[ad_1]

What You Have to Know

- Psychologist Daniel Kahneman confirmed the logic behind puzzling behaviors, like why individuals refuse to promote shares which have misplaced worth.

- He shared the 2002 Nobel Prize with Vernon Smith, one other experimental economist.

- In 2011, he printed the bestselling

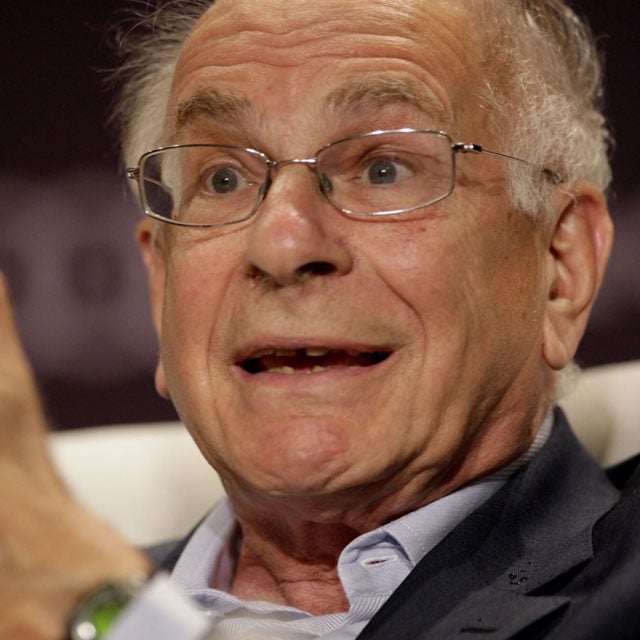

Daniel Kahneman, a psychologist whose work casting doubt on the rationality of decision-making helped spawn the sphere of behavioral economics and received him a Nobel Prize, has died. He was 90.

He died on Wednesday, the Washington Put up reported, citing his stepdaughter, Deborah Treisman, the fiction editor for the New Yorker. No different particulars had been obtainable.

Kahneman upended assumptions about rationality that had dominated economics for many years.

He was capable of present the logic behind quite a lot of puzzling behaviors — why individuals refuse to promote shares which have misplaced worth, or why they are going to drive to a distant retailer to economize on a small merchandise, however to not make the identical saving on an costly one.

Kahneman was “the world’s most influential residing psychologist,” Harvard College professor Steven Pinker advised the Guardian in 2014. “His work is actually monumental within the historical past of thought.”

Working with psychologist Amos Tversky, Kahneman remoted biases that distort decision-making. These embody aversion to loss and the way the best way a query is framed can have an effect on the reply. For instance, if a well being program will save 200 lives and lead to 400 deaths, whether or not it’s accepted might rely upon whether or not its proponents spotlight the lives saved or the lives misplaced.

Kahneman mentioned that the mind reacts rapidly and on the idea of incomplete data, usually with unlucky outcomes. “Individuals are designed to inform the most effective story potential,” he mentioned in a 2012 interview with the American Psychological Affiliation. “We don’t spend a lot time saying, ‘Nicely, there may be a lot we don’t know.’ We make do with what we do know.”

Underneath the rubric “prospect principle,” Kahneman and Tversky sparked a revolution in psychology after which in economics, which had seldom been thought-about an experimental science.

The sector of behavioral economics arose close to the top of the twentieth century as a gaggle of younger economists used their insights to problem classical notions of “homo economicus,” the rational actor.

‘Cognitive Minefield’

In 2011, Kahneman printed the bestselling “Pondering, Quick and Sluggish,” discovering a large viewers for his concepts. The research offered a complete view of the thoughts as containing two programs, one quick and intuitive, the opposite gradual and extra rational. It provided recommendation for making higher selections, beginning with: “Acknowledge the indicators that you’re a cognitive minefield.”

Daniel Kahneman was born on March 5, 1934, in Tel Aviv, the place his mom was visiting family. The household lived in France, having emigrating there from Lithuania. His father, a Jewish chemist, was arrested due to his faith throughout World Battle II, then launched. After the conflict, the household moved to Palestine.

[ad_2]