[ad_1]

Your advertising group has simply handed you SMB purchaser personas that they’ve created in your assessment and enter. You suppose again to the same train that the manager group did six or seven years in the past and also you dig it up simply to check. Right here they’re…aspect by aspect. How has the SMB purchaser modified? How has the chance modified? How has the market modified? How have your business product choices modified? The place does the brand new purchaser slot in your planning? The place do you match into theirs? These are the necessary questions that should be requested.

Proper worth.

First, you discover some similarities. SMB decision-makers are nonetheless value-driven. Considered one of their priorities is procuring their enterprise round. They’re nonetheless involved about getting a good worth. Then and now, SMB decision-makers take their time when researching choices. They’re no-nonsense. They don’t purchase into advertising fluff. They need what is important. They consider based mostly on actual data. In the event that they make an emotional resolution, it’s as a result of their evaluation has triggered an emotion based mostly on a present ache level or threat want.

Comfort and in search of suggestions have been additionally key indicators of buy patterns. Had been the merchandise straightforward to purchase, straightforward to make use of, and was the claims course of easy when it was wanted? These traits are nonetheless in impact as effectively, however one thing has modified. SMB patrons need much more comfort and they should really feel that their insurer actually understands them — not simply their business — together with the small print behind their enterprise dangers. SMB decision-makers are rising increasingly comfy with sharing company/telematic/non-public knowledge if it contributes to raised costs, improved providers, or better safety. SMB patrons respect transparency within the relationship.

Proper place.

If you have a look at the 2023 and the 2016 personas aspect by aspect, the evident distinction pertains to enterprise pressures. SMB decision-makers could have felt stress in 2016, but it surely’s nothing like immediately’s considerations. SMBs are dealing with dozens of recent challenges, together with inflation, provide chain points, rising rates of interest, rising threat, and low unemployment. Right now’s insurers can win the market by serving to SMBs survive and thrive addressing these challenges, some the identical and a few new. However the actual key to capturing a better degree of market share is ensuring the choices are positioned the place the SMB purchaser is wanting.

To assist insurers the place and find out how to meet the brand new SMB patrons as they navigate immediately’s compounding points, Majesco revealed an SMB survey report entitled, Resiliency in Occasions of Change: Rethinking Insurance coverage to Assist SMBs Thrive. It covers SMB buyer sentiment and SMB decision-maker demographics that determine choices the place to put new services and products, and find out how to place these services and products to optimize their influence. In immediately’s weblog, we glance particularly at Industrial Property and Enterprise Homeowners Insurance policies, in addition to Employees Compensation insurance coverage and Cyber insurance coverage.

Industrial Property and BOP for SMBs

Right now, we’re seeing growing environmental, societal, and technological dangers which have the potential to intersect and considerably disrupt individuals’s lives. Elevated excessive climate occasions and pure disasters have a rising unprecedented and more and more vital influence. Because of this, the price of insurance coverage is growing, placing monetary stress on SMBs.

Some areas and properties are seeing vital will increase as a result of claims from catastrophic occasions comparable to wildfires, hail, and flooding. Threat Administration journal stories that wind and flood losses have been excessive previous to Hurricane Ian, and that occasion alone is anticipated to value the business greater than $50 billion with some specialists estimating it as excessive as $100 billion. Flood premiums may rise by 25% or extra. On the identical time, the substitute worth of most properties has elevated considerably as a result of inflation, which is able to drive increased substitute value values and insurance coverage prices.[i]

What will help to decrease Industrial Property and BOP premiums?

Customized Pricing with Knowledge

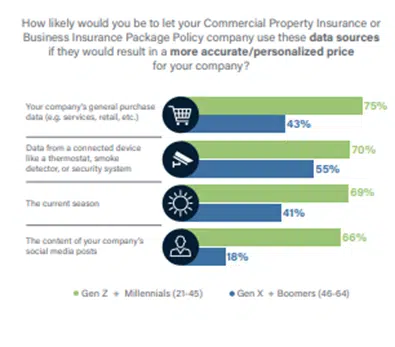

Gen Z and Millennial SMBs are extremely (66% to 75%) in utilizing knowledge from a number of new, non-traditional sources if it leads to extra correct, customized costs for business property or BOP insurance coverage (see Determine 1). In distinction, Gen X and Boomer SMBs’ curiosity is way decrease with gaps of twenty-two% to 48% as in comparison with the youthful era.

For each generations, the usage of linked units in a property is robust and presents a possibility for insurers to develop new merchandise that leverage such units to not solely assist worth but additionally monitor and cut back the chance for properties. Insurers providing merchandise that present monitoring and customized pricing may assist SMBs cut back threat and, doubtlessly, insurance coverage premiums, which addresses the monetary top-of-mind problem.

Determine 1: Curiosity in new knowledge sources for business property/BOP insurance coverage pricing

Demand for Worth-Added Companies

There’s a a lot nearer alignment between the generations relating to value-added providers for business property or BOP, with a mean hole of solely 14% (see Determine 2).

There may be very excessive curiosity by each generational SMB respondents in selling security, threat resilience, and peace of thoughts by safety monitoring with good units. These providers might be packaged together with present business or enterprise insurance coverage insurance policies, or they are often introduced as value-added service choices. Both manner, monitoring providers can use sensors and alerts for smoke/CO2, water leaks, gear failure, and extreme climate. These providers have among the many highest ranges of curiosity for each segments. Gen Z and Millennials’ demand for providers to assist make their lives simpler is as soon as once more mirrored of their very excessive curiosity in digital property self-assessment instruments (87%) computerized claims FNOLs based mostly on extreme climate and site knowledge (75%), on-demand single-item insurance coverage (73%), and concierge service for repairs and preventative upkeep (68%).

For SMBs, this turns into an actual worth with all of the pressures they face day by day — together with the time it takes to easily handle and function the enterprise. Protecting measures, similar to insurance coverage, ought to function within the background and take little or no time to arrange or preserve, however present threat resilience that ensures their enterprise is secure and safe.

Value-conscious SMB decision-makers are additionally interested by defending their property, equipment, and capital investments. The thought of threat resilience with preventive providers must be top-of-mind for insurers as a manner to supply extra worth for SMB premiums. Preventive providers could, after all, function coverage add-ons that would generate income on their very own, relying on how they’re constructed.

Insurers have to look to new merchandise that leverage IoT units and digital loss management choices to present “energy” to SMBs to evaluate and handle their property and related dangers. Majesco’s Loss Management, Property Intelligence[DG1] , and Clever Core for P&C[DG2] are tightly built-in and will help insurers incorporate loss management, property, and different knowledge to make use of for threat evaluation, underwriting and new providers inside or alongside current or new merchandise.

Determine 2: Curiosity in value-added providers with business property/BOP insurance coverage

Enhancing Product Placement By way of Expanded, Related Channel Choices

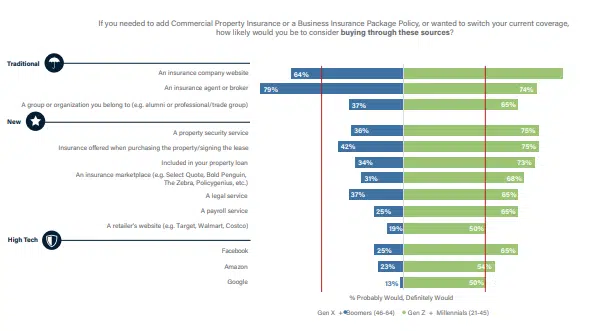

The Majesco SMB survey additionally uncovered actual alternatives for improved product placement. Although Brokers/brokers and insurance coverage firm web sites stay the popular strategies for buying business property or BOP insurance coverage (as seen in Determine 3), the generational segments flip of their preferences for these two conventional channels, with Gen X and Boomers preferring brokers/brokers by 15% and Gen Z and Millennials preferring insurance coverage firm web sites by 12%.

Gen X and Boomers SMBs have much less curiosity in all different channel choices aside from the smooth embedded possibility of buying insurance coverage when shopping for the property or signing the lease (42%). In distinction, Gen Z and Millennial SMBs are interested by all of the channels – in line with their expectations of a multi-channel world. Specifically, their curiosity is exceptionally sturdy for the embedded choices of shopping for the property/signing the lease (75%), together with the property mortgage (73%) and from a property safety service (75%). And as soon as once more, the Excessive-Tech channels do very effectively with Gen Z and Millennials, reaching 50% curiosity or increased. Because of this discovering the fitting placement for insurance coverage merchandise is now an crucial problem AND an actual alternative.

Determine 3: Curiosity in channel choices for business property/BOP insurance coverage

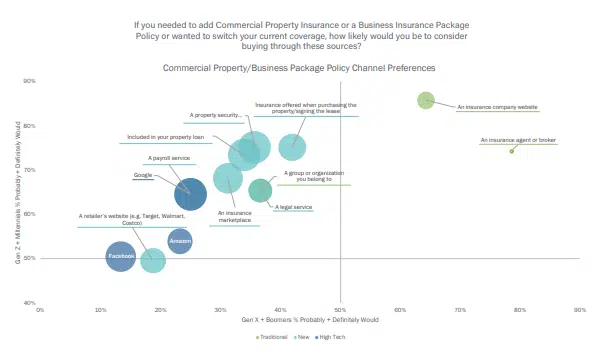

In one other view of this knowledge, Determine 4 emphasizes the dominance of the 2 conventional channels (brokers/brokers and insurance coverage firm web sites) within the higher right-hand quadrant when it comes to curiosity. The bigger bubble for insurance coverage firm web sites signifies Gen Z and Millennial SMBs’ better choice for this channel as in comparison with the older era.

Due to the decrease curiosity by the older era and huge gaps between the 2 generational teams, the opposite channels are represented by bigger bubble sizes – highlighting market alternatives for the youthful era for insurers.

Determine 4: Generational alignment on curiosity in channel choices for business property/BOP insurance coverage

The brand new and rising spectrum of channel choices, particularly the thrilling alternatives for embedded insurance coverage, will give modern insurers and their companions large alternatives for progress, with new markets, new choices, happy and dependable prospects. Majesco’s Digital Customer360 for P&C and Digital Agent360 for P&C[DG3] , with new and rising AI instruments, will place Industrial and BOP insurers able to capitalize on their Proper Place, Proper Value strategy.

Employees Compensation and Cyber Insurance coverage

As companies proceed to adapt to the impacts of the pandemic, low unemployment, new work choices, and inflation, they’re adjusting their operational fashions to satisfy worker wants and expectations, which, in flip, has implications for staff compensation. As corporations look to rising tendencies and dangers comparable to marijuana legalization, distant working, psychological well being and wellness, and elevated use of Gig staff, the influence on SMBs and staff compensation insurance coverage will drive insurers to rethink their strategy.

As well as, cyber will proceed to rise to the highest as SMBs speed up the digitalization of their enterprise. In keeping with a report by Gallagher, “After three years of hardening circumstances, the cyber insurance coverage market has lastly begun to indicate indicators of stabilization and from a premium perspective, cyber insurance coverage patrons are seeing smaller price will increase and, in some circumstances, even flat renewals.”[ii]

Managing and minimizing these dangers will change into ever extra essential to SMBs, mirrored within the curiosity in value-added providers.

Demand for Worth-Added Companies

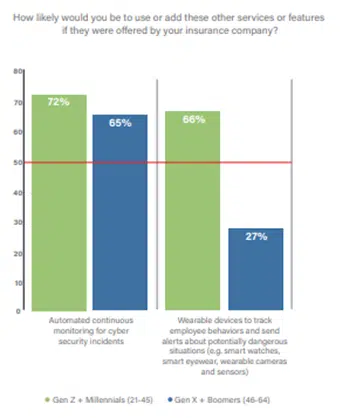

Cyberattacks are on the rise for SMBs, a lot of whom are ill-equipped to deal with or get better from an assault. Consequently, cyber threat/knowledge safety is the fifth most necessary top-of-mind problem for each Gen Z and Millennials (66%) and Gen X and Boomers (63%) as beforehand famous. As such, it isn’t stunning there may be very excessive curiosity by each generational segments within the value-added service of automated, steady monitoring for cyber safety incidents (72%, 65%), as seen in Determine 5. With their growing digital capabilities, minimizing this threat turns into more and more necessary to their ongoing enterprise operations in addition to for maintaining their prospects’ belief. Main insurers providing cyber insurance coverage are working with their prospects to supply these providers, differentiating them out there in addition to serving to to reduce any losses.

Curiosity in employee’s compensation value-added providers diverge between the 2 generational teams. Gen Z and Millennials’ sturdy curiosity in utilizing wearable units to observe worker behaviors for doubtlessly unsafe conditions (66%) is in stark distinction to that of Gen X and Boomers, with a niche of 39%.

With the rising curiosity in wearables by people by Fitbit, Apple Watch, and different units, these units have the potential to stop accidents or accidents, streamline the restoration course of, cut back claims, and in the end, enhance well being and monetary outcomes for workers and employers by a speedy restoration. Insurers ought to benefit from the curiosity of the youthful era of SMBs with new, modern merchandise and value-added providers connected to them.

Determine 5: Curiosity in value-added providers with knowledge breach/cyber and staff compensation insurance coverage

Increasing Channel Choices

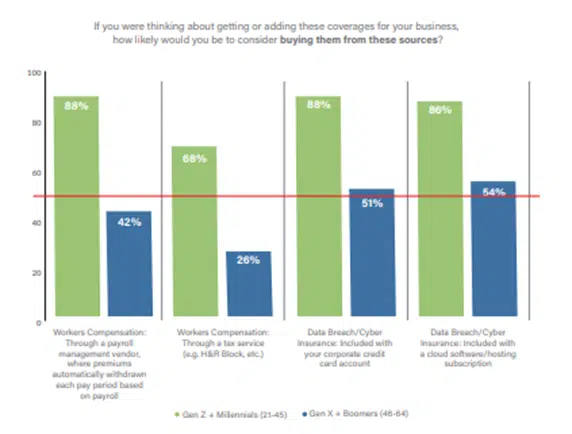

As mirrored in Determine 6, Gen Z and Millennials proceed their excessive curiosity in new channels for each staff comp and knowledge breach/cyber safety, starting from 68% to 88%.

Nevertheless, a disparity emerges for Gen X and Boomers between these two strains of enterprise. Their curiosity in two embedded choices for cyber insurance coverage exceeds the 50% midpoint, however their curiosity in new staff comp channels is decrease, reaching simply 42% for acquiring it by a payroll administration vendor and 25% for acquiring it by a tax service. We may speculate that Gen X and Boomers’ views on these two forms of protection might be influenced by their longer expertise with staff comp, and the truth that it’s typically a required protection.

Each areas are seeing elevated or rising threat for SMBs, leaving many unprepared for the possibly severe penalties. Insurers providing these merchandise ought to look to different channels to assist educate and provide these merchandise, serving to SMBs whereas additionally rising their enterprise.

Determine 6: Curiosity in channel choices for knowledge breach/cyber and staff compensation insurance coverage

Understanding these ache factors for SMBs is the equal of understanding the alternatives as an insurer. Each new menace represents a brand new chance for insurance coverage to play a job. And every new product and repair has the potential to be bought at a degree of sale or use — that means that digital service and multi-channel methods are essential to serving the brand new SMB cohort.

As an insurer, regardless of the place you’re within the strategy of product and channel enlargement for Industrial and BOP P&C, Employee’s Comp, and Cyber, your group can benefit from Majesco’s new, revolutionary Clever Core options for insurers. Majesco P&C Clever Core Suite, Loss Management, Property Intelligence and Digital 360 Options are[DG4] designed to be essentially the most versatile and sturdy system answer obtainable — able to dealing with a far wider vary of enterprise merchandise and channels than ever earlier than. Majesco’s clever core platforms harness the ability of microservices, APIs, cloud, AI/ML, generative AI, pre-configured content material and greatest practices, entry to new knowledge sources, and an ecosystem of modern capabilities.

For a clearer image of how your organization can benefit from all that Majesco presents, be sure you tune into the Majesco webinar, The Daybreak of Clever Core Insurance coverage Software program immediately.

[i] Cavignac, Jeff, “What to Count on for the Industrial Insurance coverage Market in 2023,” Threat Administration, November 21, 2022, https://www.rmmagazine.com/articles/article/2022/11/21/what-to-expect-for-the-commercial-insurance-market-in-2023

[ii] Farley, John, “2023 U.S. Cyber Market Circumstances Outlook Report,” Gallagher, January 2023, https://www.ajg.com/us/news-and-insights/2023/jan/2023-us-cyber-market-conditions-outlook-

[ad_2]