[ad_1]

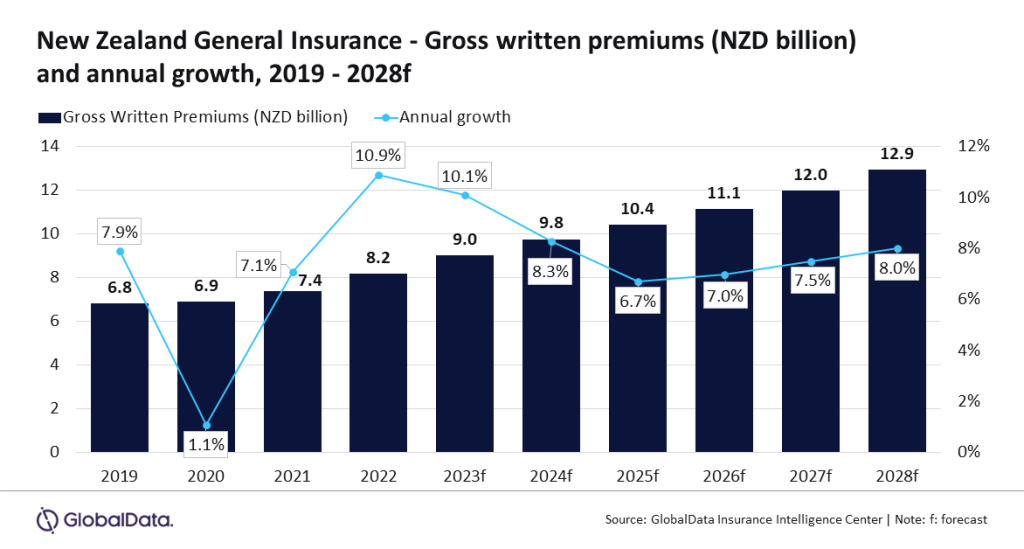

The New Zealand normal insurance coverage sector is anticipated to develop at a CAGR of seven.3% from NZD9.7bn ($5.8bn) in 2024 to NZD12.9bn ($7.6bn) in 2028 when it comes to gross written premiums.

That is in response to GlobalData which additionally predicted that the overall insurance coverage trade in New Zealand will develop by 8.3% in 2024. The property and motor insurance coverage strains will tremendously help this as they make up 75% of normal insurance coverage in 2023.

Sneha Verma, insurance coverage analyst at GlobalData, stated: “New Zealand’s normal insurance coverage trade is anticipated to witness a development of 10.1% in 2023 after rising by 10.9% in 2022. The expansion is supported by an increase within the demand for pure catastrophic (nat-cat) insurance coverage insurance policies as a consequence of a rise within the frequency of utmost climate occasions and a rise in premium costs throughout many of the insurance coverage strains pushed by inflation.”

Property insurance coverage is the main line of enterprise within the New Zealand normal insurance coverage trade, accounting for a 41.7% share of the overall insurance coverage GWP in 2023. It grew by 9.8% in 2023, pushed by the rise in demand for nat-cat insurance coverage insurance policies as a result of nation’s susceptibility to excessive climate occasions.

Moreover, motor insurance coverage is the second largest line of enterprise, accounting for a 32.9% share of the overall insurance coverage GWP in 2023. Motor insurance coverage premiums grew by 9.4% in 2023, primarily as a consequence of premium fee will increase pushed by inflation and excessive declare payouts following Cyclone Gabrielle.

As well as, automobile insurance coverage prices in New Zealand in 2023 have seen an enormous improve as in comparison with final 12 months.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

helpful

choice for your online business, so we provide a free pattern that you would be able to obtain by

submitting the beneath kind

By GlobalData

As per the New Zealand Parliament’s Month-to-month Financial Overview in February 2024, annual automobile insurance coverage premiums elevated by 30% on a median and reached $1,190 within the third quarter of 2023, as in comparison with $914 in 2022. The development is anticipated to proceed in 2024 and motor insurance coverage is anticipated to develop at a CAGR of 6.3% throughout 2024-28.

Verma added: “Excessive inflation has additionally performed a serious function in a rise in property insurance coverage costs. The annual inflation in New Zealand stood at 4.7% in 2023, a lot greater than the goal band of 1% to three% set by the Reserve Financial institution of New Zealand. Property insurance coverage is anticipated to develop at a CAGR of seven.9% throughout 2024-2028.”

[ad_2]