[ad_1]

Supply: GlobalData’s 2023 UK SME Insurance coverage Survey.

GlobalData’s 2023 SME Insurance coverage Survey signifies that the difficult monetary circumstances offered by the UK economic system are beginning to have tangible results on SMEs and insurers. In 2023, nearly 75% of SME insurance coverage supplier switches had been associated (at the very least partly) to the cost-of-living disaster whereas 86.2% of all SMEs contemplating cancellations say it’s a issue.

As UK companies face greater working and debt servicing prices, in addition to dampened demand as a result of cost-of-living disaster, many SMEs have been compelled to cancel insurance policies. GlobalData’s 2023 UK SME Insurance coverage Survey reveals that, for 15 of the 16 merchandise surveyed, greater than 10% of SMEs cancelled a coverage as a result of cost-of-living disaster in 2023. Moreover, nearly 75% of SMEs that switched suppliers in 2023 did so due, at the very least partly, to the cost-of-living disaster. Throughout every SME dimension group, this determine turns into bigger because the agency dimension will increase. 71.2% of sole merchants, 73.5% of micro-enterprises, 75.3% of small companies, and 78.1% of medium firms switched at the very least partly as a result of cost-of-living disaster. This illustrates the strain many SMEs at present face and the broad need for higher worth from insurance coverage merchandise. On common, 32.8% of SMEs mentioned they switched suppliers as a result of new supplier’s pricing concerns.

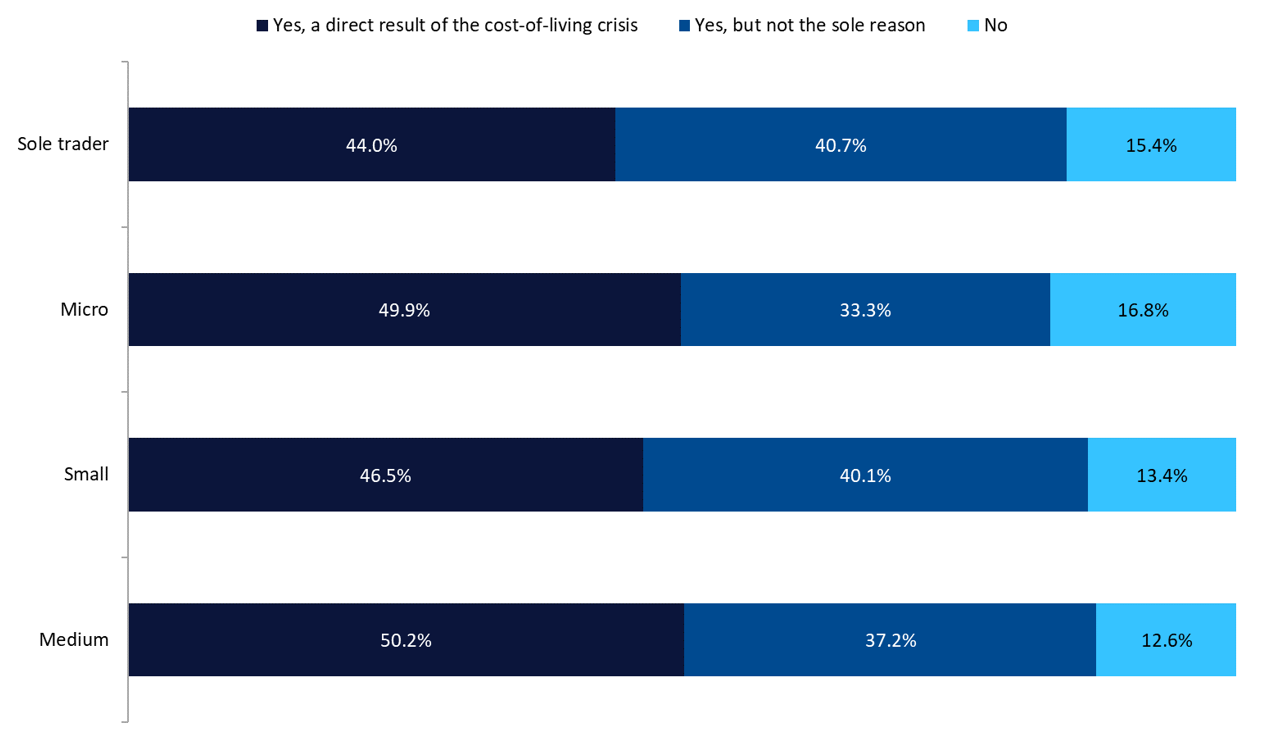

Sadly, the state of affairs could not have reached its peak. When asking SMEs about their ideas concerning switching or cancelling insurance policies sooner or later, a good higher variety of corporations inform of the affect the disaster is having on their decision-making. Nearly 50% of SMEs that indicated they’re contemplating making modifications to insurance policies sooner or later mentioned this was solely all the way down to the cost-of-living disaster. When contemplating the disaster as a contributing issue (however not the one one), the determine surpasses 85%. As business insurance coverage penetration diminishes insurers lose enterprise, placing additional strain on them to take care of cashflow at a time when outgoings for claims prices proceed to soar.

As well as, cancellations and protection reductions will go away the UK SME panorama underinsured, resulting in devastating financial impacts within the occasion of one other disaster or adversarial occasion. Over 60% of SMEs surveyed mentioned they’re involved, to some extent, about the truth that their enterprise is or may very well be underinsured. But regardless of consciousness of the issues of underinsurance, many SMEs are left with no alternative however to forgo insurance coverage right now.

Insurers are tasked with the unenviable function of assuaging many of those pressures whereas going through a number of their very own. Assembly SME calls for for cheaper (and fewer complete) cowl choices is more likely to be place to start out in minimising a lot of this affect, as SMEs have made it clear that worth is their key deciding issue right now. Whereas that is definitely simpler mentioned than performed, failure on this regard will certainly result in extra cancellations and thus the potential for a deeper disaster ought to the worst occur.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

helpful

determination for what you are promoting, so we provide a free pattern which you can obtain by

submitting the under type

By GlobalData

[ad_2]