[ad_1]

Manulife Vitality, a program that rewards policyholders for making wholesome decisions with the assistance of know-how, helps folks lower your expenses and stay higher. Learn on to study extra.

What Does Exercise Monitoring Need to Do with Insurance coverage?

The concept of mixing know-how and insurance coverage is just not new. Specifically, exercise monitoring has grow to be a standard time period within the context of insurance coverage.

It began with automobile insurance coverage, the place the thought of monitoring driving behaviours and rewarding good driving habits with decrease automobile insurance coverage premiums discovered its place throughout quite a few insurance coverage firms. The monitoring was realized most regularly through a tool/GPS put in into the automobile or utilizing a smartphone to see key driving elements.

This was later expanded to incorporate owners’ insurance coverage by offering reductions for sensible tech, sensible locks, safety methods, sensible doorbells – rewarding owners for adopting know-how that reduces dangers, in the meantime extra generally referred to as “Behavioral Insurance coverage”.

In Canada, at the moment Manulife leads the way in which amongst modern life insurers within the behavioral insurance coverage house. So, we’ll use its program, Manulife Vitality, a program that rewards Canadians for residing a more healthy life through monitoring personal bodily actions and specializing in a more healthy life-style habits, to higher perceive how Canadians, and Millennials/Gen X particularly, can profit from a mixture of leveraging know-how and behavioral life insurance coverage.

Why can we give attention to Millennials and Gen X? These are two demographic segments which have dominated the tech sphere to date in the usage of wearables and smartwatches. Right here is the usage of wearables by age class:

| Canadians | Use or desire a health gadget |

| Millennials | 77.5% |

| Gen X | 55.3% |

Supply: SCOR analysis

You will need to point out that in the meantime, extra senior segments of wearable gadget customers are rising rapidly as know-how is turning into extra sturdy and simpler to make use of.

How Does Behavioral Insurance coverage Work?

The concept behind combining life insurance coverage and selling constructive well being behaviors could be very intelligent as it’s one thing that advantages each side: insurance coverage firms and insurance coverage clients (coverage holders).

If an insurance coverage buyer permits an insurance coverage firm to view some elements of their well being and well being behaviours, the possibilities are superb that this particular person will probably be, first, taking higher care of their well being and, second, dangers related to this buyer will probably be extra clear; and subsequently, as a rule, decrease for an insurance coverage firm (e.g., threat of the life insured getting sick or dying).

It means much less declare payouts to an insurance coverage firm leading to greater profitability, whereas a part of these financial savings may be handed again to a buyer, rewarding them for a superb well being behaviour.

For example, Manulife Vitality’s program rewards clients for a mess of excellent well being habits and behaviours similar to:

- Being a non-smoker

- Partaking in bodily exercise (from strolling your canine to taking part in athletic occasions)

- Receiving routine vaccinations

- Conducting preventive well being checks

- Finishing on-line well being training programs

- Meditating

- And plenty of extra

Do any of these habits and behaviours apply to you? That’s one thing that might get you rewards and premium reductions from an insurance coverage firm.

This system is simple because the related know-how is sort of sturdy and straightforward to make use of, however self reporting is a straightforward possibility that’s supplied as properly. Collaborating and getting credit score for the stuff you do is sort of easy. Whilst you can submit proof of your wholesome actions on the web site or cell app, one of many best methods is utilization of a health gadget. Getting began is even simpler; insurers usually present a complimentary or closely sponsored gadget.

For instance, the Manulife Vitality Plus program compensates (both totally or partially, relying on the gadget mannequin) its members for sure fashions of Garmin1 and Fitbit2 gadgets.

There may be even an choice to get a sponsored Apple Watch, which comes at a value of some {dollars} per thirty days or for free of charge3 as you possibly can earn the month-to-month cost by utilizing the watch to get credit score on your bodily actions.

After you have a health gadget, use this system and gadget settings to find out how a lot information you need to robotically stream to the insurance coverage firm, and what you select to self-report. Some information, similar to smoking habits, can solely be self reported.

Manulife units your preliminary Manulife Vitality contract from a place of belief with tangible financial savings and, as soon as it has a stable monitoring foundation (e.g., 10 months for the Manulife Vitality program for the primary yr, and a reassessment of insurance coverage premiums each 12 months following) permitting you to learn from potential financial savings primarily based in your engagement with this system.

On high of this, take into consideration different non-tangible advantages from residing a more healthy life: feeling higher, having the ability to train, favorite sports activities, improved social interplay and a lot extra.

How A lot Can You Save on Life Insurance coverage with Behavioural Insurance coverage?

The quantity of life insurance coverage financial savings related to these applications totally rely on the extent of your participation in this system and your health-related behaviours.

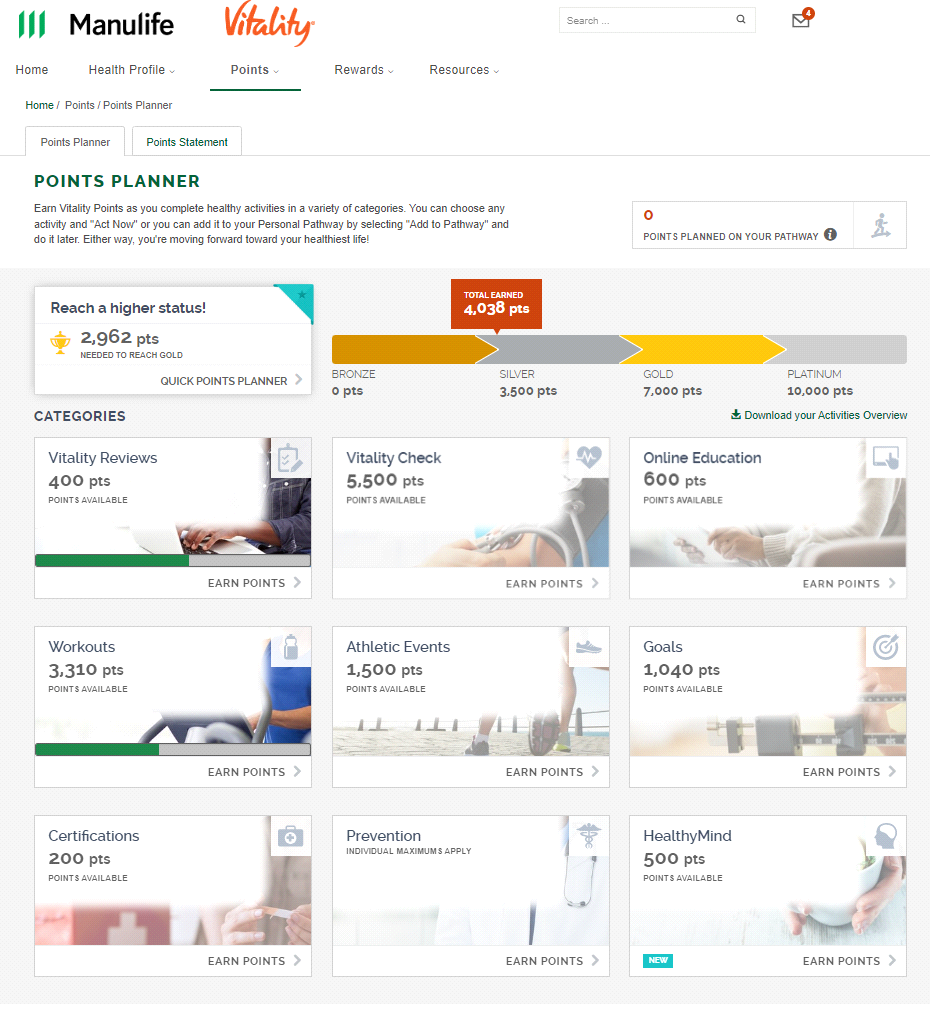

For instance, members of the Manulife Vitality Plus program are in a position to accumulate a sure variety of factors for numerous actions, qualifying them for bronze, silver, gold or platinum standing. Listed below are financial savings related to every stage:

| Bronze | Silver | Gold | Platinum | |

| Life Insurance coverage premiums | 10% financial savings after the primary yr | |||

| n/a | 2% financial savings after the primary yr | 10% financial savings after the primary yr | 15% financial savings after the primary yr | |

That’s not all. When you begin stepping into numerous ranges you possibly can get pleasure from numerous further financial savings similar to:

| Providing | Bronze | Silver | Gold | Platinum |

| GoodLife Health Membership4 | 25% low cost, no becoming a member of charges Meaning financial savings of ~$250/yr plus $70 in one-time enrollment charges |

|||

| Expedia advantages | n/a | 15% off … | 25% off … | 50% off … |

| … two resort bookings of limitless nights on the primary $1,000 of your reserving and as much as $1,000 financial savings per program yr. | ||||

| Good day Recent reductions | $0 | $20 | $45 | $83 (normal 2×3 field) |

| Amazon Prime | n/a | n/a | n/a | One-year Amazon Prime membership* If you attain Platinum standing and full your VHR for 3 consecutive years. |

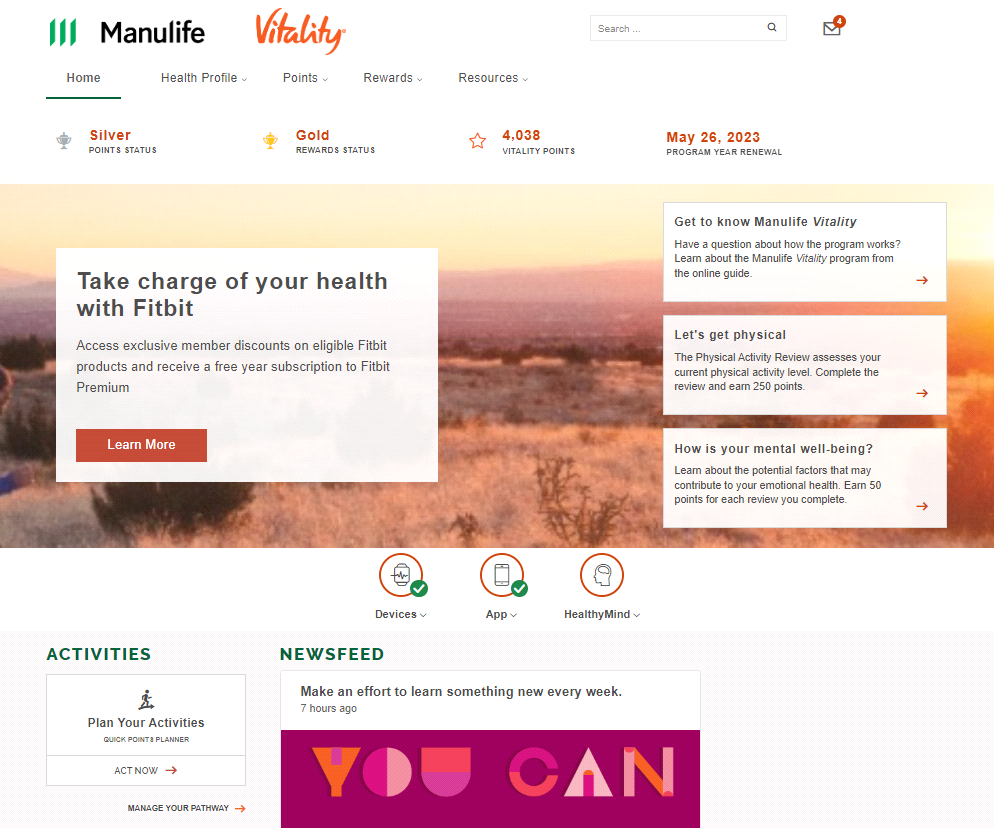

Here’s what the primary dashboard seems to be like the place clients can see their present factors standing throughout numerous classes:

What are Some Cool Options Provided At present?

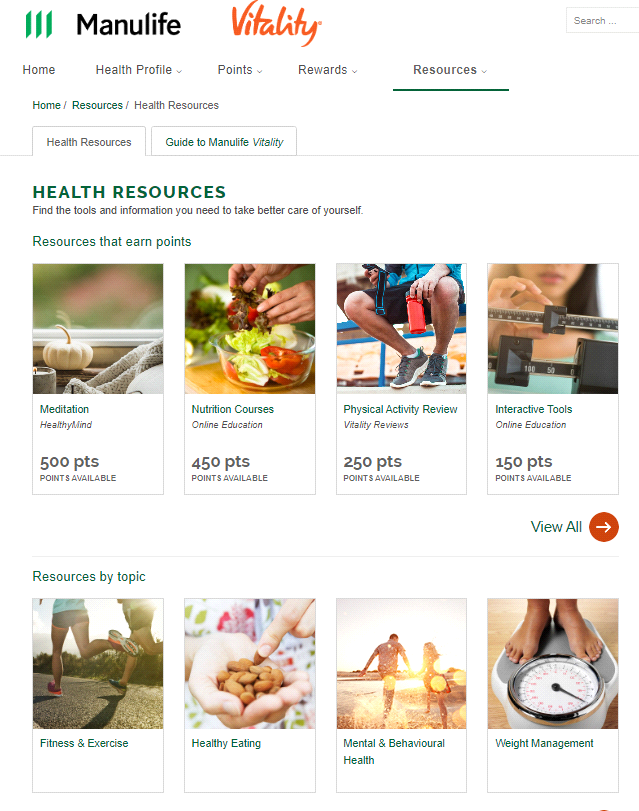

As for the Manulife Vitality Plus program, the cool side of it’s which you can accumulate Vitality FactorsTM for a really big selection of health-related behaviours. Some information is conveniently transmitted through a well being monitoring gadget, whereas others are self-entered. Privateness is assured. You can too entry a broad vary of well being assets to take higher care of your self.

Quite a few companions of this program similar to, Amazon Prime, Expedia, Saucony and others provide further perks must you get to sure ranges of membership.

What are Different Further Advantages of Behavioral Insurance coverage?

Except for tangible financial advantages, there are various further constructive elements, together with your well being progressing on a constructive course as you might be partaking in additional health-focused actions and behaviours. Right here is a few actual information from the Manulife Vitality program about its members5:

- 11% of members improved the physique mass index to a wholesome vary

- 31% of members improved their blood stress to a wholesome vary

- 21% of members improved their ldl cholesterol stage to a wholesome vary

- 26% of members improved their glucose stage to a wholesome vary

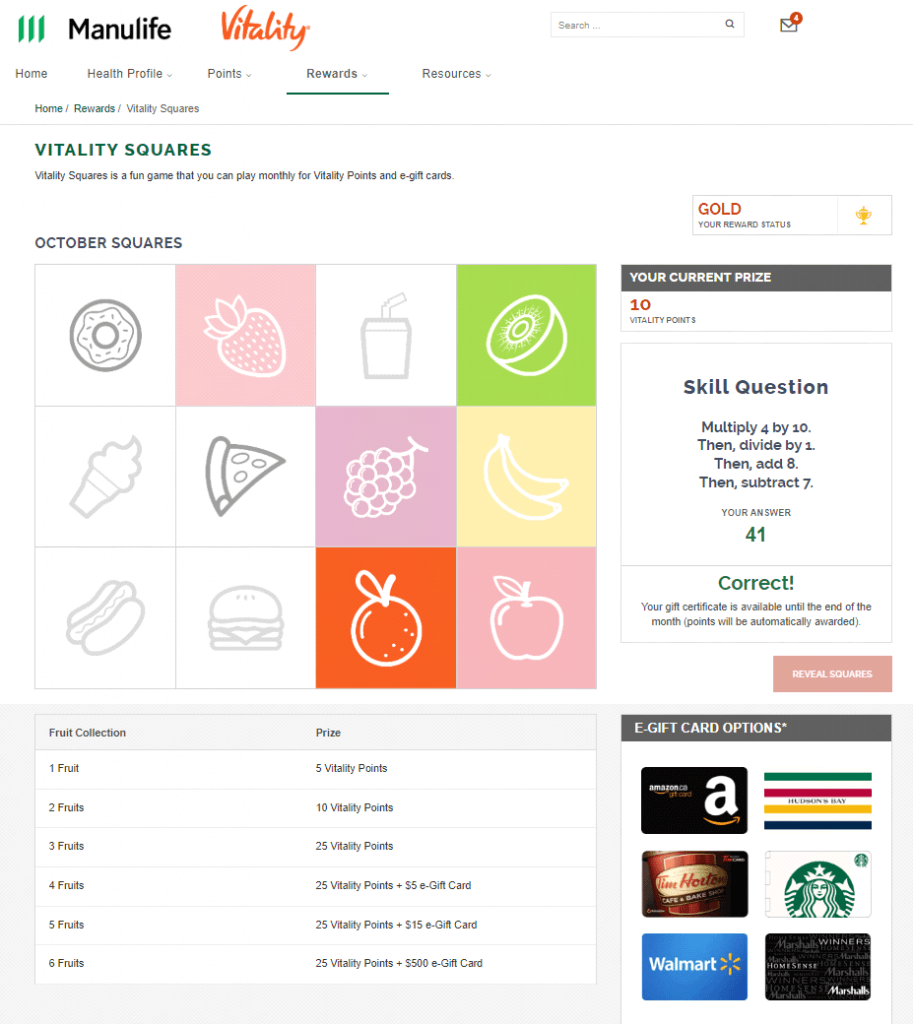

An embedded enjoyable sport Vitality Squares™ lets you play month-to-month for Vitality Factors and e-gift playing cards.

Are There Any Information Safety Considerations?

For example, Manulife follows very strict information dealing with pointers when coping with private and monitoring information. It isn’t being offered and handed to different events and is getting used solely to manage this system. Clients do have to supply their consent and may choose what providers to take part in, or not.

We hope that you simply discover this overview of the Manulife Vitality program useful. Our skilled insurance coverage professionals have entry to twenty+ life insurance coverage suppliers in Canada together with Manulife. Must you have an interest within the Manulife Vitality program, please don’t hesitate to succeed in out, both for a quote or just to ask questions.

Disclaimers

1. Solely obtainable on the primary yr of the Manulife Vitality membership. Enroll reward. Doesn’t rely on Vitality Standing™. Garmin and Vivofit are registered emblems of Garmin Ltd.

2. Enroll reward. Doesn’t rely on Vitality Standing™. Fitbit and Fitbit Luxe are registered emblems of Fitbit LLC or its subsidiaries.

3. Preliminary cost doesn’t embrace relevant taxes or upgrades which can embrace mobile fashions. Tax on preliminary cost is predicated on retail worth of Apple Watch. Apple Watch Sequence 8 requires an iPhone 8 or later with iOS 16 or later. Wi-fi service plan required for mobile service. Apple Watch and iPhone service supplier have to be the identical. Every month-to-month cost may be lowered to as little as $0 relying on what number of Vitality Factors you earn. Apple is just not a participant in or sponsor of this promotion. Apple Watch is a registered trademark of Apple Inc.

4. Goodlife Health reward not availready in Quebec.

5. Manulife Vitality program information between 2020 and 2021.

6. Vitality Wheel and Vitality Squares are usually not obtainable in Quebec.

Eligibility for rewards could change over time. Rewards are usually not assured over the total lifetime of the insurance coverage coverage.

Insurance coverage merchandise are issued by The Producers Life Insurance coverage Firm. The Vitality Group Inc., in affiliation with The Producers Life Insurance coverage Firm, supplies the Manulife Vitality program. The Manulife Vitality program is obtainable with choose insurance policies. Please seek the advice of your monetary consultant to study extra and discover out for those who qualify for this product. Vitality is a trademark of The Vitality Group Worldwide Inc., and is utilized by The Producers Life Insurance coverage Firm and its associates beneath license. Vitality Factors, Vitality Standing and Vitality Well being Assessment are emblems of The Vitality Group Worldwide, Inc., and are utilized by The Producers Life Insurance coverage Firm and its associates beneath license. Manulife, Stylized M Design, and Manulife & Stylized M Design are emblems of The Producers Life Insurance coverage Firm and are utilized by it, and by its associates beneath license.

© 2023 The Producers Life Insurance coverage Firm. All rights reserved.

The logos and different figuring out marks hooked up are emblems of and owned by every represented firm and/or its associates. Please go to every firm’s web site for added phrases and circumstances.

[ad_2]