOMO insurance coverage,’” mentioned Steve Sosnick, Interactive Brokers chief strategist — calling out the shortage of hedging on the broad market stage. “However there’s a number of room between a correction and true tail danger.”

(Credit score: Adobe)

[ad_2]