[ad_1]

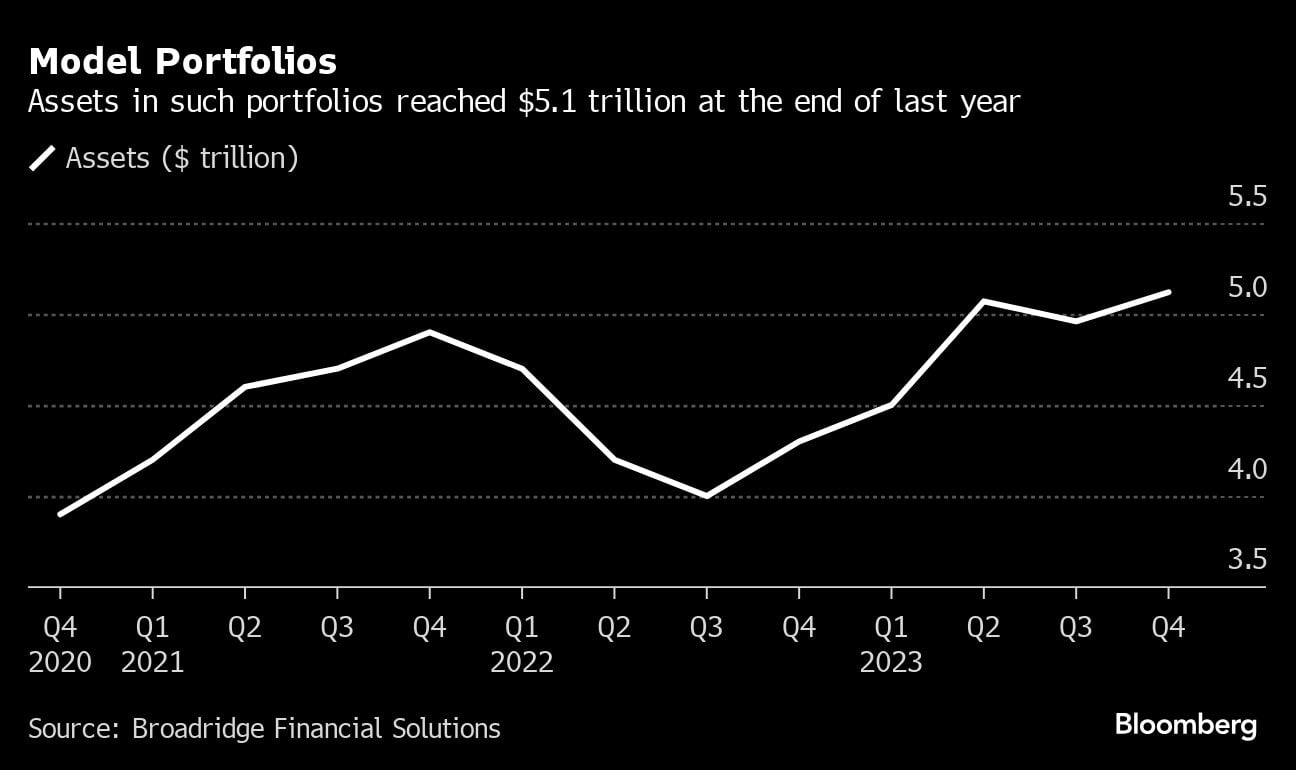

Property in mannequin portfolios possible reached $5.1 trillion on the finish of 2023 as monetary advisers more and more embrace these off-the-shelf funding methods, in response to Broadridge Monetary Options.

The monetary know-how firm expects such portfolios — created by asset managers and funding platforms by bundling funds into ready-made packages for advisers — to develop to $11.3 trillion by the top of 2028.

That’s extra bullish than the projections by BlackRock Inc., which anticipates the area of interest will change into a $10-trillion enterprise by that yr.

Trade-traded funds are seen as a key driver of that progress, in response to Broadridge’s Andrew Guillette.

ETFs comprised 51% of mannequin property on the finish of 2023, fueled by an annual progress charge that was practically twice that of mutual funds.

For ETF issuers, mannequin portfolios are a approach to drum up flows into their merchandise as competitors within the business intensifies, with corporations corresponding to State Road International Advisors trying to carve out a bigger slice of a rising pie that’s thus far dominated by the likes of BlackRock.

[ad_2]