[ad_1]

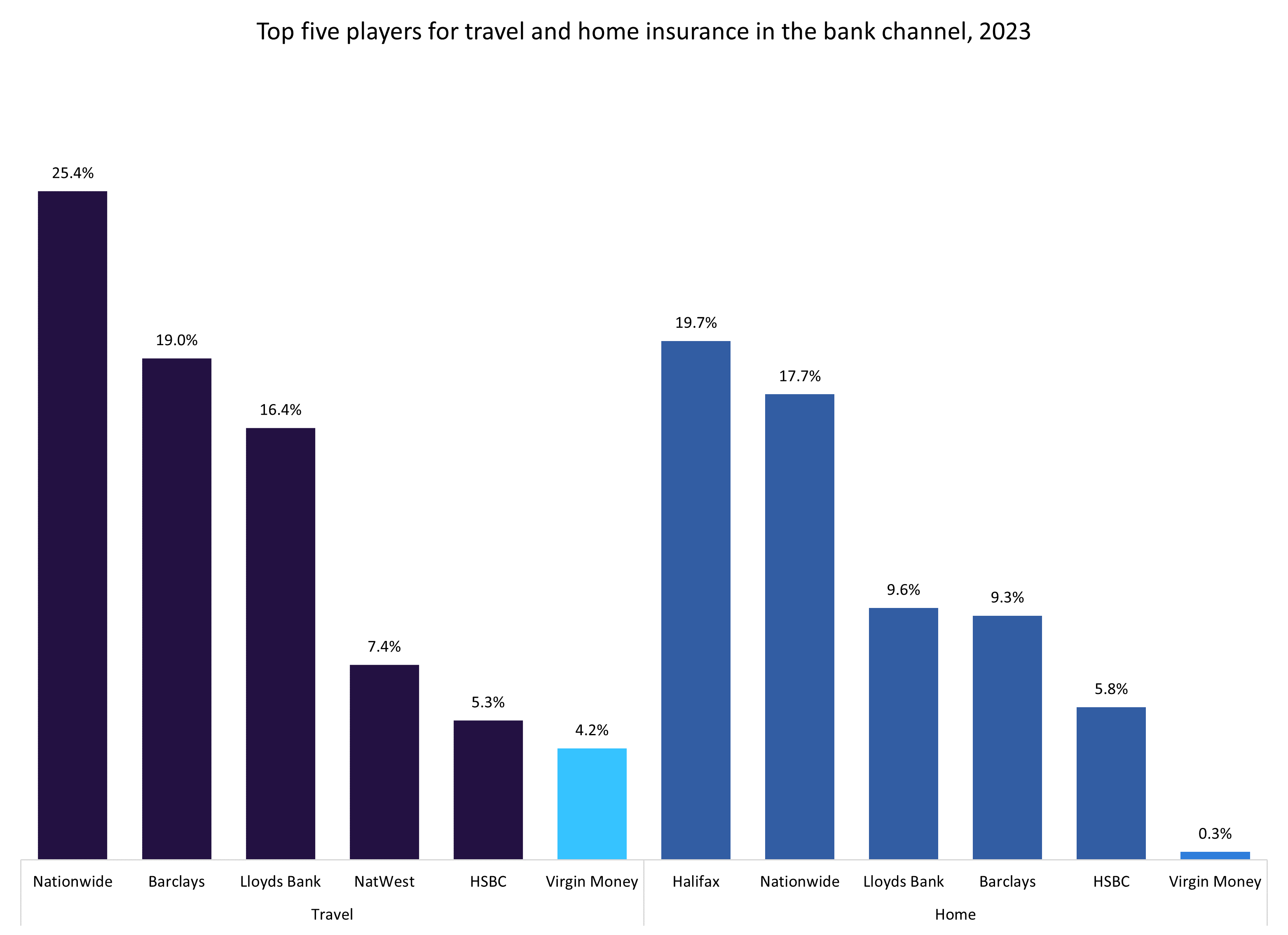

In accordance with GlobalData’s 2023 UK Insurance coverage Shopper Survey, Nationwide has a 25.4% market share in journey insurance coverage, whereas Virgin Cash has 4.2%. By the agreed acquisition of Virgin Cash, Nationwide will strengthen its place within the banking channel’s journey and residential insurance coverage markets. Moreover, Halifax is anticipated to face competitors within the house insurance coverage market because of this acquisition.

Nationwide presently instructions a 17.7% share within the house insurance coverage market, whereas Virgin Cash holds a modest 0.3%, in line with GlobalData’s 2023 UK Insurance coverage Shopper Survey. With the acquisition, Nationwide’s share will rise barely to 18%, solidifying its place because the second-largest house insurance coverage supplier by the banking channel, behind Halifax’s 19.7% share. It’s anticipated that the acquisition could current Nationwide with an opportunity to overhaul the business chief in house insurance coverage throughout the banking channel, on account of it getting access to the 6.5 million clients at Virgin Cash. Moreover, Virgin Cash has an 8.7% share of the bank card market (as of Q1 2024), in line with GlobalData’s World Retail Banking Analytics. It will increase Nationwide’s share to virtually 11%, therefore a chance to provide bank card house owners with journey insurance coverage is offered.

Nationwide intends to extend returns, diversify funding sources, and develop its enterprise by buying Virgin Cash for £2.9bn. It additionally seeks to strengthen its standing within the bancassurance business. The objective of this settlement is to offer purchasers higher service choices and extra aggressive merchandise. To remain aggressive available in the market panorama, different banks and insurers ought to deal with bettering their product choices and buyer experiences.

The acquisition will give the highest gamers in each journey insurance coverage and residential insurance coverage a substantial measurement of the market. As an example, 65% of the journey insurance coverage market throughout the financial institution channel might be shared among the many high three gamers; this determine is 47.3% for house insurance coverage. This presents a possible concern from competitors authorities on the subject of the highest gamers’ market shares in each traces, therefore it could not be a shock if the acquisition is investigated.

Different banks might want to devise new methods to attract purchasers as a result of rising market presence of Nationwide in house and journey insurance coverage throughout the banking channel. One potential method could possibly be to incentivise sure insurance coverage merchandise by the acquisition of various card tiers. Nonetheless, this growth highlights the significance of strategic acquisitions within the banking business and sends a message to different banks concerning the necessity of being artistic and versatile in response to the aggressive panorama. Enhancing product choices needs to be a high precedence for insurers and banks to successfully compete with Nationwide’s expanded market presence, in addition to enhancing the client expertise and looking out into strategic alliances to subvert the dominance of market gamers.

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

resolution for your online business, so we provide a free pattern which you can obtain by

submitting the under kind

By GlobalData

[ad_2]