[ad_1]

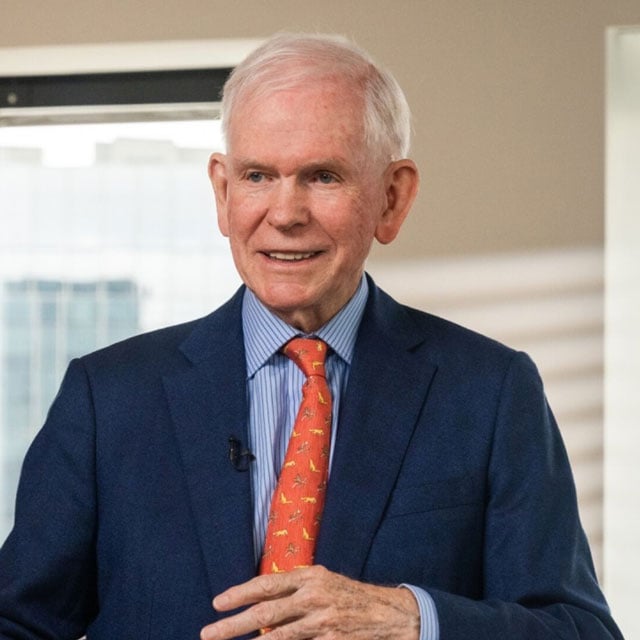

Jeremy Grantham is a well-known bubble hunter, fast to level out speculative extra on Wall Avenue and past.

So it might appear to be a shock that the largest mutual fund at his agency — GMO — is betting on lots of the so-called Magnificent Seven tech shares which have surged a lot this 12 months that they could look, properly, somewhat bubbly.

However to Tom Hancock, supervisor of the $8 billion GMO High quality Mutual Fund, there’s no contradiction per se: Hancock’s simply following the agency’s recipe for investing in corporations with stable monitor information.

That’s pushed the fund to an roughly 25% acquire this 12 months, outpacing the roughly 18% advance by the S&P 500 — even after it shied away from two of the benchmark’s greatest gainers, Nvidia Corp. and Tesla Inc.

The technique is mirrored within the agency’s first ETF, the $17 million GMO U.S. High quality ETF that was launched final month.

“It’s humorous — corporations like Microsoft and Apple, you’d suppose these can be tremendous crowded corporations however I really don’t know that they’re,” stated Hancock, who has been the lead portfolio supervisor of the mutual fund since 2015 and with GMO since 1995. “We maintain them. Clearly, we expect the valuations are cheap.”

The attitude could allay some worries that huge tech shares have run too far, with the latest leg up fueled by hypothesis the Federal Reserve will pull the financial system to a delicate touchdown and shift to chopping rates of interest early subsequent 12 months.

The Nasdaq 100 Index, one proxy, is up 44% this 12 months, mirroring the acquire in 2020 when the Fed’s near-zero charges set off a buying and selling frenzy.

Fund Focus

The GMO fund has a majority of its holdings — round 90% — in shopper staples, tech and health-care. It’s underweight on industrial and monetary shares, and, no less than within the final 4 years, has averted telecom, utilities and vitality corporations.

[ad_2]