[ad_1]

A research from Gallagher has discovered that UK companies are involved in regards to the litigation dangers related to their environmental, social, and governance (ESG) targets. In the meantime, GlobalData surveying has discovered that laws and strain from the federal government are the main the explanation why an organization ought to set an ESG efficiency plan.

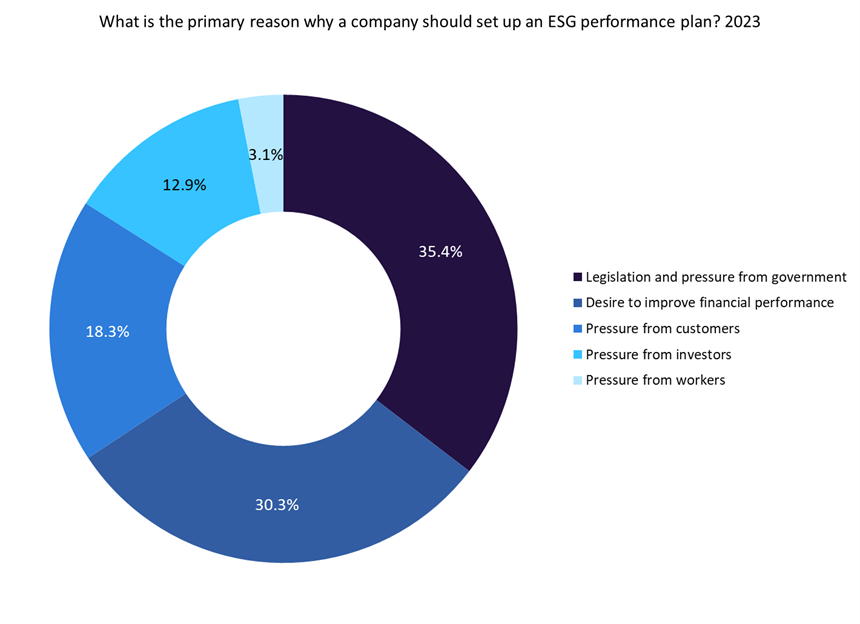

As per GlobalData’s ESG Sentiment Ballot performed in This autumn 2023, 35.4% of respondents imagine the first cause an organization ought to set an ESG efficiency plan is due to laws and strain from the federal government. Different main causes embody a need to enhance monetary efficiency (30.3%), strain from clients (18.3%), and strain from traders (12.9%).

A research by Gallagher, which was performed in 2024, revealed that 62% of senior leaders at main UK companies specific fear concerning the litigation dangers linked to their ESG targets. This concern is compounded by 72% admitting to feeling pressured to determine these targets with no clear plan for attainment. Moreover, 54% understand a considerable rise within the probability of authorized motion over missed ESG targets in comparison with a decade in the past. Concerning the repercussions of failing to fulfill ESG targets, 24% highlighted investor withdrawal as a main concern, adopted by litigation (21%) and shareholder activism (14%).

Insurers typically provide specialised insurance coverage merchandise to assist companies handle dangers associated to ESG components. These merchandise might embody protection for authorized bills arising from lawsuits associated to ESG points, resembling environmental harm or social accountability claims. Moreover, insurers might collaborate with companies to develop danger administration methods tailor-made to their particular ESG objectives and challenges. For instance, in September 2023, Zurich Insurance coverage Group’s industrial danger advisory and providers unit introduced a strategic collaboration, providing advisory providers aimed toward addressing bodily and transition climate-related dangers. The providing goals to supply corporations with a holistic method to local weather dangers, which embody transition-related dangers resembling coverage modifications, reputational impacts, and shifts in market preferences, in addition to bodily dangers resembling these brought on by the rising variety of excessive climate occasions.

By providing these services and products, insurers play a vital position in serving to companies mitigate potential dangers and shield their monetary and reputational pursuits in immediately’s more and more ESG-conscious enterprise surroundings.

Total, by partnering with insurers, companies can successfully handle ESG dangers, reveal their dedication to sustainability, and construct resilience in an evolving enterprise surroundings. By means of collaboration with insurers, companies can proactively handle ESG considerations, improve their company status, and place themselves as leaders in sustainable enterprise practices.

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we would like you to take advantage of

helpful

determination for your corporation, so we provide a free pattern that you would be able to obtain by

submitting the beneath type

By GlobalData

[ad_2]