[ad_1]

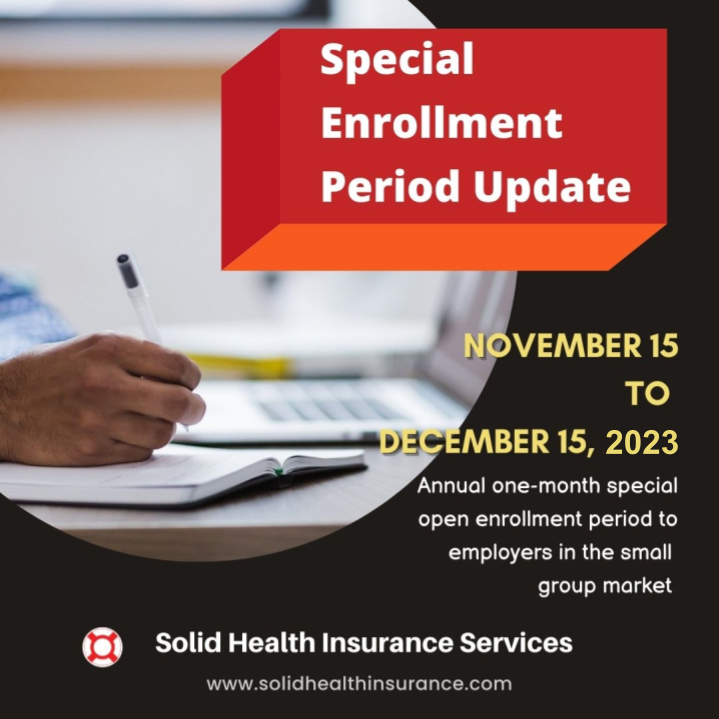

Yearly, small companies have a particular window to begin a small group medical health insurance coverage with small group medical health insurance carriers with relaxed underwriting. This era is named a Particular Enrollment Interval and begins on November fifteenth by December fifteenth. Throughout this era, small companies can join small group medical health insurance protection with no minimal worker participation fee (normally 65-70% worker participation required) and no minimal employer contribution to the well being plans (normally $100 or 50%).

Throughout this one-month interval, small companies can seamlessly present group advantages with out considerations about assembly worker participation quotas or calculating contributions towards worker advantages. Quite a few insurance coverage carriers, together with Anthem Blue Cross, Blue Defend of California, and Cigna + Oscar, will exempt the requirement for submitting a De9C (quarterly payroll report) so long as a minimum of three staff enroll or take part within the group advantages. Kaiser, SHOP Coated CA, and California Alternative additionally supply extremely adaptable underwriting processes to encourage extra small companies to increase advantages to their staff.

Group insurance coverage advantages play a pivotal position in an worker advantages package deal, providing a aggressive edge within the job market by attracting prime expertise and retaining present staff. They not solely improve your group’s attraction but in addition present a dependable, cost-effective resolution for employers, providing secure prices by negotiated premiums with insurance coverage suppliers upfront, in contrast to self-insured or particular person insurance coverage. Furthermore, wholesome and financially safe staff are typically extra productive and engaged.

In case your small enterprise is contemplating providing staff group advantages, now’s the proper time to evaluation your choices. Learn this weblog to study the fundamentals.

At Strong Well being Insurance coverage Companies, we take nice pleasure in guiding you thru the array of plan selections on your staff. We’re excited to give you complimentary on-line onboarding on your staff and seamless on-line advantages processing for well being, dental, imaginative and prescient, life, and incapacity protection. Be happy to succeed in out to us at ☎️310-909-6135 or e mail us at barb@solidhealthinsurance.com or schedule a fast assembly for extra info. Our dedication is that will help you and your organization discover the best profit plans that handle your staff’ well being wants whereas additionally assembly your monetary targets.

[ad_2]