[ad_1]

Shares rose and bond yields fell after the Federal Reserve signaled stronger probabilities of interest-rate cuts subsequent 12 months, with merchants now targeted on Jerome Powell’s remarks for extra clues on the central financial institution’s subsequent steps.

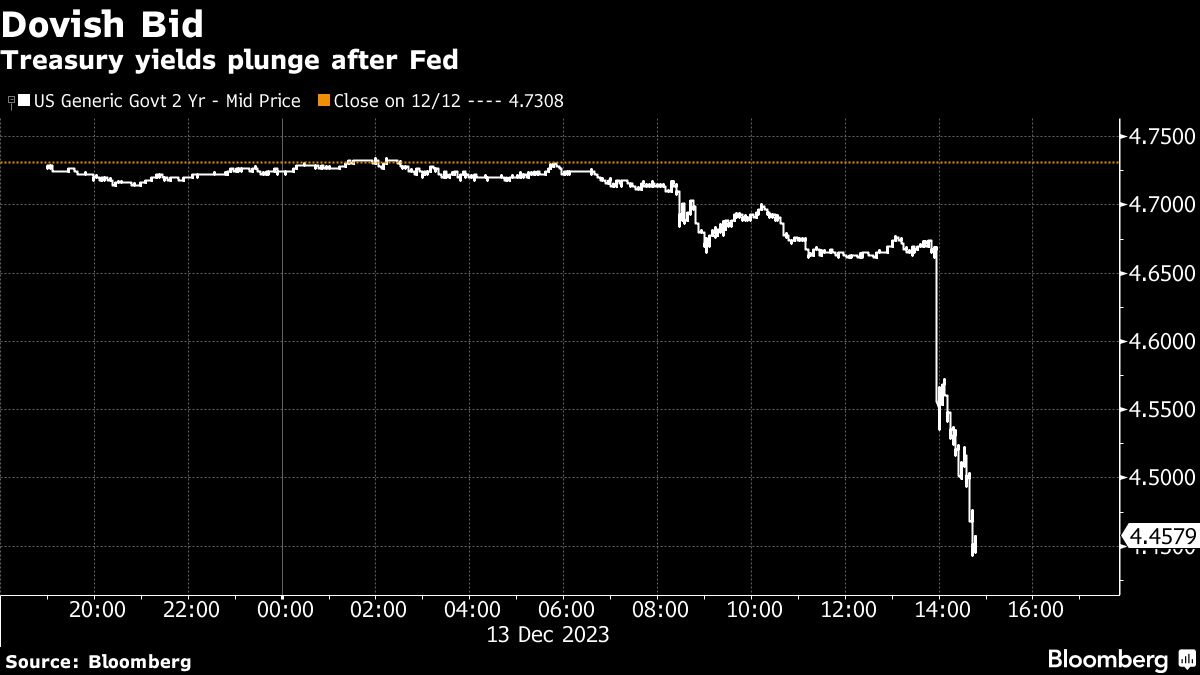

The S&P 500 prolonged good points to 1.2% as of three:15 p.m. in New York. Two-year yields dropped 28 foundation factors to 4.45%. The greenback fell. Swap contracts repriced to ranges according to 130 foundation factors of easing over the following 12 months.

In what was arguably the most-important Fed determination of 2023, officers mentioned they count on to decrease charges by 75 foundation factors subsequent 12 months — a sharper tempo of cuts than indicated in September’s projections.

Powell mentioned inflation easing with out unemployment spike is nice information, whereas reiterating that coverage has moved effectively into restrictive territory. The Fed chair continued to say that officers are continuing fastidiously as inflation could have eased, however it’s too excessive.

Specialists’ Feedback

Jon Maier, chief funding officer at International X: “The market is celebrating that the Fed dots moved nearer to the market’s. This isn’t only a mere determination to take care of present charges; it’s a commendation for an economic system that seems to be aligning with the Fed’s long-term aims.”

Diane Swonk, chief economist at KPMG: “They signed off on this assertion they usually signed off on this forecast and that is about as dovish as we may have anticipated. That is greater than I anticipated when it comes to dovishness.”

Krishna Guha, vice chairman at Evercore: “The FOMC assertion and new Abstract of Financial Projections are dovish and risk-on with new language within the assertion assessing that ‘inflation has eased over the previous 12 months’ and a 3 lower median projection for subsequent 12 months.”

Callie Cox at eToro: “The Fed believes they’ve the mushy touchdown within the bag. Clearly, markets imagine them now. Fed members now see just a few price cuts in 2024, and these appear to be celebratory price cuts too. No person has a crystal ball, so it’s vital to remain nimble and do not forget that charges may keep excessive for some time. However the Fed’s stance may preserve the speed lower commerce rolling via the tip of the 12 months.”

Gina Bolvin, president of Bolvin Wealth Administration Group: “The Fed has given the market an early vacation reward immediately when , lastly, for the primary time, they’ve commented positively about inflation. I’d say we’ve seen a pivot as they acknowledged inflation is falling. It seems that the Fed is transferring within the markets route, moderately than the market transferring in direction of the Fed. The Santa Claus rally could proceed.”

Chris Larkin, managing director of buying and selling and investing at E*Commerce from Morgan Stanley: “Sure, inflation has been transferring in the fitting route, however the Fed maintained its hawkish tone in immediately’s assertion, though they anticipate chopping charges thrice subsequent 12 months. Buyers ought to count on extra of the identical within the New 12 months. Having waited this lengthy for his or her insurance policies to start slowing the economic system and cooling inflation, the Fed isn’t going to throw warning to the wind simply because the end line lastly seems to be in sight.”

Inflation Points

Forward of the choice, information confirmed producer-price good points slowed as power prices fell. Client costs Tuesday underscored a drop within the annual price of inflation — at the same time as month-to-month good points picked up. Taken collectively, the numbers reinforce the notion that inflation is trending again towards the Fed’s goal.

Earlier Wednesday, Treasury Secretary Janet Yellen mentioned it might make sense for the Fed to think about reducing rates of interest as inflation eases to maintain the economic system on an excellent keel.

[ad_2]