[ad_1]

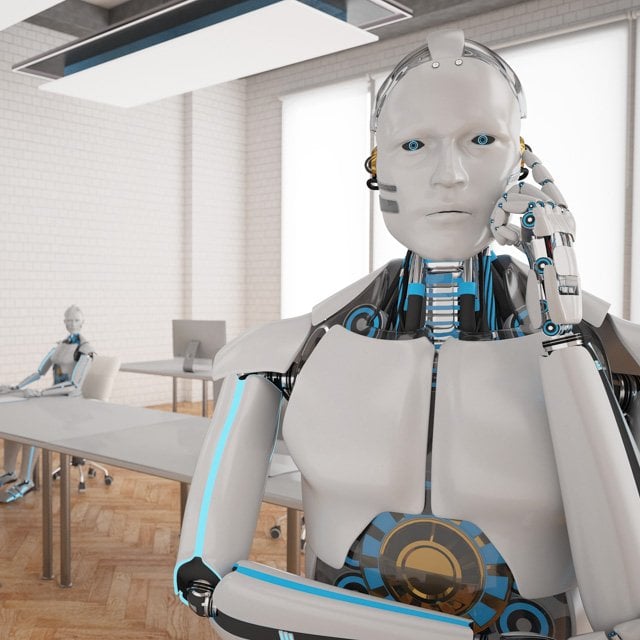

Life insurance coverage and annuity issuers ought to guarantee that any synthetic intelligence methods they use play truthful, even when outdoors distributors handle the AIs, in accordance with state insurance coverage regulators.

The regulators’ group, the Nationwide Affiliation of Insurance coverage Commissioners, has adopted a mannequin bulletin that features many provisions associated to insurers’ relationships with AI system suppliers.

Insurers utilizing AI “should adjust to all relevant insurance coverage legal guidelines and laws,” the NAIC states within the new Use of Synthetic Intelligence Methods by Insurers bulletin, which was permitted Monday on the group’s fall nationwide assembly in Orlando, Florida. “This consists of these legal guidelines that tackle unfair commerce practices and unfair discrimination.”

What it means: The NAIC, a gaggle for state insurance coverage regulators, is likely one of the first entities answerable for setting the principles for machines that appear as if they’ve a thoughts of their very own.

The historical past: Insurers had been among the first U.S. customers of computer systems, they usually have been utilizing AI and machine-learning methods to enhance knowledge evaluation and quicken processes for years.

Birny Birnbaum, a client advocate, has warned that, as a result of AI methods don’t essentially present how they’ve reached their conclusions, they might find yourself discriminating primarily based on race or violating different legal guidelines, even when the system managers and customers didn’t intend to discriminate.

In 2019, New York state issued a letter warning insurers in opposition to letting new, automated life insurance coverage underwriting methods discriminate. The NAIC adopted AI rules in 2020.

[ad_2]