[ad_1]

GlobalData’s 2023 UK Insurance coverage Client Survey signifies that greater than one-third of under-40s with a automobile insurance coverage coverage even have assured asset safety (GAP) insurance coverage. Insurers that ship enhancements to the product, really useful by the Monetary Conduct Authority (FCA), can reap advantages together with decrease acquisition prices and larger buyer satisfaction.

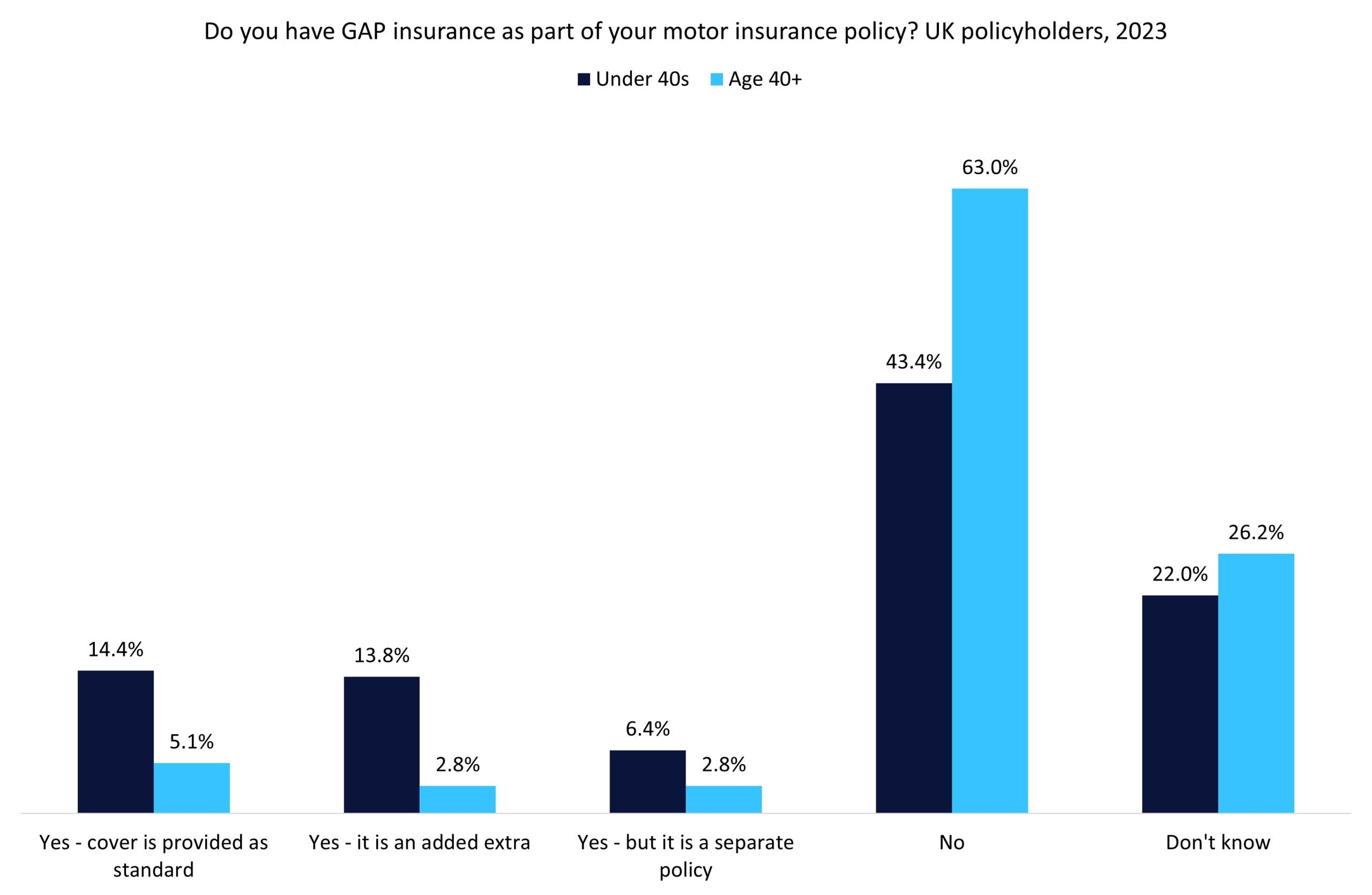

In accordance with GlobalData’s 2023 UK Insurance coverage Client Survey, simply 10.7% of motor insurance coverage policyholders aged 40 and older have a GAP insurance coverage coverage. That is in comparison with 34.6% of policyholders aged below 40. Whereas youthful customers usually tend to personal a automobile on finance (and therefore want GAP cowl), the relative distinction is just not as vital because the distinction in GAP penetration. Analysis from Admiral earlier than the pandemic means that 64% of millennials took out finance to purchase their automobile in comparison with 38% of Era X customers. Youthful generations’ decrease monetary literacy and their lack of ability to cowl potential losses themselves has left these customers extra weak to the downsides of GAP insurance coverage.

Following the raft of client obligation measures launched by the FCA in July 2023, a spotlight throughout the insurance coverage sector has been on worth for cash from merchandise—a side that’s particularly essential amid the UK’s cost-of-living disaster and financial recession. Having discovered that solely 6% of premiums paid to insurers for GAP insurance coverage are paid out in claims, the FCA has a really sturdy case that these merchandise fall quick on this regard. Insurers that may provide this cowl at a fairer value are prone to see a progress in satisfaction from prospects, given the squeeze on incomes seen over the previous few years.

Moreover, the FCA discovered that, in some circumstances, round 70% of premium revenue was allotted to fee funds. Insurers have to be extra proactive in plugging the areas from which premium revenue is leaking, given the challenges going through underwriting and working prices within the post-pandemic period. The motor line has seen its expense ratio develop from 29.5% in 2019 to 35.7% in 2022 (it was simply 18.2% in 2010). Insurers should consider their total product suite and distribution mannequin and assess areas which can be inflicting appreciable premium losses. Suppliers should begin getting severe of their makes an attempt to slimline buyer acquisition or value administration bills, in any other case extra fashionable companies will usurp them in profitability and buyer numbers.

Whereas the motion taken by insurers to pause and rework their GAP insurance coverage choices exhibits dedication to client obligation, gamers should go additional. These that may begin displaying real dedication to offering honest worth to customers, whereas getting severe with their makes an attempt to handle pointless outflows of revenue, can be in the very best place for progress over the approaching years.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

helpful

resolution for your online business, so we provide a free pattern which you can obtain by

submitting the beneath type

By GlobalData

[ad_2]