[ad_1]

LifeTrends, a life insurance coverage knowledge firm, posted a spreadsheet displaying that the rules decreased most illustrated returns for some insurance policies by greater than 1 share level however led to small will increase in illustrated returns for another insurance policies.

The NAIC Life Insurance coverage Annuities Committee got here near shutting down a panel that was engaged on IUL illustration rule updates, the Listed Common Life Illustration Subgroup, due to considerations a couple of lack of regulator settlement on easy methods to transfer ahead, however the committee ended up retaining the subgroup in operation.

The brand new presentation: Birnbaum and Cude’s new presentation depends partly on factors about reengineering life and annuity illustrations and different disclosures that Birnbaum made throughout a discuss in November 2020.

Additionally they draw on an article about funding index design by Bobby Samuelson and a paper in regards to the weaknesses of disclosure-based client safety efforts that was created by the Australian Securities and Investments Fee and the Dutch Authority for the Monetary Markets.

Samuelson recommended that index designers have created indexes that look unusually good in 10- and 20-year historic illustrations however appear unlikely to carry out particularly properly sooner or later.

The Australian and Dutch staff argued, primarily based on analysis on customers’ use of many forms of advisors and disclosures, together with mortgage mortgage advisors, that disclosure necessities could backfire, by inflicting high-risk advisors who present the disclosures to look extra reliable.

“Re-engineer illustrations laws for a constant method for listed annuities and life insurance coverage,” Birnbaum and Cude inform regulators of their new presentation, which is included in a gathering doc packet. “Get rid of hypothetical historic outcomes and projections of non-guaranteed outcomes.”

Eliminating each outcomes will enhance the illustrations and scale back the chances that insurance coverage brokers and brokers will find yourself performing as monetary planners with out having the coaching to take action, the reps say.

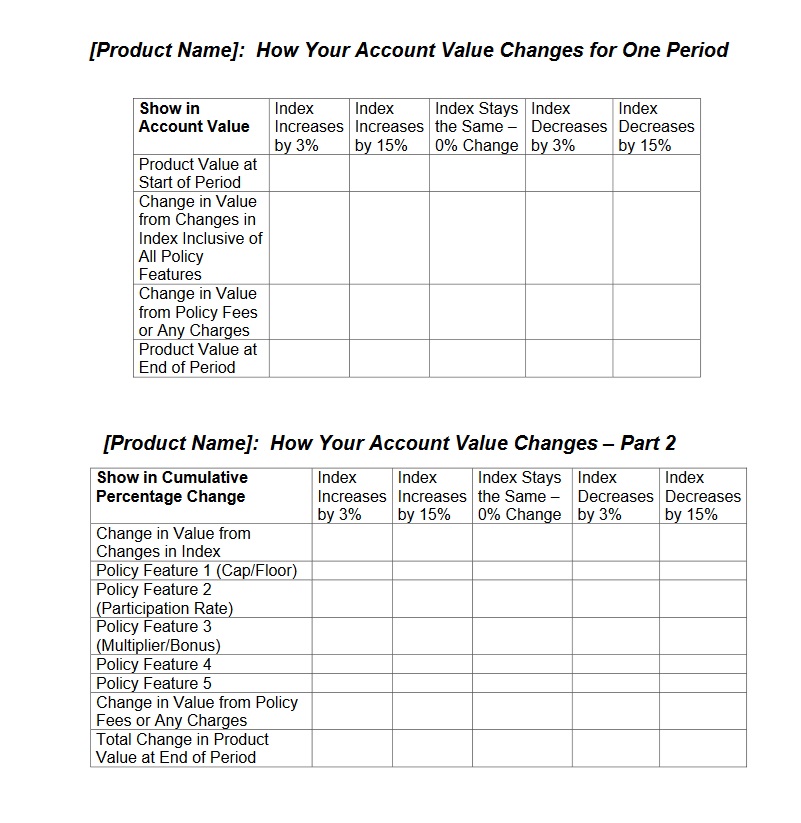

Birnbaum and Cude have included what they hope could possibly be a less complicated, extra full instrument for displaying how merchandise will work: A set of two tables that may present how 12 product variables would carry out in very unhealthy markets, superb markets and markets the place funding indexes modifications just a bit or keep the identical.

Credit score: Heart for Financial Justice

Credit score: Heart for Financial JusticeIf an annuity or life insurance coverage coverage issuer can change an essential performance-related parameter, resembling return caps or participation charges — the proportion of index good points that move right into a consumer’s personal product returns — the issuer must also present how the way it has dealt with these forms of parameters for all of its merchandise prior to now, the reps say.

They word that the product efficiency tables, which had been developed by Birnbaum, haven’t but been consumer-tested and would should be to see if they might work.

The ferment: Larry Rybka, the chairman and CEO of Valmark Monetary Group, who has been writing about issues with unrealistic listed life and annuity product illustrations for years, is getting enthusiastic responses from life and annuity professionals for his LinkedIn posts in regards to the matter.

In October, for instance, Rybka argued in a put up that the utmost charge included in listed common life coverage illustrations must be 5%, somewhat than the 5.5% default illustrated charge included in Actuarial Guideline 49, as a result of alternations of excellent years, when charges are capped, with down years, when investment-linked additions to the crediting charge are zero, imply that the precise charge will have an effect on precise returns and maintain precise returns under the default charge.

Many life and annuity professionals replied with feedback about their very own considerations in regards to the excessive charges they see in illustrations.

However different contributors within the dialog, together with regulators on the NAIC, have questioned whether or not the critics’ proposals would work higher than the principles and disclosures now in use.

Credit score: vetta/iStock

[ad_2]