[ad_1]

Open enrollment for the Particular person medical insurance marketplace for 2024 begins November 1st, and it’s time to start out serious about your healthcare protection for the upcoming yr. Policyholders have the chance to evaluation their 2024 medical insurance choices. It is a essential time so that you can evaluation your protection as a result of statewide premium enhance of 9.6%. The rise was attributed not solely to the persistent surge in healthcare utilization post-pandemic, but additionally to greater pharmacy bills and inflationary impacts inside the healthcare sector, comparable to escalating prices of care, labor shortages, and wage and wage raises. Policyholders also can replace their private data in addition to their revenue. Your current well being plan shall be renewed robotically should you make no adjustments until acknowledged in any other case. Key dates to recollect: the enrollment interval for 2024 runs from November 1 to January 15.

Coated California

In 2024 Coated California gives Californians whose incomes are not more than 250% of the federal poverty stage to be eligible for 3 silver plans that may require no deductible. These are family earnings of at the least $33,975 for a person and $69,375 for households of 4. Learn all the small print within the full article right here.

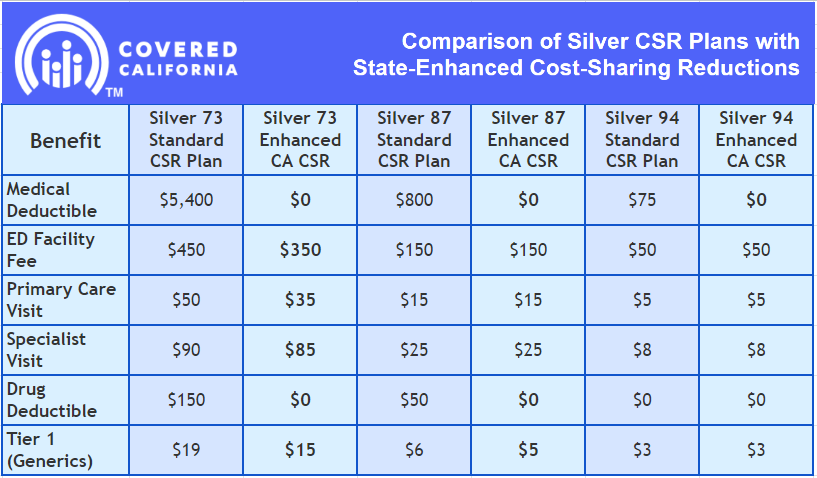

Right here’s the Comparison of Silver CSR Plans with State-Enhanced Price-Sharing Reductions

Furthermore, in all three Silver CSR plans, deductibles shall be totally eradicated, thereby eradicating a possible monetary impediment in terms of accessing healthcare and streamlining the method of choosing a plan. As well as, different advantages will differ by plan. Nonetheless, they may embrace a discount in generic drug prices and copays for major care, emergency care, and specialist visits, and a decreasing of the utmost out-of-pocket value.

Oscar Well being

Oscar will not provide particular person insurance coverage within the California market. Because of this, people who’re policyholders with Oscar might want to transition to a special insurance coverage provider for his or her protection. Moreover, policyholders ought to diligently examine different insurance coverage choices to safe steady well being protection.

Blue Protect of California

Blue Protect serves greater than 3.4 million members and has virtually 65,000 physicians throughout the state. It gives HMO and PPO plans. The HMO Trio has a strong major care physician community with the Windfall system (St. John Hospital, St. Joseph, Windfall Cedars Tarzana, Entry Medical Group Allied Pacific, UCLA, and Cedars aren’t within the community). The PPO protection has an in depth community with self-access to many UCLA, Cedars Sinai, and Windfall medical doctors. Premium prices, nonetheless, will enhance to 15% in 2024.

Anthem Blue Cross

With over 8.6 million members in California alone, Anthem Blue Cross covers extra Californians than every other provider within the state. Anthem’s broad supplier community consists of over 65,000 care suppliers in California. Alongside the Windfall System, Axminster, Allied IPA, and others—nonetheless, not UCLA and Cedars. Their premium price enhance in 2024 is 10.9%.

Well being Internet

In 2022, Well being Internet’s particular person and household plans (IFP) could have a brand new title, Ambetter from Well being Internet. Obtainable in most counties in California, they provide HMO, EPO, and PPO plans. Their PPO plans don’t contract with UCLA or Cedars Sinai, however they permit self-referral to the Windfall system and different suppliers. Premium prices will enhance to 8.4% in 2024.

Kaiser Permanente

Kaiser serves greater than 10 million members, gives HMO protection with the Kaiser System, and consists of entry to Kaiser hospitals. They personal the amenities, and so they do rent medical doctors. Their premium price enhance in 2024 is 7.4%.

LA Care Coated

L.A. Care gives HMO plans with entry to the UCLA system and, relying in your zip code, the Windfall system, Optum, Prospect IPA, PIH, and extra. Premium prices will enhance to 6.1% in 2024.

Please learn our weblog to take a look at different supplier choices in California and their premium enhance expectancy for 2024.

At Strong Well being Insurance coverage, we ease the complexity of the person insurance coverage market. We discover a well being plan that matches your price range and your medical wants, whether or not you’re contemplating renewing your present plan or purchasing for a brand new one. It’s essential to know that not having medical insurance can result in a tax penalty. Maintain this in thoughts while you’re deciding in your healthcare protection to keep away from any additional prices.

Chances are you’ll name us at 310-909-6135 or e book an appointment. We’d be pleased to reply your questions on your medical insurance so you may make well-informed choices about whether or not it’s your particular person, household, or small enterprise’s protection.

[ad_2]